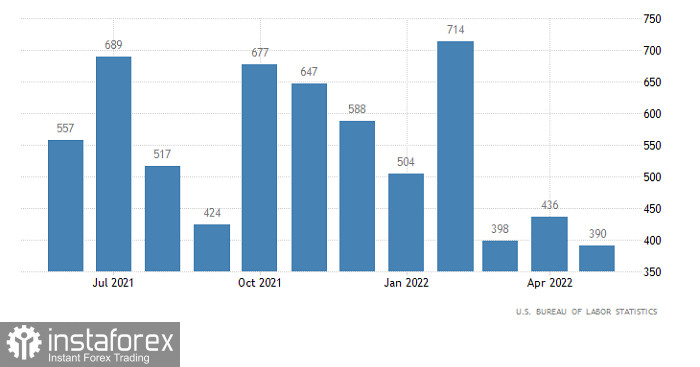

The content of the report of the United States Department of Labor was supposed to show a decrease in the unemployment rate from 3.6% to 3.5%. But unemployment remained unchanged. Still, the dollar has noticeably strengthened. It's all about new jobs, of which as many as 390,000 were created outside agriculture. This is not just more than the forecast of 320,000, but also almost twice as much as is necessary to maintain the stability of the labor market. In other words, even if unemployment remains unchanged now, it will inevitably decline in the near future. So the general nature of the content of the report is extremely optimistic. And thus, the dollar rose.

Number of new jobs outside agriculture (United States):

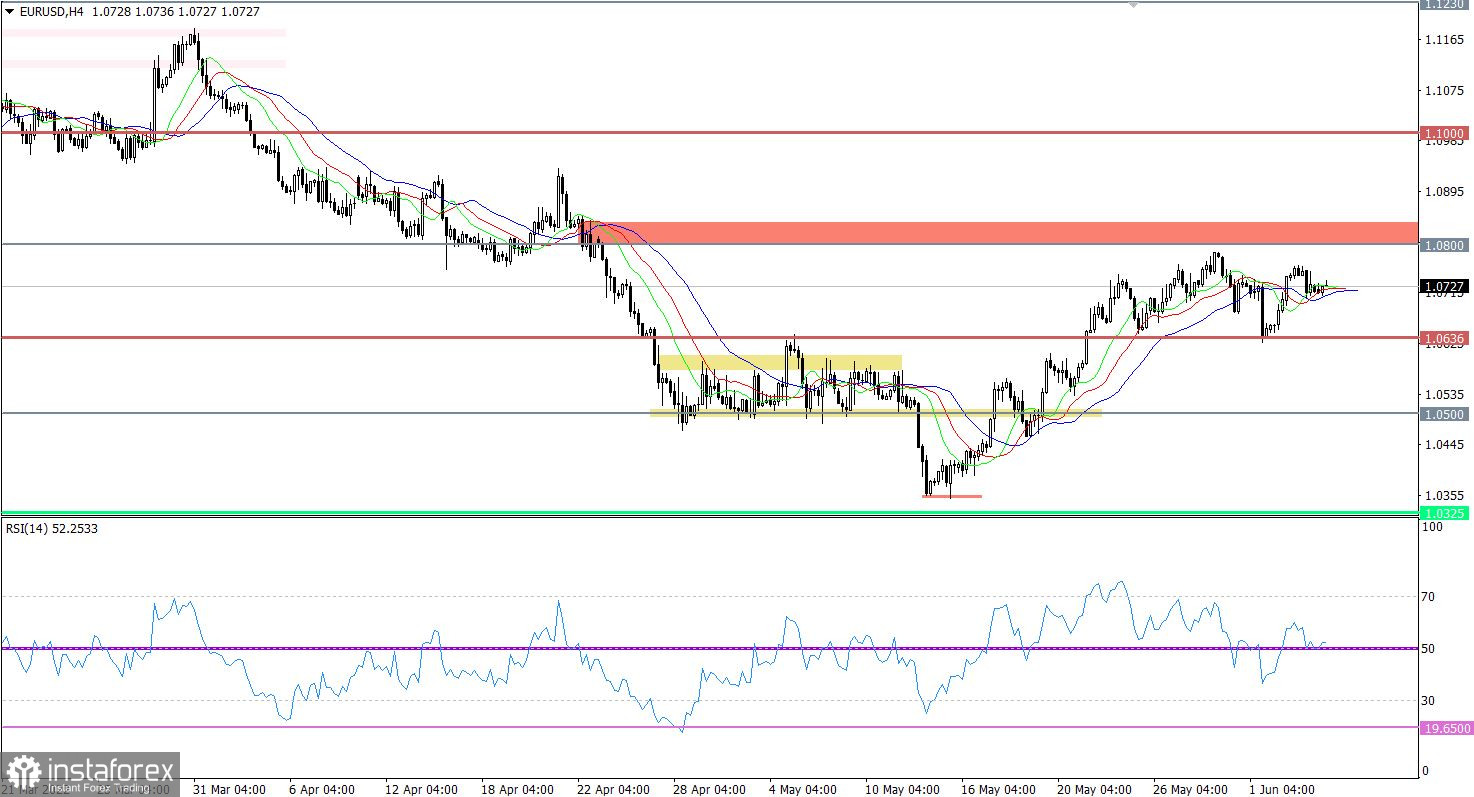

The EURUSD currency pair is moving around the local high of the corrective move, while there is a signal of a characteristic euro overbought.

The technical instrument RSI H4 is moving along the 50 middle line, which indicates a possible stagnation. RSI D1 is still in the upper area of the 50/70 indicator, which confirms the relevance of the corrective move.

The MA moving lines on Alligator H4 have many intersections, which may signal a slowdown in the correction. Alligator D1 indicates an upward cycle, the MA line is directed upwards.

On the trading chart of the daily period, there is a corrective move from the pivot point of 1.0350, which fits into the clock component of the downward trend. As resistance on the path of correction is the resistance of 1.0800.

Expectations and prospects:

Based on the recent price action, we can assume that the volume of short positions may increase when the price stays below the value of 1.0700. This move will lead to a move towards the support level of 1.0636.

An alternative scenario considers a control convergence of the price with the resistance level of 1.0800. A buy signal may appear when the price is kept above 1.0765.

Complex indicator analysis has a variable signal in the short-term and intraday periods due to price stagnation. Indicators in the medium term have a buy signal, indicating a continuing corrective move.