US and European stocks noticeably sank on Thursday, after the ECB announced its decision to start raising interest rates in July and the release of US inflation data today.

Reportedly, the ECB said it will only increase rates by 0.25%, not by 0.50%, which most markets expected. They said they refuse to aggressively raise the cost of borrowing because they do not want to provoke stagflation in the face of high inflation. They also noted that a rate hike may not happen if inflation in the Euro area stalls. Unsurprisingly, such a decision led to a decline in EUR/USD to 1.0350.

In terms of US data, forecasts for the CPI in May expect a stabilization in the year-on-year figure around 8.3%, and a 0.7% increase in month-over-month data. Meanwhile, core consumer inflation is expected to fall to 5.9% y/y and dip to 0.5% m/m. All these are very optimistic forecasts, especially since oil and energy prices in the US are sky-high. If real values do turn out this way, the dollar will come under pressure as the Fed will either halt its increase in rates, or change it to just 0.25% instead of 0.50%.

But if inflation surges again, a new wave of sales will occur in the US stock market, which will then spread to other world markets. Dollar, on the other hand, will show a sharp increase as the Fed will not only raise rates by 0.50%, but also continue it in the following months.

In short, until inflationary pressure eases in predominantly Western countries, the world's central banks will raise interest rates at one rate or another, which in turn will lead to a deepening of the global crisis with negative consequences.

Forecasts for today:

XAU/USD

Spot gold found support at 1841.80 ahead of the release of the US inflation data. If the figure declines, gold will rise to 1866.70, especially since dollar demand will decrease.

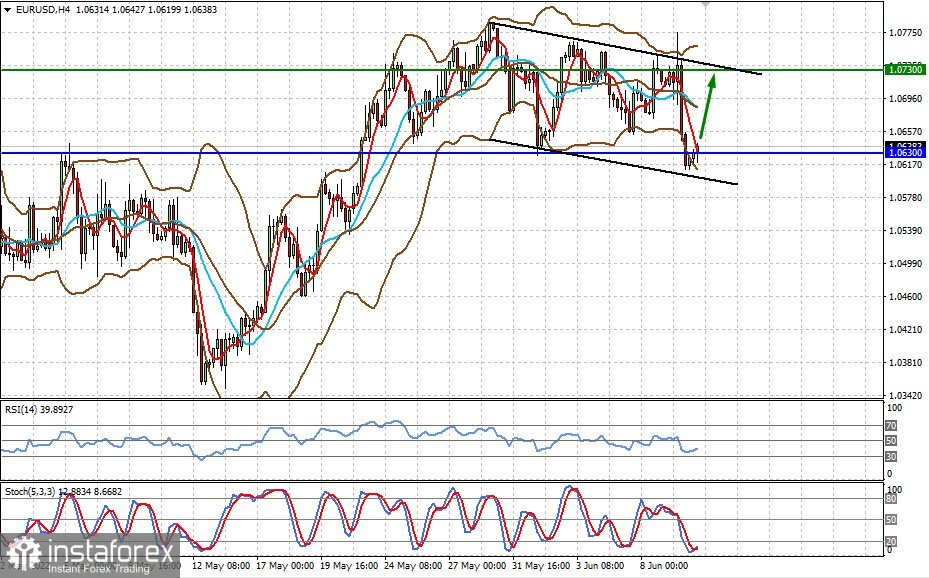

EUR/USDEuro is currently trading above 1.0630. If inflation in the US declines, the pair will rise to 1.0730.