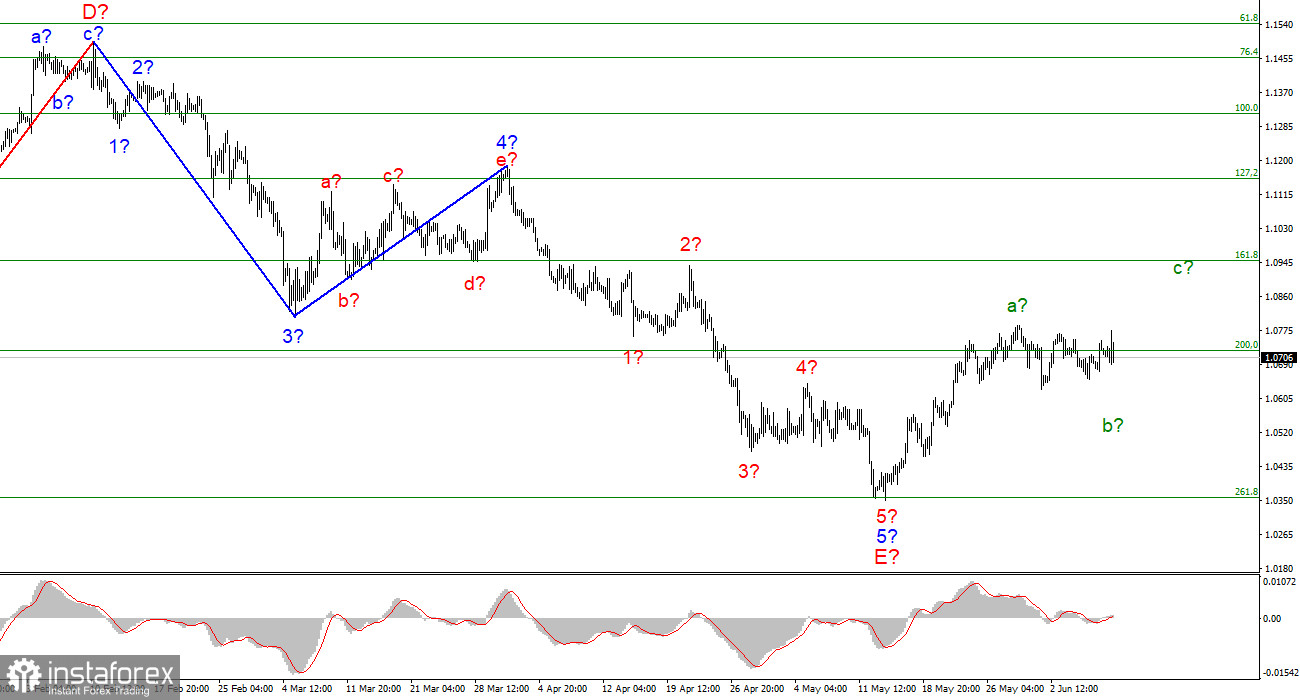

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. The instrument has completed the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is indeed the case, then at this time the construction of a new upward trend section has begun. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are already visible. Wave a is completed, and wave b can take a three-wave form, and in this case, the decline in the quotes of the instrument will continue with targets located around the 6th figure or slightly lower. Wave 5-E turned out to be a pronounced five-wave, so its internal wave marking is beyond doubt. The only option now in which the decline of the euro can resume for a long period is the rapid completion of the correction section of the trend and the construction of a new downward impulse. However, to identify this option, you need at least the completion of the ascending wave c, the targets of which are located about 9-10 figures.

The results of the ECB meeting did not come as a surprise to the market

The euro/dollar instrument on Wednesday first increased by 50 basis points, then decreased by 70, but in general remains at the opening levels of the day. Market activity was not too high today, but immediately after summing up the results of the ECB meeting, the market moved very actively. It is a pity that it could not resume the construction of the corrective wave b, nor begin the construction of wave C. The instrument simply went both ways and returned to where it was before the ECB meeting. I note that the demand for the European currency could grow today. For the first time in a long time (since 2014), the ECB said that rates will be raised in the near future. They practically promised to raise the rate by 25 basis points in July and continue raising it in September. In addition, the deposit rate will exceed the zero level, as stated by Christine Lagarde, in the third quarter. Thus, slowly and slowly, the ECB is connecting to the trend set by the Bank of England and the Fed.

