The EU leaders are unlikely to impose further economic sanctions against Russia, including an embargo on oil imports. Earlier, the situation did not seem complicated. The EU managed to persuade Hungary to ban Russian oil imports. However, Budapest made new demands. According to Bloomberg, the country plans to sell refined products of Russian oil, which is strictly prohibited to EU members. This news was the reason for Brent crude to go south. Moreover, bulls in the EUR/USD pair became more active.

The embargo was considered another aggravating factor for the EU economy, which along with the renewed rally of the US Treasury bond yields allowed the sellers of the EUR/USD pair to regain the initiative. The EU did not impose a ban on Russian oil imports. Therefore, stagflation risks are minimal which is favorable to the euro. Moreover, the ECB officials take a hawkish stance concerning monetary policy. Francois Villeroy de Galhau stated that inflation in the euro area is accelerating which was initially seen as an argument in favor of raising the deposit rate by 50 bps in July.

European Inflation Dynamics

In fact, the president of the Bank of France voiced a very clear view: This inflation requires normalization, not a tightening of the monetary policy. It is obvious that rapid removal of monetary stimulus is implied, that is the end of quantitative easing programs.

I believe Hungary will sooner or later accept the EU view concerning embargo on Russian oil imports unless it wants to follow the UK and to leave the European Union. The EUR/USD quotes have already included the ECB monetary restriction. Therefore, investors shift their focus to the US. The key question for the US dollar is the Treasury bond yields' next movements.

There are currently two scenarios in the market. Inflation continues to rise gradually, so the Fed has to keep raising interest rates. Otherwise, the Fed realizes its mistakes, which implies a change in the direction of monetary policy. In the first case, bond yields rise, contributing to the decline of the EUR/USD pair. In the second case, bond yields fall causing the major currency pair to pull back.

I prefer the first option. Moreover, it is confirmed by the data on business activity in the US manufacturing sector. The indicator advanced in May which was not in line with expectations of Bloomberg analysts. However, this fact was favorable to the US dollar.

