Following the trading results of the last five days, the British pound sterling declined against the US dollar, much more significant than the single European currency. It should be emphasized once again that, despite several interest rate increases by the Bank of England, the pound is in a disassembled state and shows weakness across a wide range of the market. Just look at the huge bullish weekly candle of the euro/pound cross rate to understand a lot. As I have repeatedly noted, the price dynamics of this cross-rate have an impact on the movement of the main currency pairs - euro/dollar and pound/dollar. Naturally, the most important role in any trading instrument is played by the technical picture, and GBP/USD is no exception here. So let's do a technical analysis of GBP/USD, starting with a weekly timeframe.

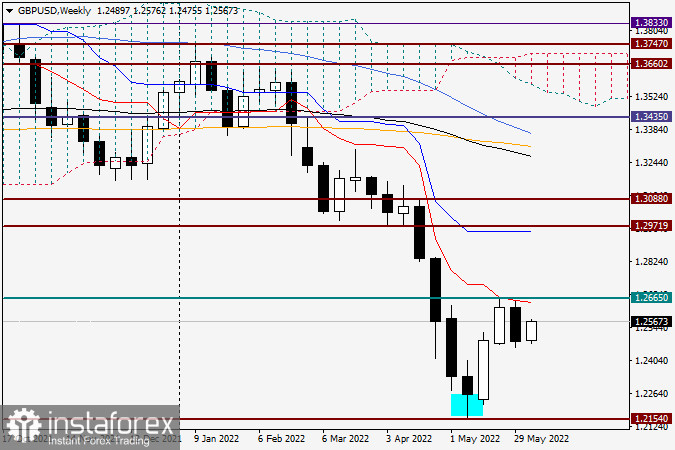

Weekly

After the previous two-week growth, the bulls for the pound got tired and gave the course of trading to their opponents. Technically, the pair again tried to overcome the strong resistance of sellers at 1.2665, and again this attempt was unsuccessful. Although to be precise, the pair did not reach 1.2665 but showed maximum values at 1.2658. There is no doubt that the red Tenkan line of the Ichimoku indicator, which is located near 1.2665, also directly provides strong resistance to growth attempts. Now the Tenkan is located at 1.2650, so we will consider 1.2650-1.2665 as the resistance zone. At the same time, only a breakdown of the 1.2665 level with the mandatory closing of weekly trading above will open the way to higher prices. If, according to the results of the current weekly trading, sterling bulls again fail to break through the designated level, and another bearish candle appears on the weekly chart, this may signal the end of the corrective pullback, which began from 1.2154. I assume that this week may be decisive for the subsequent direction of the GBP/USD currency pair. Also, I will not see anything surprising if the players on the exchange rate increase finally manage to overcome the designated obstacles, thereby confirming their further readiness to move the quote in the north direction.

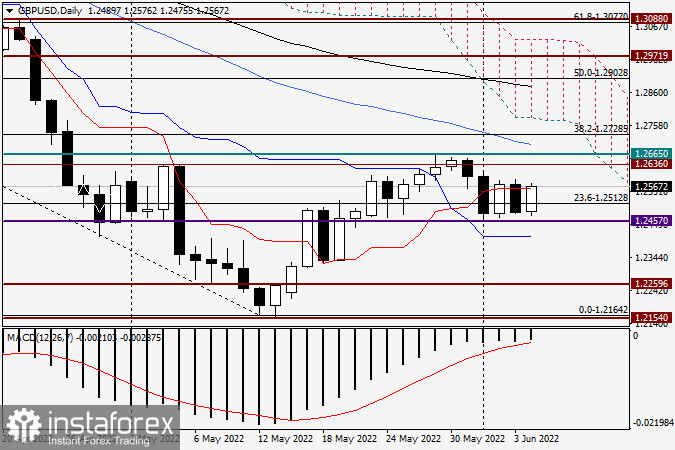

Daily

But on the daily chart of the pound/dollar pair, the red Tenkan line of the Ichimoku indicator is already all in operation. This line resists attempts to continue growth, and bulls for GBP/USD still fail to gain a foothold over it. Friday's ambiguous labor reports from the United States were still won back by market participants in favor of the US currency, as a result of which trading on June 3 closed under the important psychological and technical level of 1.2500. Today, at the end of the article, the Briton is showing growth against the US dollar, the continuation of which will inevitably send the pair to the resistance area, which looks like 1.2636-1.2665 on the daily chart. To implement a bearish scenario, it is necessary to break through strong support near 1.2457, and then pass the blue Kijun line on the decline, which is located at 1.2409. There is still no complete clarity on trading recommendations, and this is seen by the alternation of candles on the daily chart. For sales, I suggest looking for bearish-looking reversal candlestick patterns on this or smaller timeframes. Purchases, under the same conditions, I recommend considering after a decline in the price area of 1.2500-1.2460.