As can be seen from today, the market was not too happy about these plans. However, if the ECB does decide on at least two rate hikes, then this may already be enough to build a corrective wave c, which I am waiting for. Without this wave, you will have to make adjustments to the entire wave layout. Lagarde also announced a new forecast for inflation. In 2022, it will be 6.8%, and next year it will be 3.5%. By 2024, the index is expected to decline to 2.1%. "Our forecasts say that inflation will remain high for an undesirable long time. We expect that lower energy prices and the release of tension in supply chains will contribute to a slowdown in inflation. For our part, we will normalize monetary policy, which will also have a positive effect on prices," the ECB president said during a press conference. Lagarde also noted that the Ukrainian-Russian conflict will negatively affect the global economy and undermine trade, creating a shortage of raw materials and energy.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". It is best to wait for the completion of the construction of wave c-b, its low should be located slightly below figure 6.

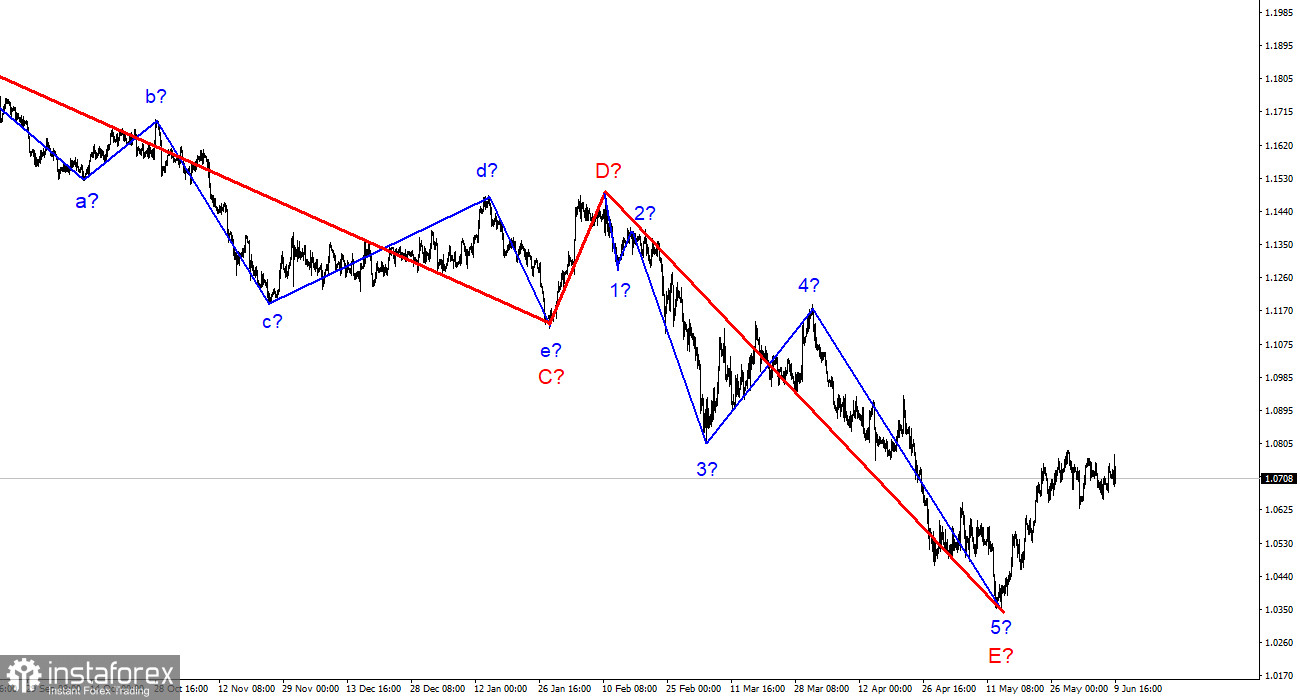

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downtrend has acquired a complete look. If this is true, then in the future for several months the instrument will increase with targets located near the peak of wave D, that is, to the 15th figure.