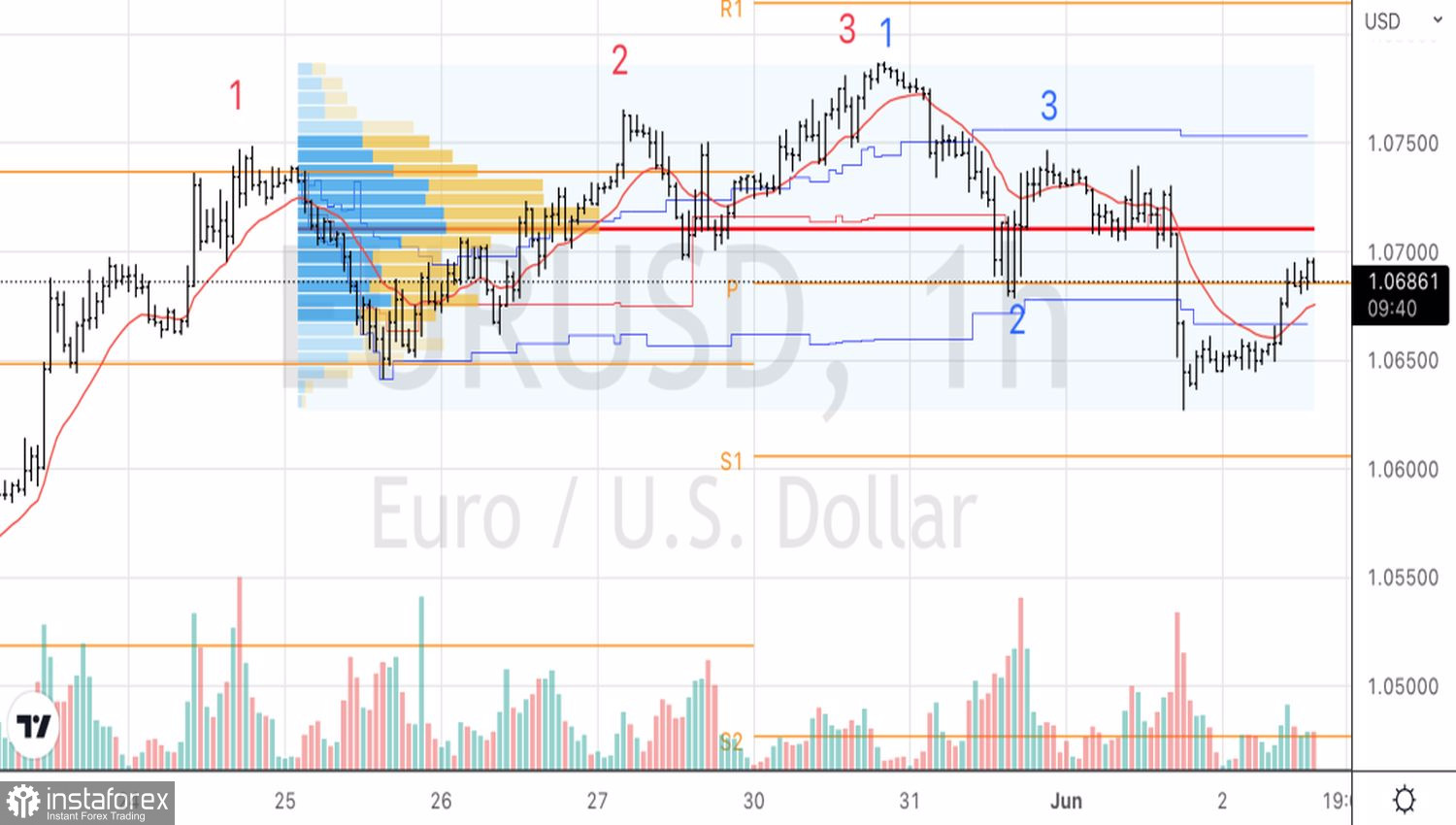

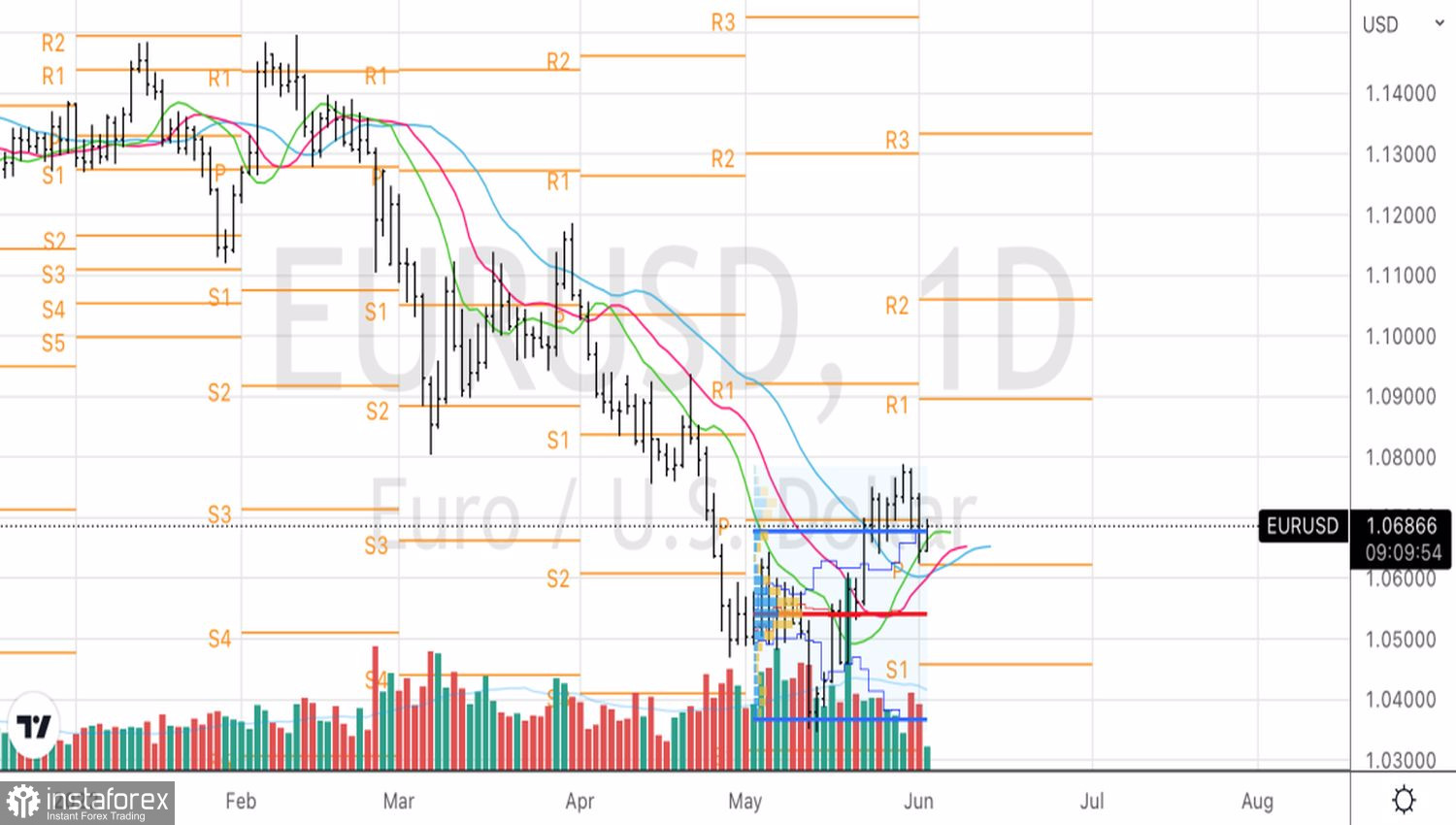

Technically, there is a struggle for the upper boundary of the fair value range of 1.036-1.068 on the EURUSD daily chart. However, if bulls succeed, it will not guarantee them a major advantage as important pivot levels are located above at 1.07 and 1.0715. On the hourly chart, a rebound of the fair value at 1.071 may be a reason for selling the pair.

EUR/USD, daily chart

EUR/USD, hourly chart