Global yields rose on Monday amid generally calm news background. The 10-year UST is back above 3%, while the German bonds are at a multi-year high of 1.32. New Zealand bonds also approached 4%.

Unsurprisingly, stocks traded in green territory as well, partly supported by China who not only lifted some of its covid restrictions, but also signals that the authorities will support the economy and weaken some regulatory functions.

In terms of the forex market, pound traded upwards yesterday as the expected vote of no confidence in Johnson did not take place. However, it rolled back down before the end of the day.

This week, the most important event is the US consumer inflation report on Friday, which is forecasted by analysts to show a decrease from 8.3% to 8.2%. If real data turns out that way, volatility will remain low. If not, then there will be a sharp movement in the markets.

There are no significant drivers today, so trading will mainly be in the formed ranges.

NZD/USD

Inflation in New Zealand already rose to 6.9%, but it seems that it will only go up even more. Forecasts suggest that it will break 7% in Q2, driven by rising energy prices and pressure from the labor market. Reducing the pressure on the housing market may help, but there is a risk as the central bank may raise interest rates more aggressively.

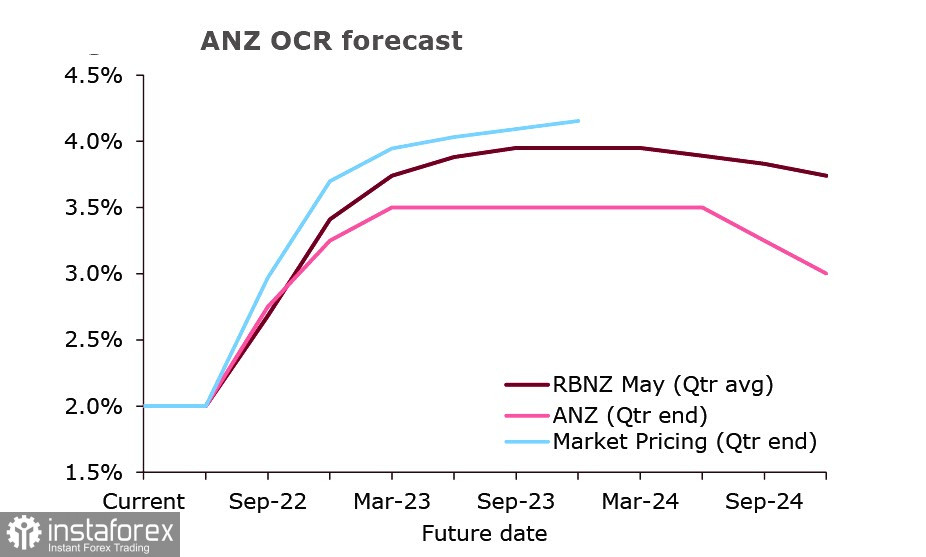

Many predict a peak of 4.25% by the end of 2023, but the RBNZ itself is more cautious and does not exceed its forecast to 4%. So far, the most conservative bank is ANZ, which believes that the rate will not be raised above 3.5%.

If ANZ is right, then the kiwi will lose to the dollar as it has higher forecasts. This means that the NZD/USD pair will be under long-term pressure.

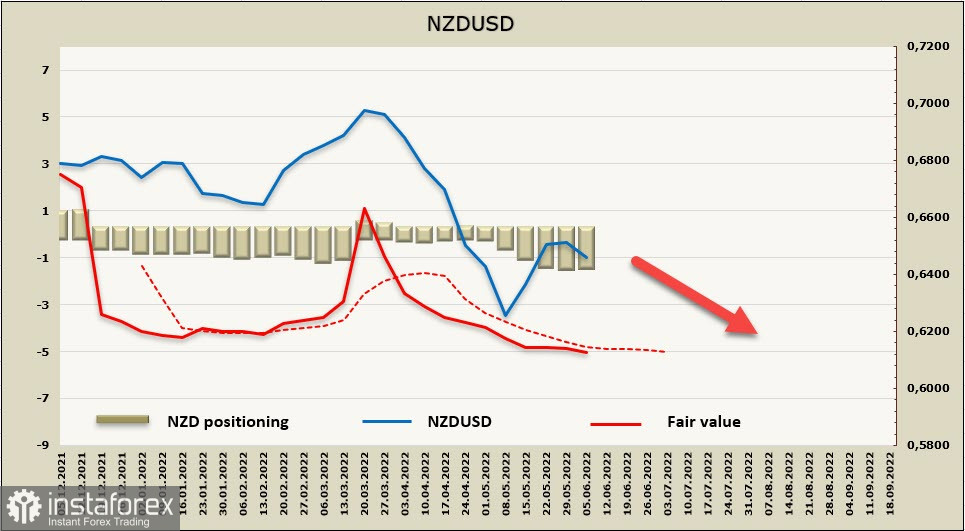

A weekly change of +30m does not have a significant impact on NZD positioning as usual, as the accumulated bearish edge is -1.22bn. Also, the settlement price is held below the long-term average, which signals a further decline in NZD/USD.

The trend continues to be bearish even though trading has been in a sideways range over the past week. In fact, there may be an attempt to test the support level of 0.6210.

AUD/USD

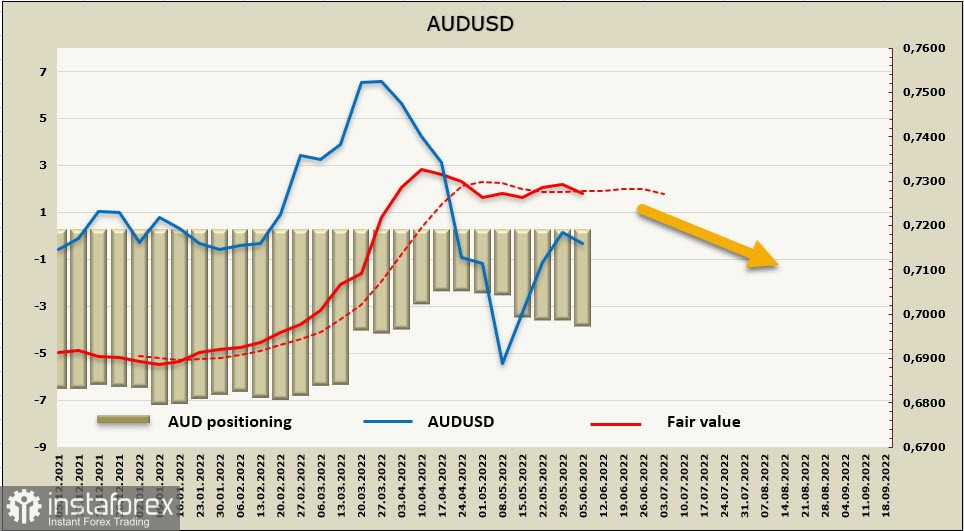

The RBA raised the interest rate by 0.25% to 0.60%, prompting a decrease in AUD. The reason is that the central bank did not give any hint about it prior to the meeting, making market players unprepared. Also, although the central bank considered a 0.40% increase last month, it decided to limit itself to a quarter percent. Their reason back then was that they meet every month, much more than other banks, so they have more opportunity to respond more quickly to changing conditions. This is why many were caught off guard with their decision to raise rates.

Inflation in Australia is high, but is lower than in the US or Europe.

But even though AUD hit a new local high, its trend is still bearish. As such, it is likely to move down to 0.7130/42 and 0.7030/40, though the rising oil prices and growing demand in China could turn it up.