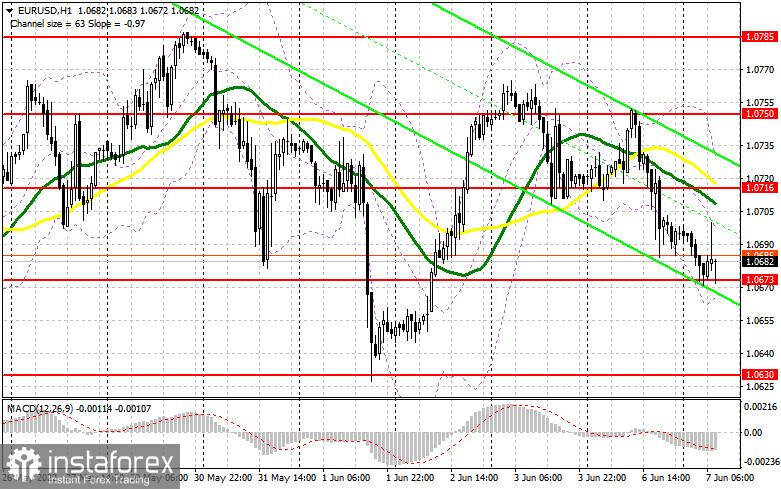

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier I asked you to pay attention to the level of 1.0750 to decide when to enter the market. The absence of statistical reports from the eurozone affected the market volatility as expected. That is why bears easily protected the resistance level of 1.0750, which led to a false break and sell signal. As a result, the pair dropped by more than 45 pips to touch the support level of 1.0711. A false break of this level gave a buy signal, but the pair showed an insignificant rise.

Conditions for opening long positions on EUR/USD:

Pressure on the euro is returning amid whispers that in May, the US inflation will hardly reach its peak that was expected by most economists. In this case, the US Fed may continue using an aggressive approach to its monetary policy tightening. Early today, the eurozone is going to disclose some macroeconomic reports. Traders should pay attention to Germany's factory orders and IHS Markit construction PMI. Weak data may lead to a new test of 1.0673, where during the Asian trade we saw a false break. That is why it will be wise not to bet on this level in the first part of the day. At the same time, positive data on the eurozone Sentix investor confidence index may prevent a new sell-off of the euro. However, it is unlikely to alter the situation. If the pair drops, only a false break of 1.0673 will give a long signal with the target at the resistance level of 1.0716. There, we see bearish moving averages that may cap the upward potential. A break and a downward test of this level may seriously affect sellers' stop orders, providing traders with a new long signal with the target at yesterday's high of 1.0750, where it is recommended to lock in profits. The pair will hardly reach the next target of 1.0785, the last month's high, due to the absence of positive news that may revive demand for risk assets. If the euro/dollar pair drops and buyers fail to protect 1.0673, pressure on the euro will return. The pair may also slide to 1.0630. That is why it will be better to go long after a false break of this level. It is also possible to buy the euro from 1.0596 or lower – from 1.0561, expecting a rise of 30-35 pips within the day.

Conditions for opening short positions on EUR/USD:

Sellers managed to protect 1.0750 and partially regained control over the market. Now, the pair may break the level of 1.0673 and form a new downtrend in an attempt to return to 1.0630. Strong data from Germany may reduce pressure on the euro, though for a short period of time. That is why if the pair increases in the first part of the day, only a false break of 1.0716 will give a short signal with the target at the support level of 1.0673, where the pair is trading at the moment. A break and settlement below this level as well as an upward test of this level will give an additional sell signal, thus affecting buyers' stop orders. In this case, the pair may slide to 1.0630. A break and fixation below 1.0630 may take place only in the second part of the day after the publication of the US trade balance figures. If the prediction comes true, the next target will be located at 1.0596, where it is recommended to leave the market. If the euro/dollar pair climbs during the European session and bears fail to protect 1.0716, buyers will regain control over the market. This will allow the pair to form a new lower limit of the upward channel. Against the backdrop, it will be better to open short positions after a false break of 1.0750. It is also possible to sell the euro from the monthly high of 1.0785 or higher – from 1.0820, expecting a drop of 30-35 pips.

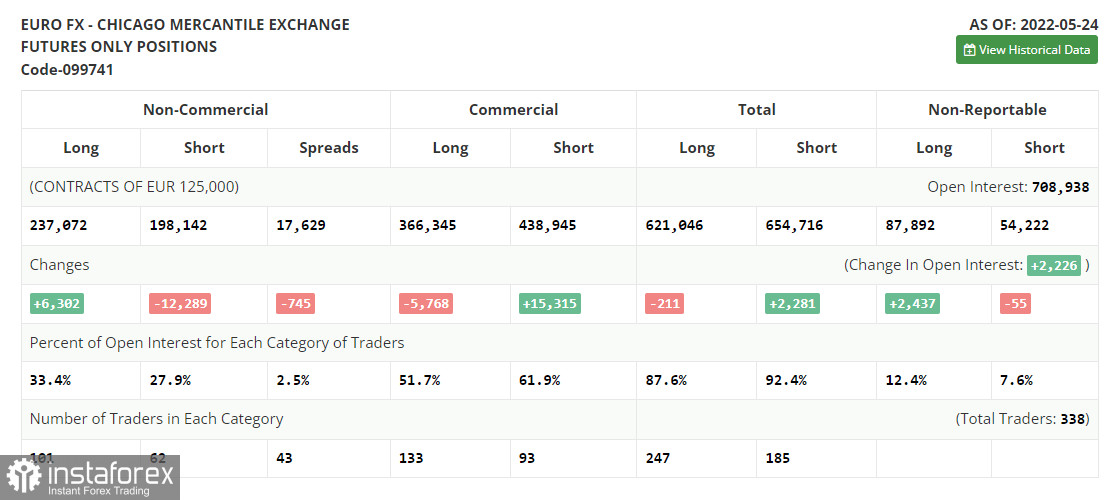

COT report

According to the COT report from May 24, the number of long positions advanced, whereas the number of short positions dropped. Traders continued opening long positions, expecting a more aggressive monetary policy from the ECB. Although last week, there were less comments about a key interest rate hike in the near future, the euro/dollar pair managed to retain its upward potential. Now, analysts suppose that the ECB will raise the deposit rate by one-fourth of a basis point as early as July. The next two hikes will take place in September and December. By the end of the year, the benchmark rate is expected to be at the level of 0.25%. However, some experts are sure that the central bank will have to take more aggressive measures. A lot depends on the inflation report for May of this year. The indicator may jump to 7.7% on a yearly basis, thus increasing pressure on politicians. Against the backdrop, the regulator may raise the key interest rate up to 0.5% from the current zero level. The COT report unveiled that the number of long non-commercial positions increased by 6,302 to 237,072 from 230,770, while the number of short non-commercial positions declined by 12,289 to 198,142 from 210,431. The euro's low price is making the currency more attractive for mid-term traders. According to the weekly results, the total non-commercial net position increased to 38,930 from 20,339. The weekly close price jumped to 1.0734 from 1.0556.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, thus pointing to a possible decline in the euro in the short term.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a decline, the lower limit of the indicator located at 1.0665 will act as support. If the pair grows, the resistance level will be located at the higher limit of the indicator at 1.0730.

Description of indicators- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.