Analysis of transactions in the EUR / USD pair

EUR/USD tested 1.0699 when the MACD line was far from zero, keeping the chances of a reversal and a rally. It then went to 1.0738 just when the ECB announced its decision on interest rates, but since the MACD line was still far above zero, the pair did not increase further. It moved down to 1.0699, where a sell signal was formed. By then, the MACD line had started to go down, so the quote fell by another 50 pips. It reached 1.0655, but long positions there did not bring much profit.

The European Central Bank is set to end its large-scale bond purchase program in three weeks, a key step in its fight against record inflation. They are also preparing for the first interest rate hike in more than a decade, which will begin next month and again in autumn if inflation calls for a tighter stance in monetary policy.

Today, there are no statistics scheduled to be released in the Euro area, so markets will be waiting for the US trading session. The report on industrial production in Italy may be of little interest, but the speech of ECB President Christine Lagarde will be decisive. US data on CPI will determine the direction of the pair as well, where, if inflation rises, dollar demand will surge. But if inflation falls, risky appetite will turn. The University of Michigan's report on consumer expectations and sentiment will no longer be of any interest after the May CPI figures.

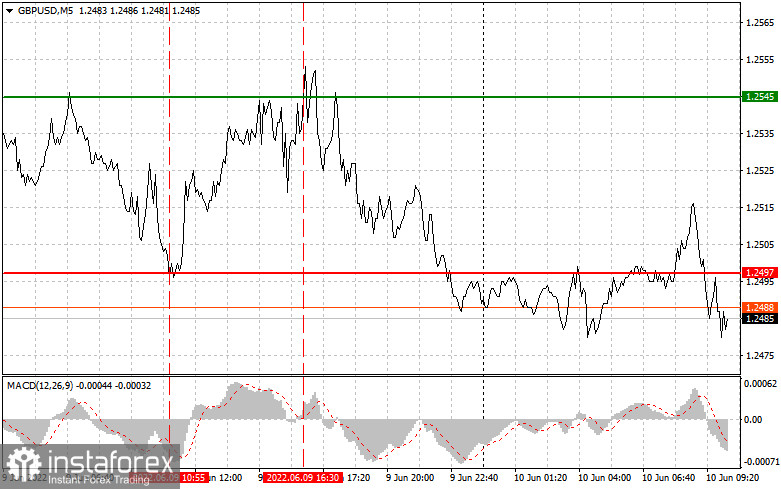

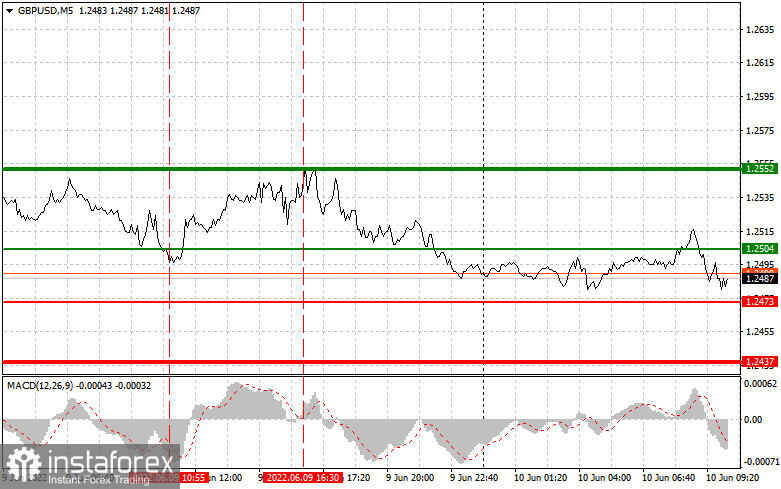

For long positions:

Buy euro when the quote reaches 1.0655 (green line on the chart) and take profit at the price of 1.0702 (thicker green line on the chart). Although a rally is quite unlikely today, bearish traders may close a number of positions, which will lead to a slight correction. But note that when buying, the MACD line should be above zero or is starting to rise from it. It is also possible to buy at 1.0616, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0655 and 1.0702.

For short positions:

Sell euro when the quote reaches 1.0616 (red line on the chart) and take profit at the price of 1.0565. Pressure will return after the US releases its data on the economy. However, note that when selling, the MACD line should be below zero or is starting to move down from it. Euro can also be sold at 1.0655, but the MACD line should be in the overbought area, as only by that will the market reverse to 1.0616 and 1.0565.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.