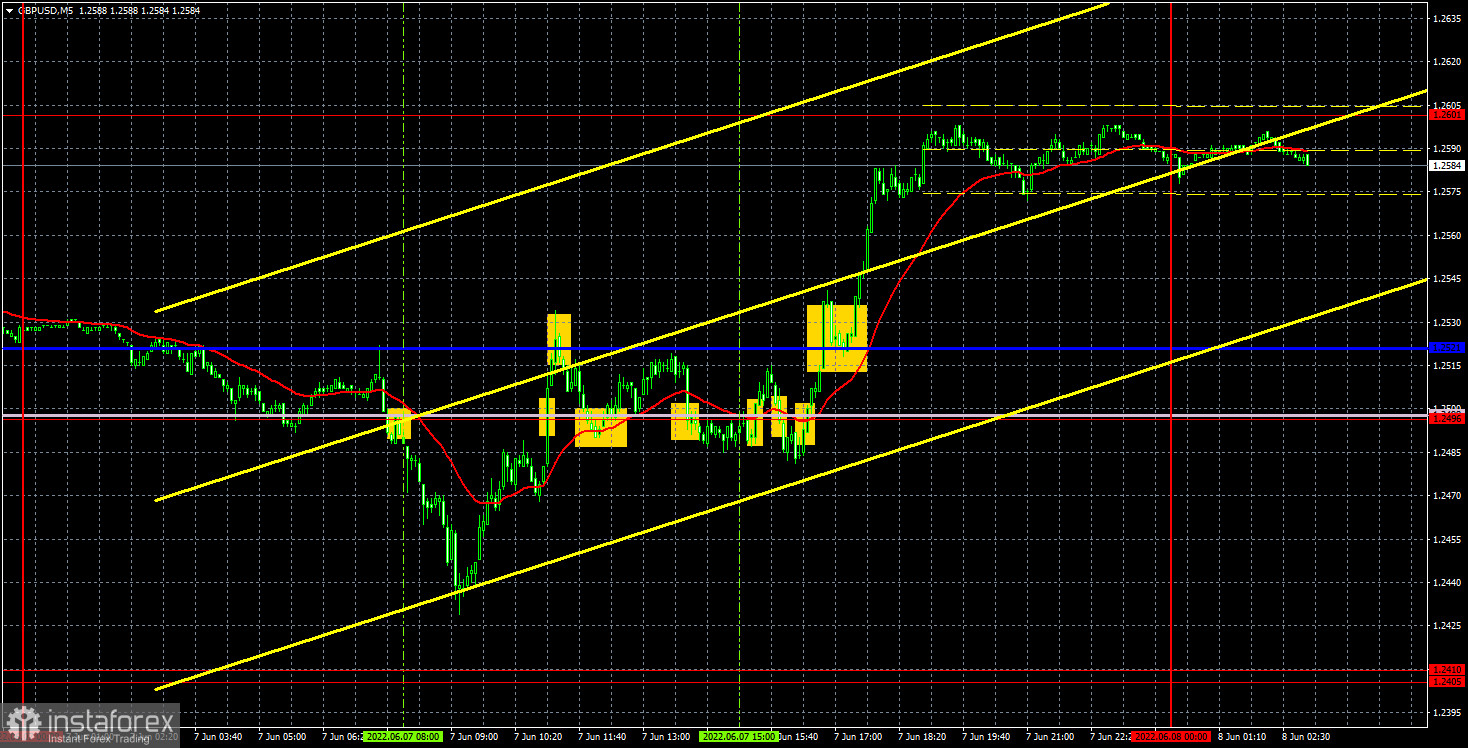

Analysis of GBP/USD 5M.

The GBP/USD currency pair traded very volatile on Tuesday. During the day, the price passed about 170 points, with the price falling for almost half of the day. That is, at first, there was a fairly strong drop, and then even stronger growth. It is rather difficult to explain what provoked such a strong movement since there were no important macroeconomic reports scheduled for Tuesday. And in any case, the reports do not provoke a movement of 170 points. There was, of course, news of a vote of no confidence in Boris Johnson, whose attempt failed in the Conservative Party, but it is unlikely that the news that nothing has changed in the British government could lead to such a strong increase in the British pound. Thus, just like the euro, the "swing" is preserved for the pound at this time. The price changes the direction of movement almost every day and very often crosses the lines of the Ichimoku indicator, which simply become irrelevant in the flat.

A lot of trading signals were generated on Tuesday. The first one is for sale at the very opening of the European trading session. The price went down after its formation by about 50 points but failed to reach the target level of 1.2410. A return to the Senkou Span B line followed, which together with the Kijun-sen line formed the area. It should be noted that Kijun-sen decreased during the day. Most of the signals were formed near these two lines, most of which turned out to be false. We warned in our recent articles that a lot of false signals can form during a flat, and the lines of the Ichimoku indicator become weak. On Tuesday, we could see this firsthand. Only the most recent buy signal, which was formed after overcoming the critical line, deserved attention. It was even possible to try to work it out since up to this point only one signal was formed to Kijun-sen and it was not false (formally). If traders worked it out, they were able to earn about 60-70 points.

