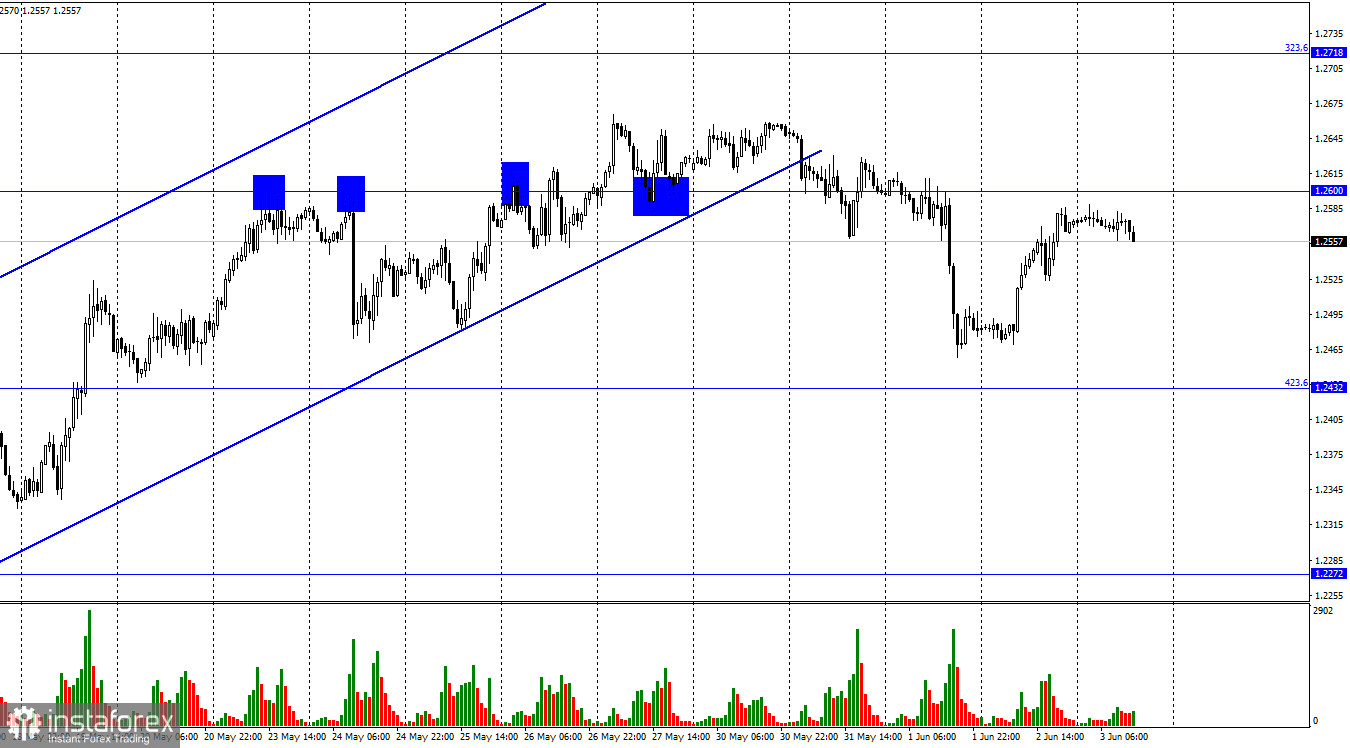

Good afternoon, dear traders! On the 1H chart, the GBP/USD pair rose considerably by 100 pips yesterday and almost reached 1.2600. This level was like a magnet for the price in the past days. However, this time, the price did not rebound from it. So, it is likely to fall to the Fibonacci correction level of 423.6% - 1.2432. Yet, it is still just a probability because the US is about to reveal its labor market reports. Naturally, they will significantly impact the market sentiment. Besides, traders are anticipating today only this data. The Nonfarm Payrolls report has always been one of the few reports that traders are waiting for with bated breath. The pair may change its trajectory in any direction following the NFP data. If the economy adds 325K, the US dollar is sure to advance. In case of a negative figure, it will slip.

However, there are also other possible readings. If the indicator for May totals 340K, will it be good or bad? What if the indicator amounts to 310K? I am expecting a drop in the euro/dollar and the pound/dollar pairs because both pairs closed below the uptrend corridors a few days ago. After that, their downward movement was not too strong to be completed. However, I do not rule out that the NFP data may surprise traders. Therefore, the pairs may change drastically their trajectories. The US will also publish reports on the unemployment rate and average hourly wages. However, they will be eclipsed by the Nonfarm Payrolls report.

