The European currency remains on the back foot ahead of a potentially explosive US inflation data release. If inflation increases once again in May, it will lead to a sharp drop of risky assets, pushing up USD. This will likely force the Federal Reserve to act more aggressively as well. In the meantime, yesterday's policy meeting of the European Central Bank has resulted in major banks worldwide revising their forecasts.

These long-term outlooks are important for traders, because they set the tone in the FX markets. Leading global banks and their economists have already revised their eurozone interest rate forecasts for 2022 and 2023. However, they disagree over how fast and far the European Central Bank will ultimately increase borrowing costs.

The ECB left its deposit rate unchanged at -0.5% yesterday. The rate would be increased by 25 basis points in July and autumn of 2022, if inflation remains high. The next two ECB meetings will obviously end the 8-year period of very low interest rates. According to the latest data, inflation in the eurozone reached 8.1% in May, exceeding the regulator's target level of 2.0% more than fourfold. Soaring prices are weighing down on European households, while governments spend billions of euros to shield consumers from the impact of skyrocketing energy prices. Many policymakers are now considering a 50 basis point deposit rate increase.

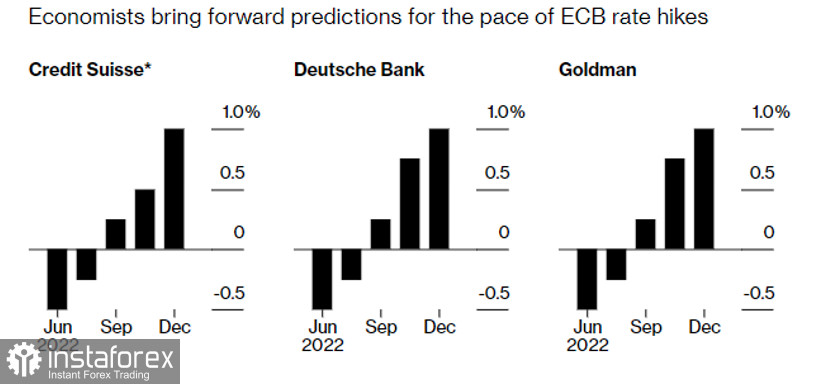

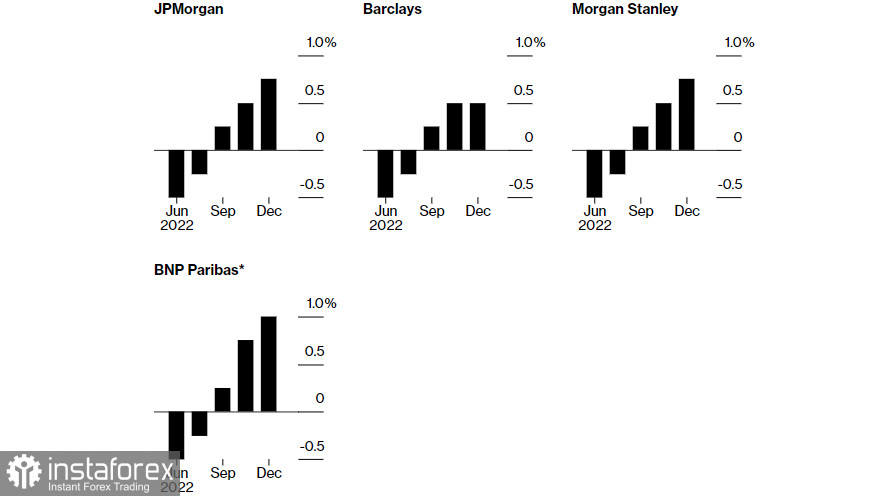

Here are the forward interest rate predictions by leading banks:

Credit Suisse expects a 75 basis point increase over the fourth quarter, with a 25 point move in October and a 50 point increase in December.BNP Paribas assumes a 50 basis point increase in October would be sufficient.Deutsche Bank AG predicts that the ECB would hike interest rates by 25 basis points in July, followed by a 50 point increase in September and October and another 25 point increase in December. The bank expects interest rates to reach 2% in June 2023.Goldman Sachs Group Inc's outlook matches Deutsche Bank's forecast. However, Goldman Sachs expects three more hikes in 2023, with the terminal rate reaching 1.75%.JPMorgan Chase & Co. sees a 25 basis-point hike in July and then 50 in September, with additional quarter-point increases in October and December. If inflation continues to rise, there is a chance of more aggressive actions by the regulator, the bank's economists said.According to Barclays Plc, the ECB will increase the deposit rate by 25 basis points in July, 50 points in September, and 25 in October.Morgan Stanley expects a quarter-point hike in July, a half-point hike in September and two more 25 basis-point increases in October and December.

Euro bears are steadily pushing the market downwards, striving to send the pair into a new downtrend and test May's lows. In the short term, a break below 1.0580 would open the way towards 1.0530 and 1.0490. If EUR/USD breaks through these levels as well, it could then test 1.0420 and 1.0360. Opening short positions would only be possible if the pair returns above 1.0660. This would allow it to move towards 1.0720 and 1.0775.

GBP bulls have many more problems now than before. In the short term, they would try to push the pair above 1.2520, which would extend its upside momentum. However, if GBP/USD breaks below the 1.2460-1.2430 range, it would lead to a sell-off, pushing the instrument towards the lows at 1.2390 and 1.2360, as well as the support at 1.2330 further below.