Pair failed to go against the trend

Today, let's sum up the results of yesterday's meeting of the European Central Bank. Then, we will try to figure out the future prospects of the euro/dollar pair.

Yesterday, the ECB kept the interest rate unchanged which was hardly surprising. Markets were mainly focused on the speech by ECB President Christine Lagarde. Let's first discuss the decision of the ECB Governing Council. The regulator announced the end of the APP program that will start in July. This means that the central bank will stop buying assets which it has been doing for 7 years as a monetary tool. As for other statements made by Christine Lagarde about the negative deposit rate, they are likely to be true. The despot rate which now stands at -0.5% will be raised by 25 basis points as soon as next month. The next round of a rate hike is set for autumn but only if the inflation rate is bad. Most likely, high inflation will persist until autumn and the rate increase will continue.

As for the key interest rate, which has long been in the zero zone, its increase is also planned for July. The whole market volatility yesterday was caused by the uncertainty around the size of a rate hike. During the press conference, Christine Lagarde said that the main priority for her was a gradual and cautious increase of interest rates. Since it took so long for the ECB to start its monetary tightening, many investors expected it to take more aggressive steps and raise the rate by 50 basis points at once instead of 25. However, that was not the case, especially given the dovish stance of the regulator. At the same time, Lagarde also noted that the regulator was not going to discuss the neutral interest rate.

Unlike the US Federal Reserve that defined the neutral rate in the range between 2.5-3.0%, the ECB keeps this information secret. In fact, it simply avoids giving precise information and gives some general statements instead. For instance, market participants are already tired of reading again and again about running inflation, disruption to supply chains, lockdowns in China due to the covid-19 outbreak, and the conflict in Ukraine. The coronavirus agenda is no longer surprising and everyone is tired of it. Anyway, yesterday's statement by the ECB was far from dovish. On the other hand, all this has already been priced in by the euro traders. And here is the result.

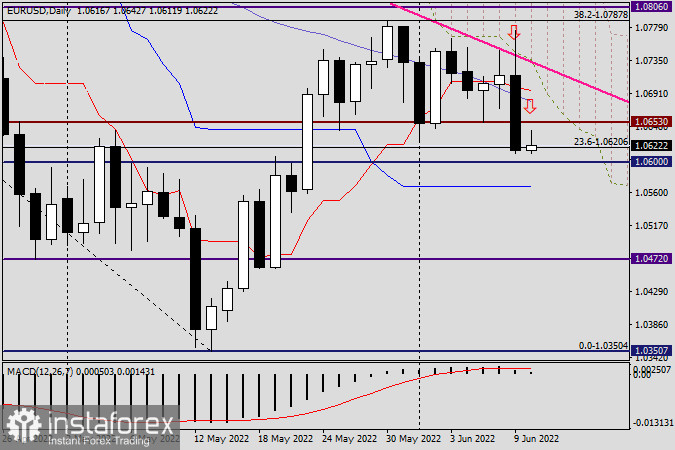

Daily chart

I think that what happened to the euro yesterday was not supposed to be this way. On expectations of a higher rate hike by the ECB, all stop-loss orders that were placed too close were triggered. After that, EUR/USD plunged. From the technical point of view, the whole process was perfectly done. The arrow pointing down that you see on the chart was set yesterday to indicate a good opportunity to sell. The resistance was really strong there. First of all, a pink resistance line at 1.1495-1.1185 is located here. Secondly, the lower boundary of the daily Ichimoku Cloud also passes there. As a result, the price performed a false breakout from the pink resistance line, and the euro bulls failed to enter the Ichimoku Cloud.

By the way, the pink resistance line is the line of the downtrend, and you should not trade against the trend. As bulls' hopes were ruined, the pair tumbled as well and broke through the support level of 1.0653. The breakthrough was strong. At the moment of writing, we can observe a pullback or an attempt to perform it towards the broken support line. Given the market reaction to the ECB yesterday and the overall sentiment, I would recommend selling the pair from a strong technical zone of 1.0650-1.0700. This is where the broken support level of 1.0653, as well as the Kijun and Tenkan lines, are located. All together, they can act as strong resistance and reverse the price to the downside again. Today is the last trading day of the week which means that EUR/USD may rise amid profit-taking. Yet, its rise is unlikely to be strong as the euro bulls might still be shocked after yesterday's drop. For those who are going to sell the pair today, I recommend placing take-profit orders at 1.0600 and/or at 1.0572.Good luck!