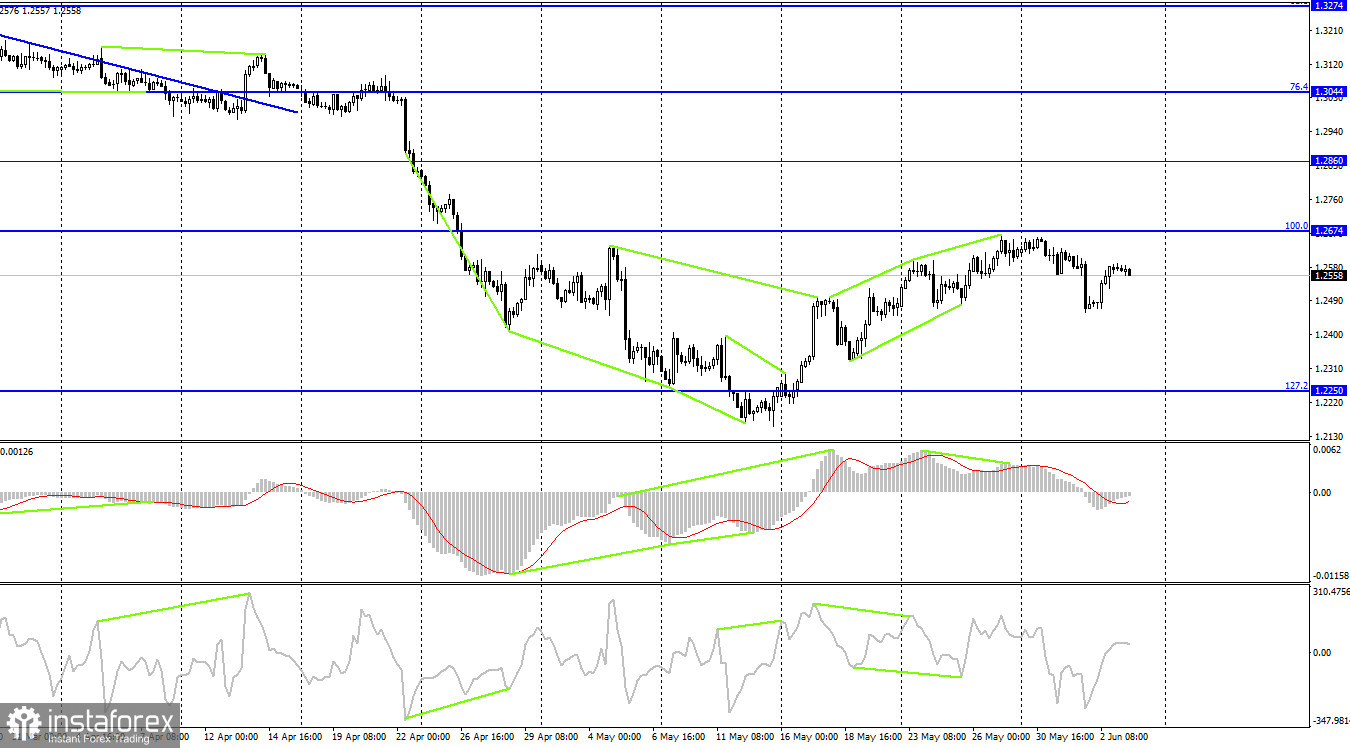

On the 4H chart, the pair performed a reversal with the US currency taking the lead after the formation of a bearish divergence of the MACD indicator. It occurred near the Fibonacci correction level of 100.0% - 1.2674. Yet, there was no rebound. Thus, a fall in the quotes has already begun. The pair may drop to the correction level of 127.2% - 1.2250. The pound sterling will strengthen if it rises above the Fibo level of 100.0%. If so, it may resume an upward movement to the 1.2860 level.

