US index futures plunged after reports that Tesla Inc. Chief Executive Officer Elon Musk said the electric carmaker should cut staff amid a gloomy economic outlook. Tesla stocks were down by 3.7% at the premarket in New York. Investors are also awaiting key US jobs data to understand the pace of Federal Reserve policy tightening.

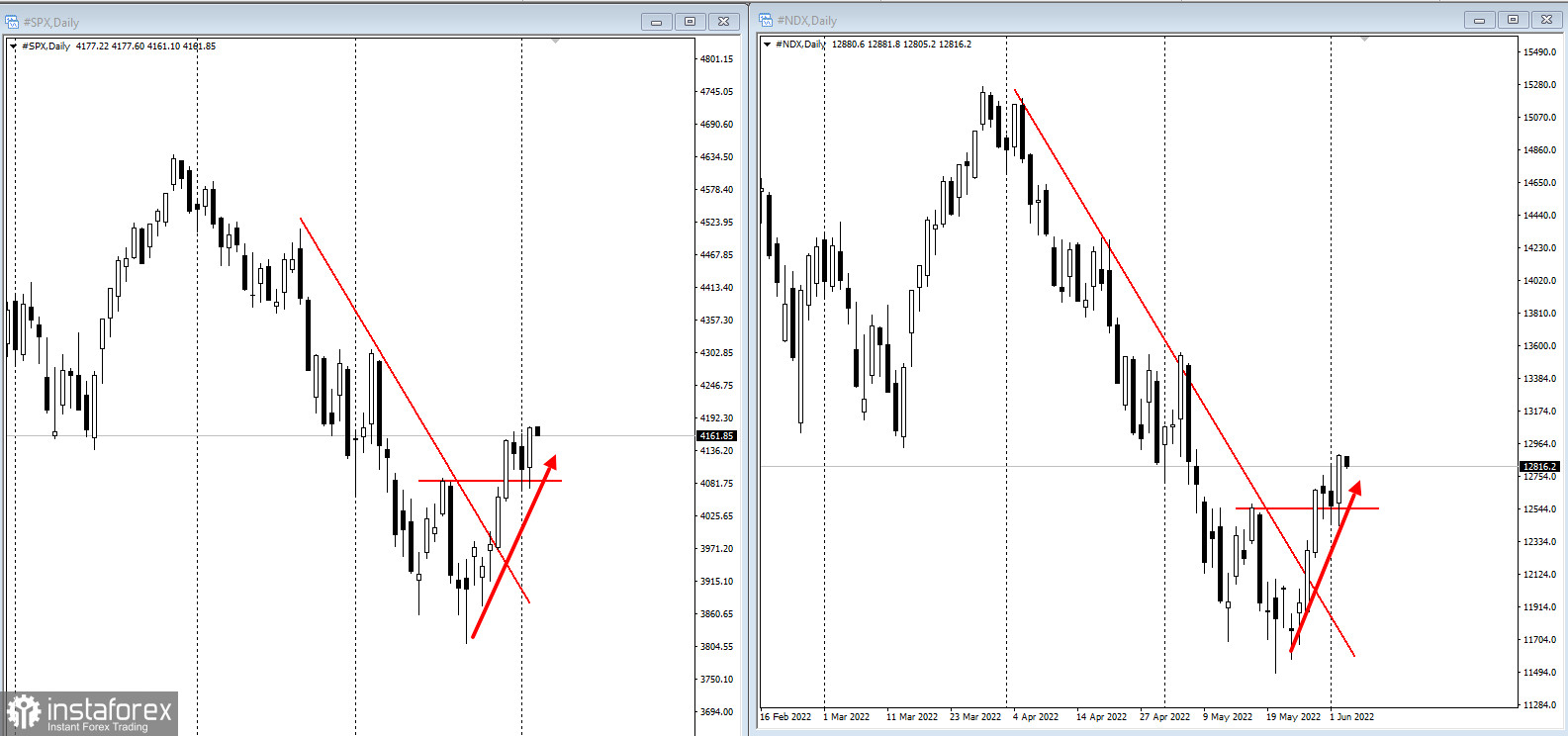

The Nasdaq 100, where Musk's company is among the largest index components, shed by 1.5%. Futures on the S&P 500 fell by 0.3%.

