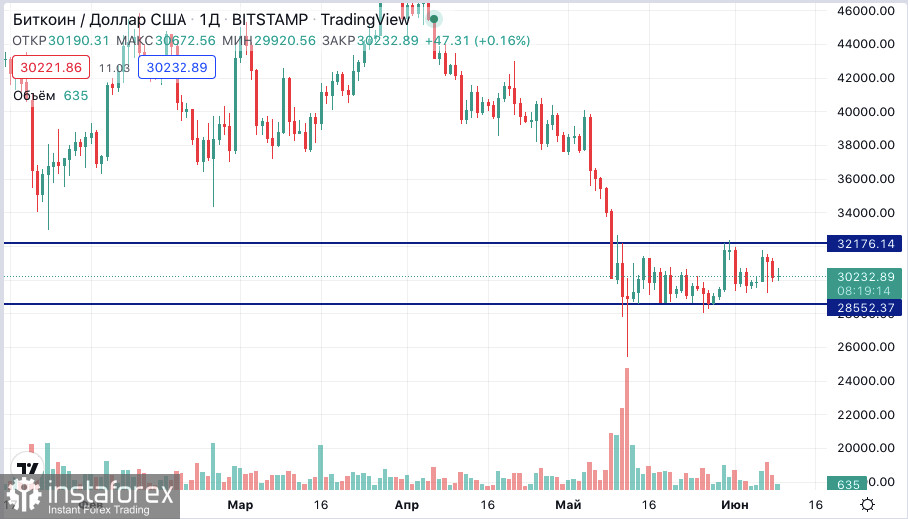

On the main cryptocurrency chart, there are no significant changes. The sideways momentum continues, leaving a margin for price moves towards the lower border. Against this backdrop, the forecasts are unchanged.

Meanwhile, the crypto community continues to debate the future of the crypto market. However, even BTC best-known proponents have cooled its price forecasts considerably.

Tom Lee, co-founder of independent research firm Fundstrat, was interviewed by CNBC today. He noted that he is not sure that Bitcoin will be able to reach January's opening prices by the end of the year. Nevertheless, the expert suggests that the major cryptocurrency has "already bottomed out."

While many argue that the price could fall even lower in the coming months, bringing Bitcoin to $20,000 or under, Lee believes that underlying strength is worth paying attention to now.

"It's a risk-on asset, so I think to the extent that Nasdaq and Bitcoin rally, it's helping us become more comfortable that the market's already bottomed," he said.

At the same time, Lee brushed off the Terra debacle and redundancies at major crypto companies including United States exchange Coinbase, saying that Bitcoin was "acting far better than people expect."

When asked where BTC price action was headed by the start of 2023, even if correlated stock markets put in gains, the response was less optimistic.

"I think Bitcoin's going to make its way to flat for the year, possibly up," he concluded.

Lee was previously famous for his bullish takes on Bitcoin, among which was a prediction of $200,000 for 2022 made shortly after the latest all-time high of $69,000 last November.

Meanwhile, MicroStrategy CEO Michael Saylor remains unapologetically bullish. In his comments, he firmly brushes aside any suggestion of permanent price downside.

On Wednesday, he said those who had claimed Bitcoin would be banned or go to zero had already been "discredited"."If the deniers are wrong and the skeptics are wrong — and it's pretty obvious they're both wrong at this point — it's not going to zero, and if it's not going to zero, it's going to a million," Saylor forecast.

While nothing new, Saylor being increasingly grates with the downbeat perspective on risk assets across the board in the new era of central bank monetary tightening.

At the same time, Saylor argues that when it comes to buying more BTC for its existing reserves, there is no point in "timing the market."

"We're kind of doing the equivalent of dollar cost averaging for a large corporation. "We're not trying to time the market; I think all the statistics on the S&P and on the Bitcoin index show you can't time the market. We're just reinvesting free cash flows in the market as circumstances allow us."

Meanwhile, the crypto community does not seem to be so optimistic, as not everyone has the opportunity and the challenge to "reinvest free cash flows into the market as circumstances permit".

Today it was reported that the correlation between $SPX and $BTC seems to be close to 1 again.

Notably, the US jobless claims data had little impact on the markets, and on June 10, the US consumer price index will be released.

Other analysts, assessing correlations based on stock market movements, report that BTC/USD could climb as high as $35,000 before entering the next major correction phase.

Meanwhile, crypto traders are comparing the current price movement to the bear market of 2018 and the cryptocurrency collapse in March 2020. This could be a sign of another expected correction.

There have always been differing views in the bitcoin community, especially in times of uncertainty and pressure on the price. However, given a strong technical level, as in the summer of 2021, a reversal could happen at any time.

When it comes to those who, like big investors and Michael Saylor, cannot "reinvest free cash flows into the market as circumstances permit", a speculative strategy based on technical analysis should be chosen.

It is difficult to draw conclusions about the future direction as long as the price is not out of sideways. However, there is hope that the strong support in the area of $28,000 will hold, as it did last year.