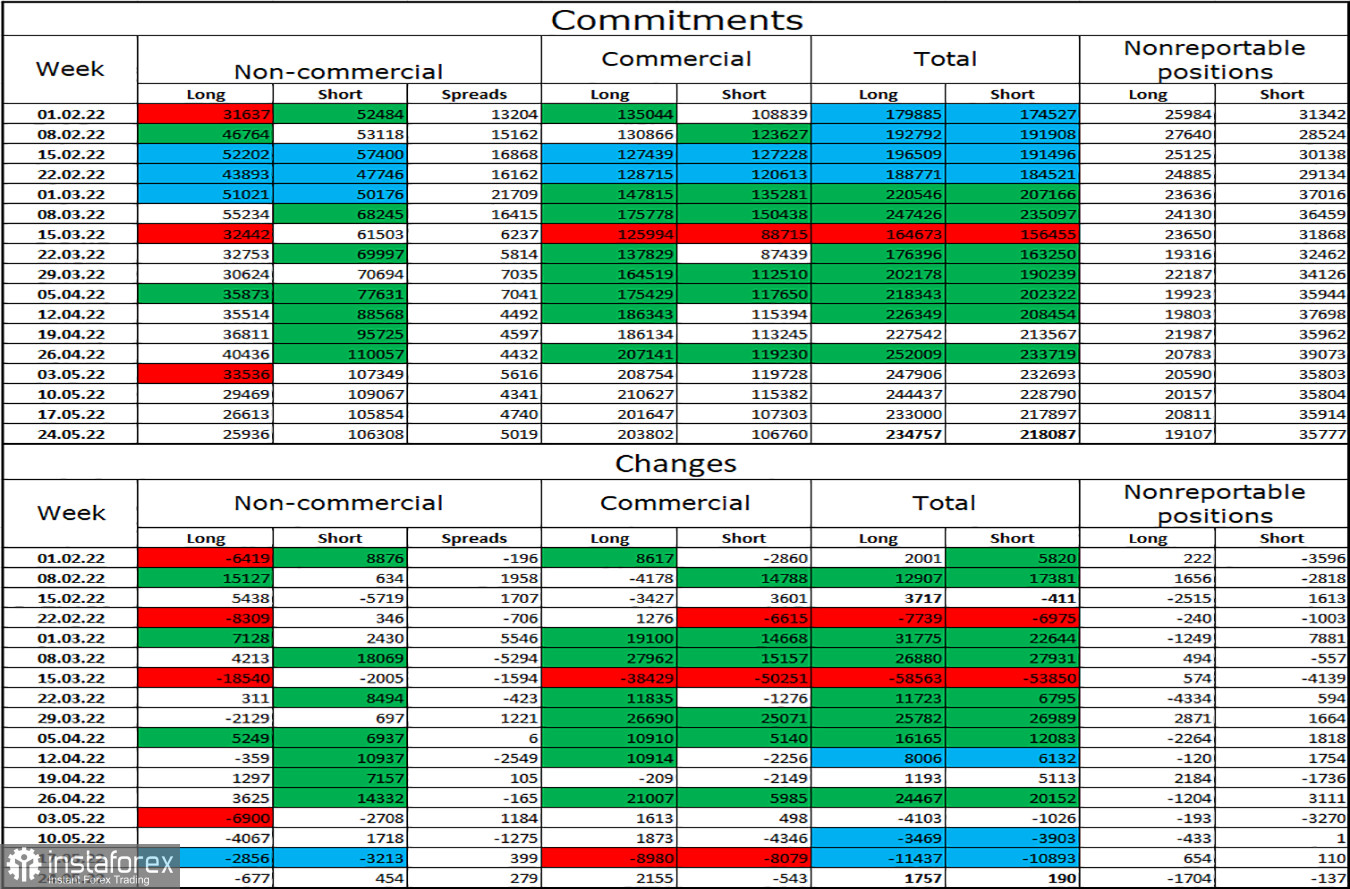

Commitments of Traders (COT):

The mood of the Non-commercial category of traders has not changed significantly over the past week. The number of Long contracts decreased by 677, while the number of Short contracts increased by 454. Thus, the general mood of traders remained bearish. The number of Long contracts exceeds the number of Short ones by four times as before. Large traders continue to get rid of the pound sterling. Thus, the bears are likely to take the upper hand over the pound sterling over the next few weeks. Now, the range indicated on the 1H and 4H charts will be of great importance. Such a big difference between the numbers of Long and Short contracts may also indicate a trend reversal. Nevertheless, speculators are now more inclined to sell than buy.

Macroeconomic calendar for the US and the UK:

US - Average hourly wage (12:30 UTC).US- Nonfarm Payrolls (12:30 UTC).US - Unemployment Rate (12:30 UTC).

On Friday, the economic calendar for the UK is completely empty. In the second half of the day, the US will unveil crucial reports that may significantly affect market sentiment.

GBP/USD outlook and recommendations to traders:

It is recommended to open short positions if the pair closes below the indicated corridor on the 1H chart. If it drops below the 1.2600 level, it is better to keep short positions open, bearing in mind the target level of 1.2432. It is better to open long positions if the pound sterling rises above 1.2674 with the target level of 1.2860 on the 4H chart.