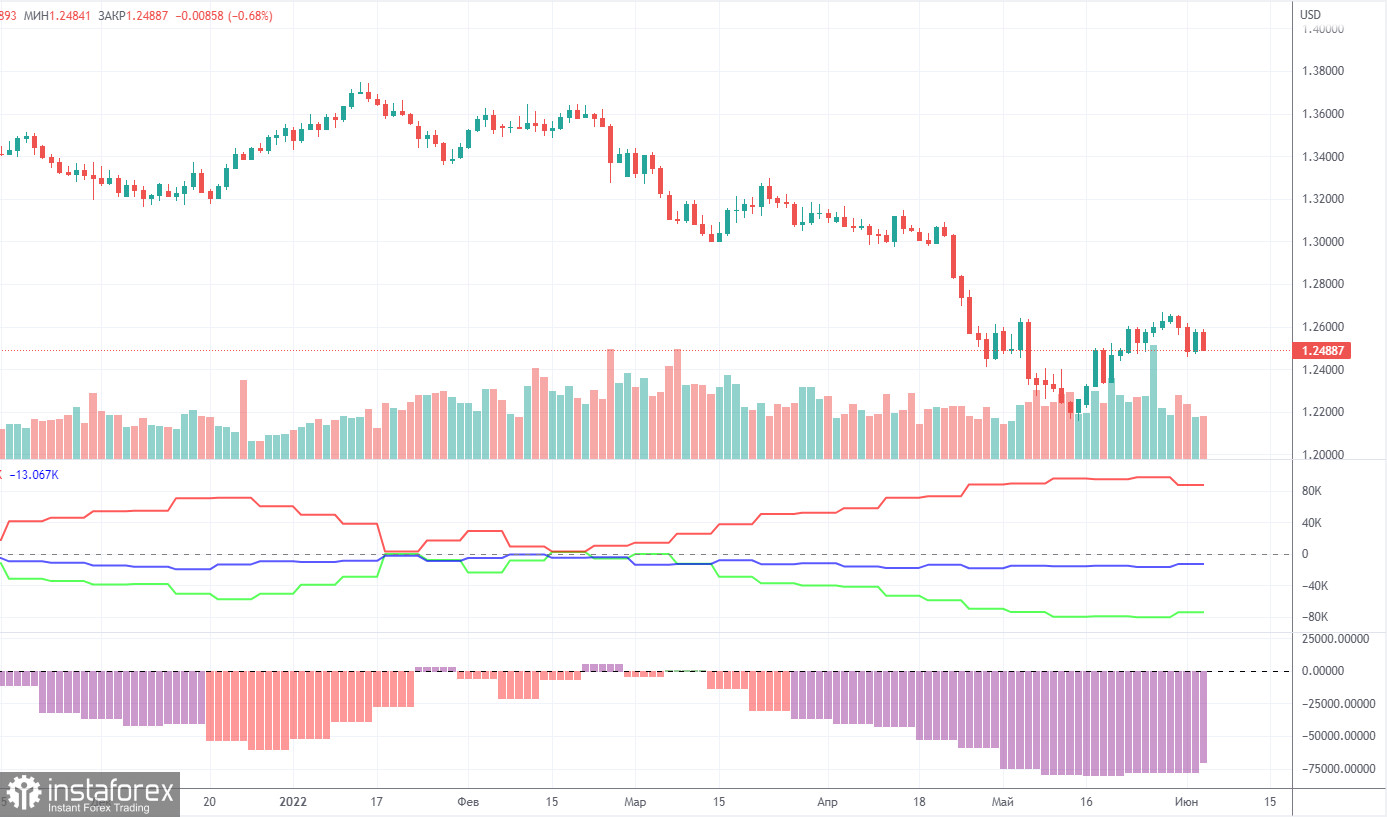

COT Report:

The latest COT report on the British pound showed minimal changes. During the week, the Non-commercial group opened 4.8 thousand buy contracts and closed 1.4 thousand sell contracts. Thus, the net position of non-profit traders increased by 6.2 thousand, for the first time in a long time. The net position has been falling for 3 months, which is perfectly visualized by the green line of the first indicator in the illustration above or the histogram of the second indicator. Therefore, one increase in this indicator hardly unambiguously indicates the end of the downward trend in the pound. The Non-commercial group has already opened a total of 105 thousand sales contracts and only 31 thousand purchase contracts. Thus, the difference between these numbers is already more than three times. This means that the mood of professional traders now remains "pronounced bearish". Note that in the case of the pound sterling, the COT reports data very accurately reflect what is happening on the market: the mood of traders is "very bearish", and the pound has been falling against the US dollar for a long time. In the last few weeks, the pound has shown growth, but even in the illustration in this paragraph (daily TF), this movement looks very weak. Since in the case of the pound, the COT report data shows the real picture of things, we note that a strong divergence of the red and green lines of the first indicator often means the end of the trend. Therefore, formally, now we can count on a new uptrend. However, weak geopolitical, fundamental, and macroeconomic backgrounds for European currencies may put pressure on these currencies again.

Analysis of GBP/USD 1H.

In the hourly timeframe, the pair is already definitely trading in the "swing" mode, which leads to the formation of false signals, and the lines of the Ichimoku indicator lose their strength. Therefore, you should be very careful when opening any positions. It is best to work out the most accurate and strong signals. On June 8, we highlighted the following important levels: 1.2259, 1.2429, 1.2458, 1.2589, and 1.2659. The Senkou Span B (1.2562) and Kijun-sen (1.2520) lines can also be signal sources. Signals can be "bounces" and "surmounts" of these levels and lines. It is recommended to set the Stop Loss level to breakeven when the price passes in the right direction by 20 points. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. Also in the illustration, there are support and resistance levels that can be used to fix profits on transactions. Only the index of business activity in the construction sector is scheduled for Wednesday in the UK. Not the most important indicator, especially now. It's even more boring in the States. Nevertheless, volatility may remain high, and the "swing" may persist.

Explanations of the illustrations:

Price levels of support and resistance (resistance/support) - thick red lines, near which the movement may end. They are not sources of trading signals.

Kijun-sen and Senkou Span B lines - the lines of the Ichimoku indicator, transferred to the hourly timeframe from the 4-hour one. Are strong lines.

Extreme levels - thin red lines from which the price bounced earlier. They are sources of trading signals.

Yellow lines - trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.