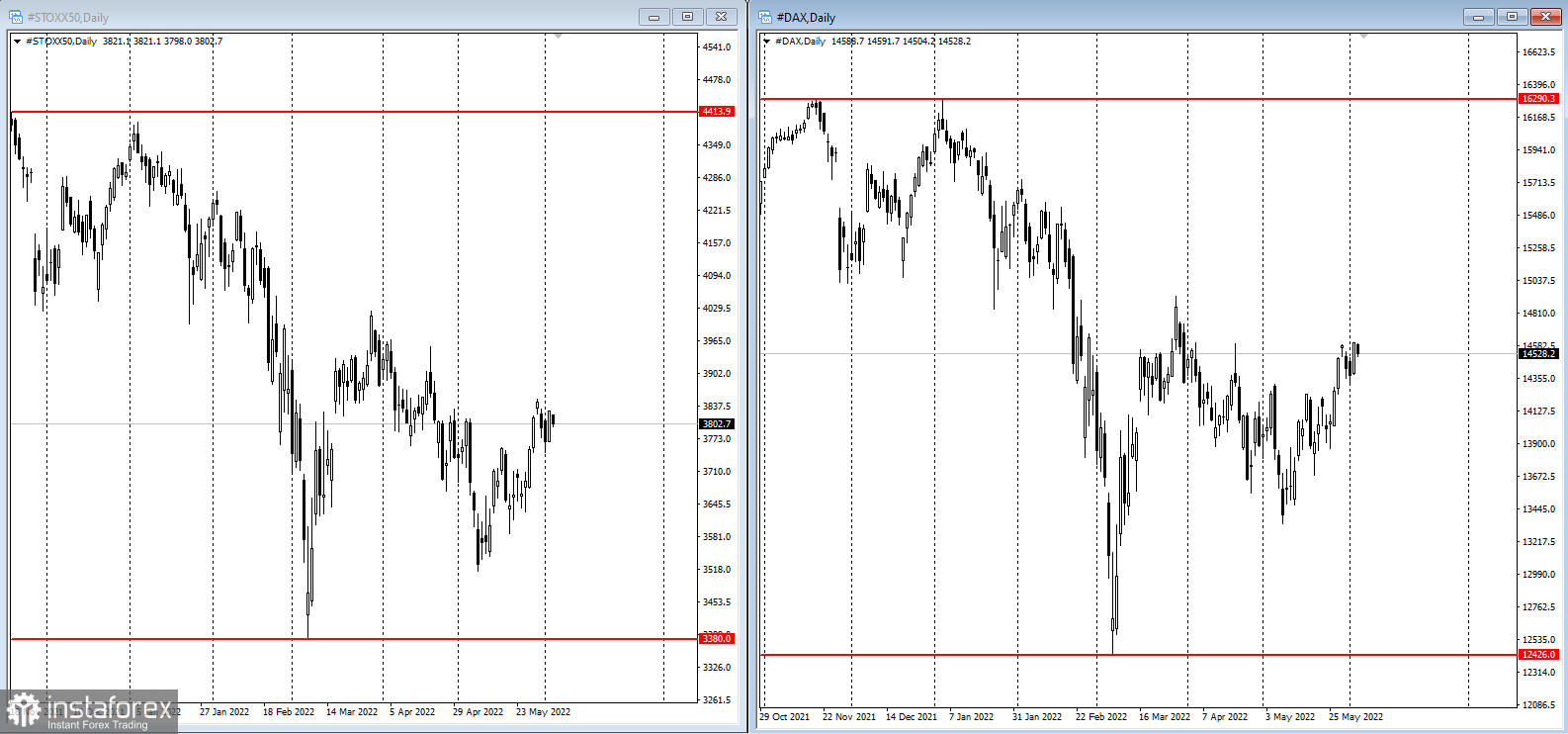

The European Stoxx50 index pulled back after yesterday's gains, with consumer staples and chemical companies showing modest gains. UK markets remain closed for the Queen's Jubilee holiday, reducing trading volumes.

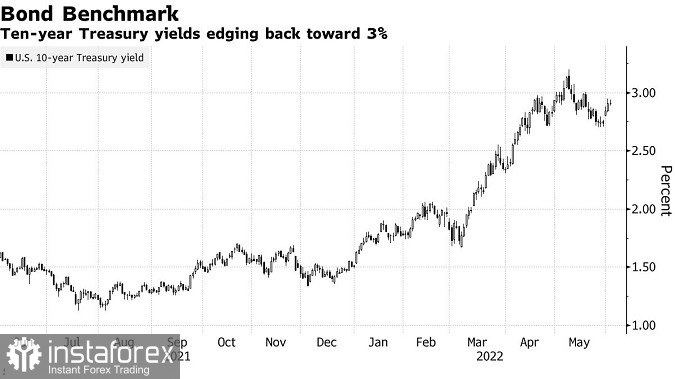

Treasury bond yields are hovering around 2.91%.

Investors remain on edge as some fear the pace of US monetary tightening could throw the world's largest economy into a recession. Friday's May labor report is likely to show the smallest gain in jobs since April 2021 alongside a down shift in average hourly earnings growth.

"We really do just need a lot more data, not one data point, not just the jobs data," Carol Schleif, BMO Family Office LLC deputy chief investment officer, said. "The potential range of outcomes is wider than it has been. We do think that you are going to see a lot of volatility through the summer," she added.

The median forecast in a Bloomberg survey of economists is for the payrolls data to show a 320,000 gain after a 428,000 increase in April.

Federal Reserve Vice Chair Lael Brainard said it was hard to see a case for a September pause in rate hikes, and that increases of 50 basis points in June and July seemed reasonable.

Meanwhile, OPEC+ agreed to increase the size of its oil-supply hikes by about 50% in July and August, bending to pressure by major consumers including the US to fill the gap created by sanctions on Russian supplies. At the same time, oil futures soared.

Here are some key events to watch this week:

- US May employment report Friday

- The UN's Food and Agriculture Organization releases its monthly food price index at a time of maximum concern about global supplies on Friday