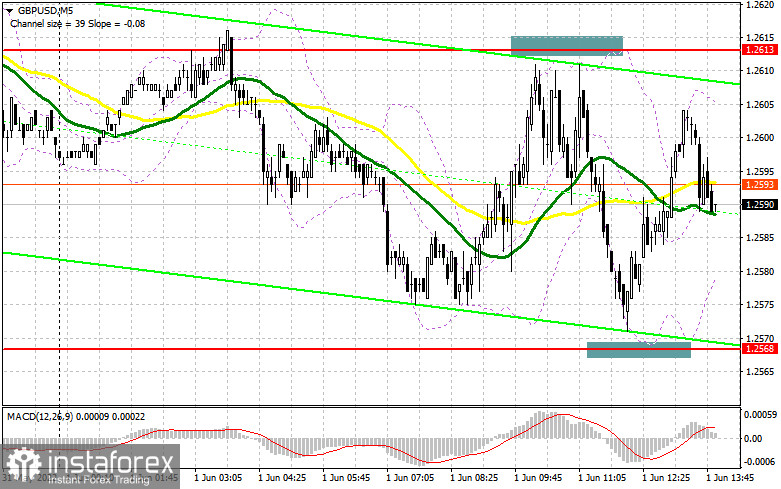

In my forecast this morning, I drew your attention to the level of 1.2613 and 1.2568. Let's have a look at the 5-minute chart and analyze where and how we could enter the market. Taking into account that the data on manufacturing activity in the UK was predictable, I did not see much movement in the GBP/USD pair. There was no possibility to open short positions because there was no false breakout at 1.2613. Likewise, we were a few pips short of the test of 1.2568 and a false breakout at this level, with a buy signal for the pound. From the technical point of view, nothing has changed, as well as the trading plan has not changed, too.

Long positions on GBP/USD:

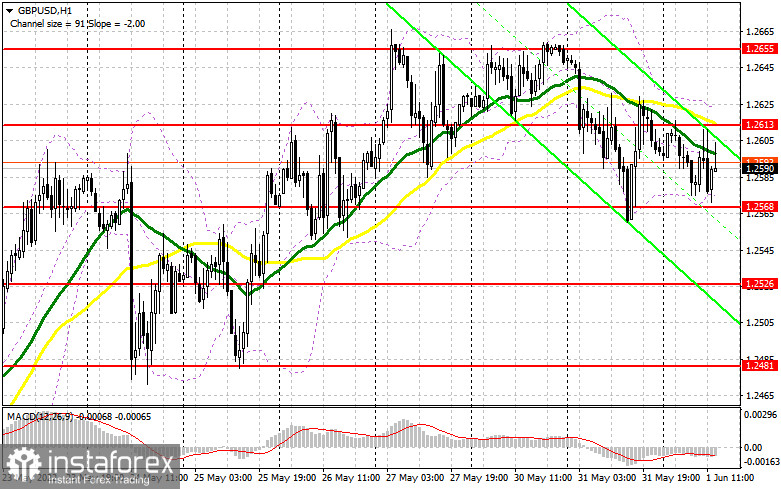

The PMI data for the UK manufacturing sector almost matched the economists' forecasts, which is good as there is no reason for the producers to panic yet, which leaves chances for a less active slowdown in the economy this summer. In the afternoon, there is also quite an interesting set of US statistics and one of the representatives of the Federal Reserve System, James Bullard, is going to give a speech. If he sticks to his usual approach of not reacting in any way to what is going on with inflation, there is a chance that the pair may stay within the sideways channel with a prospect of further depreciation of the pound. Much will depend on the manufacturing activity index and the ADP's non-farm payrolls of in the US. With strong numbers, I would bet on a continuation of the bear market. In that case, buyers will have to think about protecting the level of 1.2586, which the pair did not manage to reach by a few pips during the first half of the day. Only if there is a false breakout at this level, new long positions will be opened, if we count on the continuation of the bullish trend seen in May and return to the resistance of 1.2613. The moving averages, which play on the side of bears, pass at this level and partly allowed bears to control the market in the first half of the day. We may expect a sharper rally in the pair, but only after a weak report and a consolidation above 1.2613. A reverse top/bottom test is likely to open the way to the monthly high at 1.2655 and also allow the pair to test the resistance levels at 1.2709 and 1.2755, where traders may take profit. The next target is located within the area of 1.2798. In the case of a decline in the pound and a lack of activity from bulls at 1.2568 in the second half of the day, the pressure on the pair is likely to increase considerably. This may allow the price to return to 1.2526. Therefore, it is better to postpone the opening of longs. It is best to enter the market after a false breakout at this level. It is possible to buy the pound on a rebound only from 1.2481 or lower near 1.2427, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

