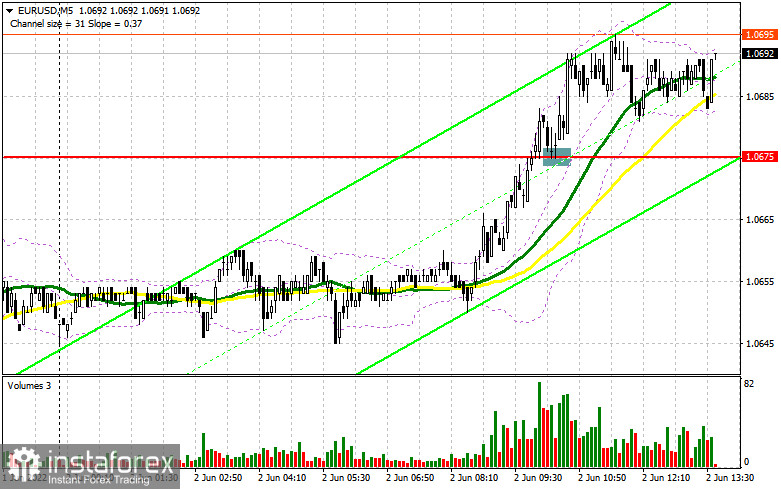

In the morning article, I highlighted the level of 1.0675 and recommended taking decisions with this level in focus. Now let's look at the 5-minute chart and try to figure out what actually happened. A breakout and consolidation above this level, as well as a downward test, gave an excellent bug signal. The euro climbed by 20 pips. After that, an upward movement slowed. The eurozone macro stats supported the euro. However, the higher it rises, the more reluctantly buyers open new long positions. For the second half of the day, the technical outlook and the trading strategy have not changed drastically.

What is needed to open long positions on EUR/USD

In the Euro Area, the Producer Price Index rose less than in April, undershooting analysts' forecasts. However, traders were hardly surprised given a strong correction in the commodity market in that month, which allowed to contain inflation. In the afternoon, the US will unveil a batch of reports on the labor market. In addition, Fed policymakers are going to deliver their speeches today. A further trajectory of the euro/dollar pair will largely depend on the tone of their speeches. Jim Bullard made some hawkish statements yesterday which increased pressure on risk assets. Some analysts expect more hawkish remarks today. This is why the bulls need to make a big effort and protect the nearest support level of 1.0675. The ADP report and weekly initial jobless claims data may also boost the US dollar if the figures exceed economists' expectations. If EUR / USD declines following the release of the reports, I advise you to go long only after a drop and a false breakout of 1.0675. Only in this case, a buy signal may appear amid the bullish trend started today in the morning. The pair is projected to return to the resistance level of 1.0727. However, it will be rather hard to grow above this level. If the pair consolidates above this level, the bulls will surely rake the upper hand. A breakout and a downward test of this level will give a new buy signal. Thus, the price could reach the highs of 1.0784 and 1.0811 where I recommend locking in profits. If EUR/USD drops and the bulls show no activity at 1.0675 in the afternoon, the pressure on the euro will escalate. It will lead to a sharp fall in stop-loss orders below this level. A larger downward correction will push the pair to 1.0631. It is better to open long positions after a false breakout of this level. You can EUR/USD immediately at a bounce from 1.0596 or even a low of 1.056, keeping in mind an upward intraday correction of 30-35 pips.

What is needed to open short positions on EUR/USD

Sellers failed to defend the resistance level of 1.0675. This level turned into support. The main goal today is to regain control of this level and push the price below this level. Otherwise, it will be very difficult to build a more powerful bearish correction and cement a downtrend. In case of weak data on the US labor market, the US dollar is likely to slide down. It may lead to a breakout of 1.0727. Only a false breakout of this level will generate a sell signal against the trend. If this scenario comes true, the price is expected to slip to the support level of 1.0675. A breakout and a decline below 1.0675, as well as an upward test and Fed members' hawkish statements on inflation, will give a sell signal. Bulls will rush to close their stop-loss orders. The price may plunge to the weekly low of 1.0631. It is better to close some of the short positions at this level. A more distant target will be the 1.0596 level where I recommend closing all short positions. If EUR/USD rises during the US session and bears show no energy at 1.0727, the bullish sentiment will strengthen. So, the uptrend will persist. It would be wise to open short positions after a false breakout of the last month's high of 1.0784. You can sell EUR/USD immediately at a bounce from 1.0844 or even a high of 1.0894, keeping in mind a downward intraday correction of 30-35 pips.

COT report

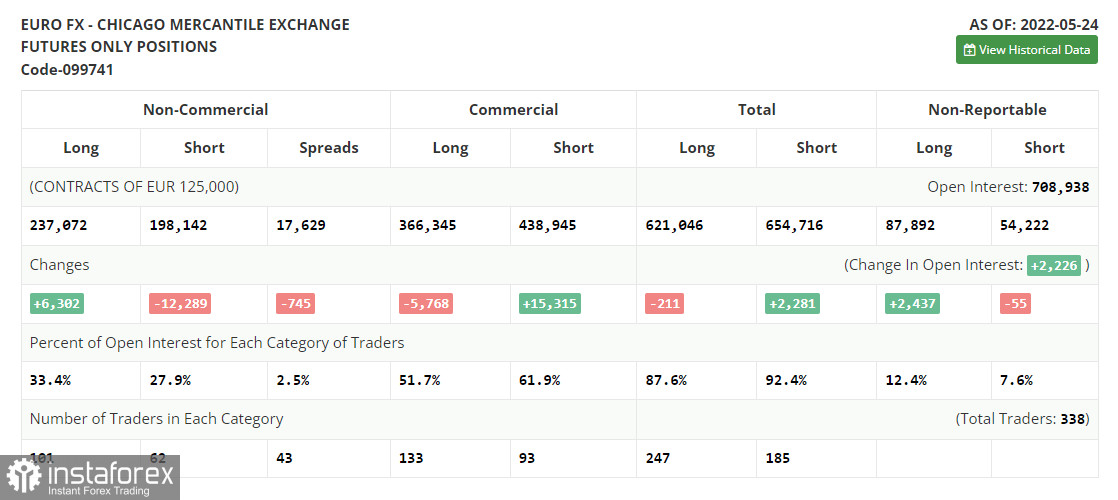

The COT report for May 24 logged a further increase in long positions and a drop in short ones. Traders continue to increase long positions on the instrument, expecting aggressive moves by the ECB. Last week, the euro advanced significantly even though ECB policymakers made only a few hawkish statements. Now, the regulator is expected to raise the key rate by a quarter-point in July this year, followed by rate hikes in September and in December. The benchmark rate could be lifted to 0.25% by the end of the year. Some experts anticipate more aggressive measures from the ECB if inflation soars to 7.7% in May. The watchdog may hike the key rate in September and December to 0.5% from the current zero level. The COT report revealed that the number of long non-commercial positions rose by 6,302 to 237,072 from 230,770. The number of short non-commercial positions declined by 12 289 to 198,142 from 210,431. Notably, the weaker euro is more attractive to traders. Last week, the total non-commercial net position grew to 38,930 against 20,339 a week earlier. The weekly closing price edged higher to 1.0734 against 1.0556.

Signals of technical indicators

Moving averages

EUR/USD is trading near 30- and 50-period moving averages. It means that bulls and bears are tussling for the prevailing trend.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case of a decline, the lower border at 1.0631 will act as support. In case of a rise, the upper border at 1.0695 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal

- line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.