In the first half of the day, bears confirmed their dominance in the market. They have protected 1.2613. However, no one wished to sell the pound after that. Bears need to protect a very important resistance at 1.2613. A false breakout formed at this level can create the first signal for the opening of new short positions, counting on a further downward correction of the pair started earlier this month. In the case of strong statistics on the US labor market, bears may attempt to fix the price below 1.2568. Only a breakthrough and a reverse bottom/top test of this level are likely to give a sell signal, allowing the GBP/USD pair to return to the area of 1.2526 and opening a direct road to the low of 1.2481, where traders can lock in profits. The next target is located at 1.2427, and if broken through, it may cancel the bull market. In the second half of the day, if the GBP/USD pair grows and we see weak trading activity at 1.2613, there may be another surge in the price after triggering sellers' stop-loss orders, who are counting on a larger fall of the pair this week. In that case, it is better to postpone opening shorts until the pair hits the last month's high at 1.2655. In addition, you can also sell the pound at this level only after a false breakout is formed. At the same time, short positions can be opened on the rebound from the high of 1.2709, or higher from 1.2755, counting on an intraday decline in the pair by 30-35 pips.

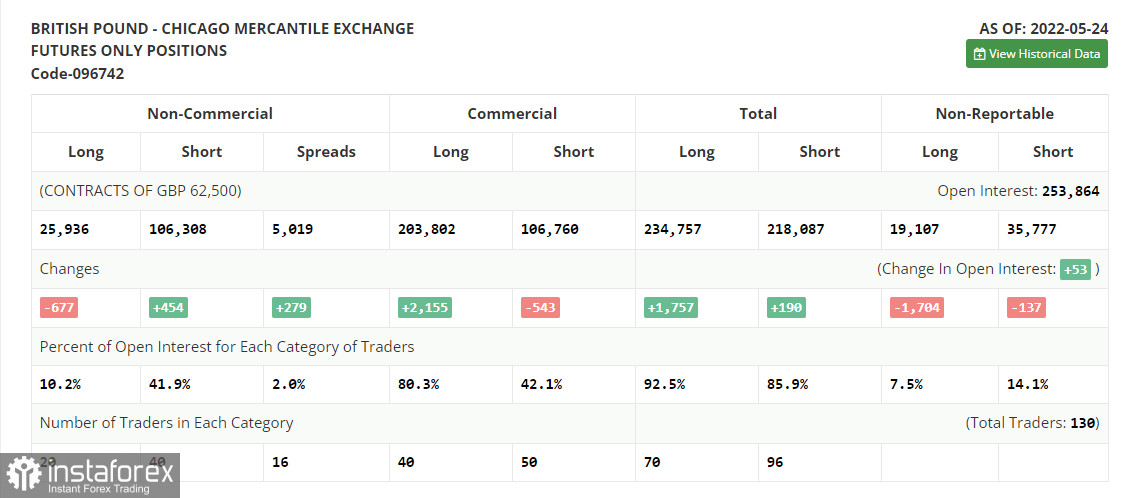

The COT report for May 24 logged a reduction in long positions and growth of short ones. However, it did not have a significant impact on the balance of power in the market. Despite the growth of the pound from the middle of this month, the market remains under the control of bears. Apparently, only the absence of fundamental statistics, to which the pair reacts rather negatively lately, and some profit-taking from the year lows allowed the GBP/USD pair to recover slightly. There are no other reasons for the growth. The economy continues to slide into recession, inflation is breaking another record, and the cost of living in the UK is steadily rising. The Bank of England is under pressure from both sides, but even despite all this, Governor of the Bank of England Andrew Bailey continues to say that the regulator is not yet going to give up on raising interest rates. Spreading rumors that the US central bank plans to "pause" the interest rate hike cycle as early as September this year continue to gain traction, putting little pressure on the US dollar as well as strengthening the pound. The COT report for May 24 indicated that long non-commercial positions declined by 667 to 25,936, while short non-commercial positions rose by 454 to 106,308. This led to an increase in the negative nonprofit net position to -80,372 from -79,241. The weekly closing price soared to 1.2511 from 1.2481.

- Moving average defines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator Fast EMA of period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of noncommercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.