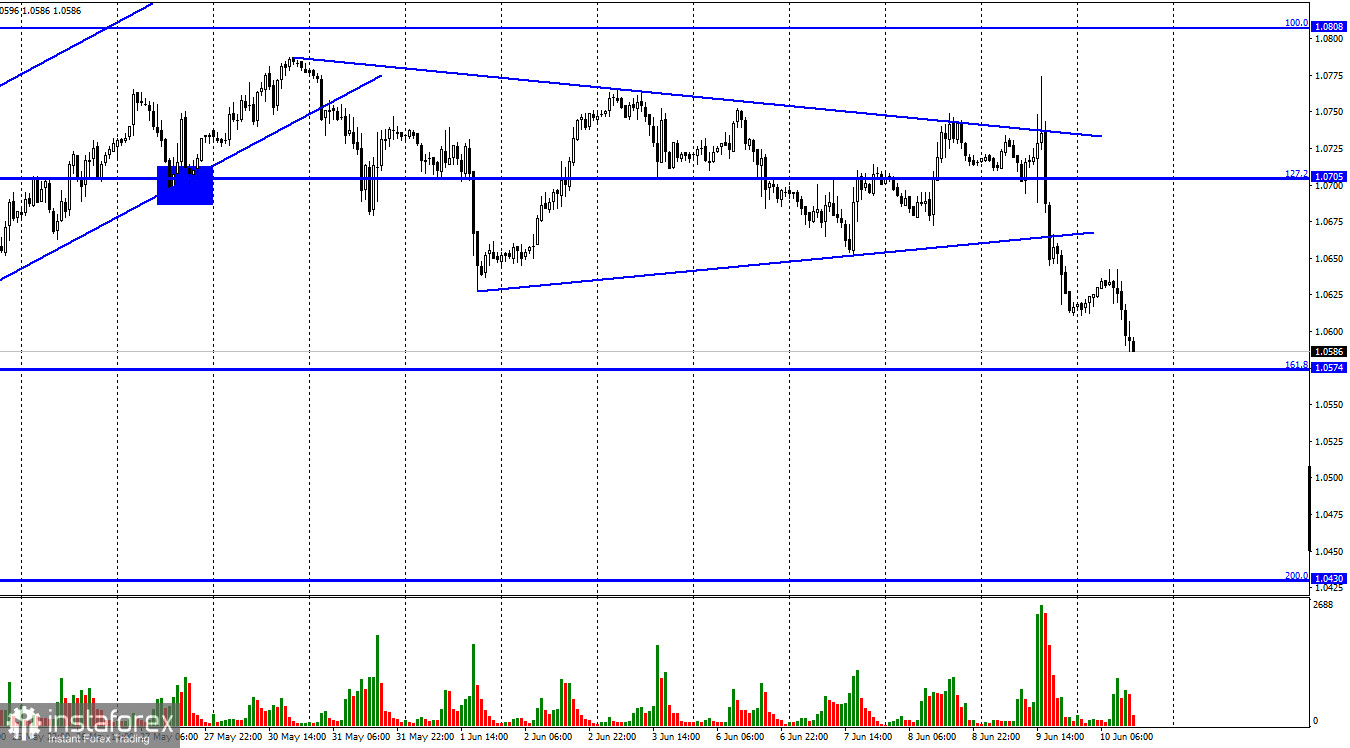

Hello, dear traders! On Thursday, the EUR/USD pair was trading in accordance with the graphic elements on the chart. The pair's attempt to consolidate above the triangle failed. Then the pair rebounded, reversed in favor of the dollar and performed a dramatic drop which caused the closing below the triangle. The pair continued falling afterwards. Moreover, it is still declining towards the 161.8% correction level at 1.0574. Therefore, the overall situation was not very favorable for the euro. However, I believe the outcome of the ECB meeting was quite positive for the EU and the euro. Christine Lagarde pledged that the regulator would hike the interest rate at the following meeting and more likely in September again. Further tightening of the monetary policy will depend on the connection between inflation and the ECB steps in the next three months.

Moreover, the ECB issued a new inflation forecast for 2022. The regulator lowered it to 6.5%. Currently, inflation in the EU is around 8%. Besides, Christine Lagarde announced that the APP stimulus program will end on July 1. This decision will likely stop rising inflation. Therefore, the ECB and Lagarde did their best. Nevertheless, the euro declined significantly. Traders probably expected the ECB president to adopt a more hawkish stance and the regulator to raise the interest rates in June. I think this view was wrong. Besides, it was not reasonable to sell off the euro in the current situation. But it is not possible to change anything. However, the positive aspect is that the trading signals were worked out properly. The US inflation report will be released today. Whatever its data are, I do not think the euro will stop declining. Bear traders have been very active. US inflation would have to be extremely accelerating for bears to stop selling off the pair.

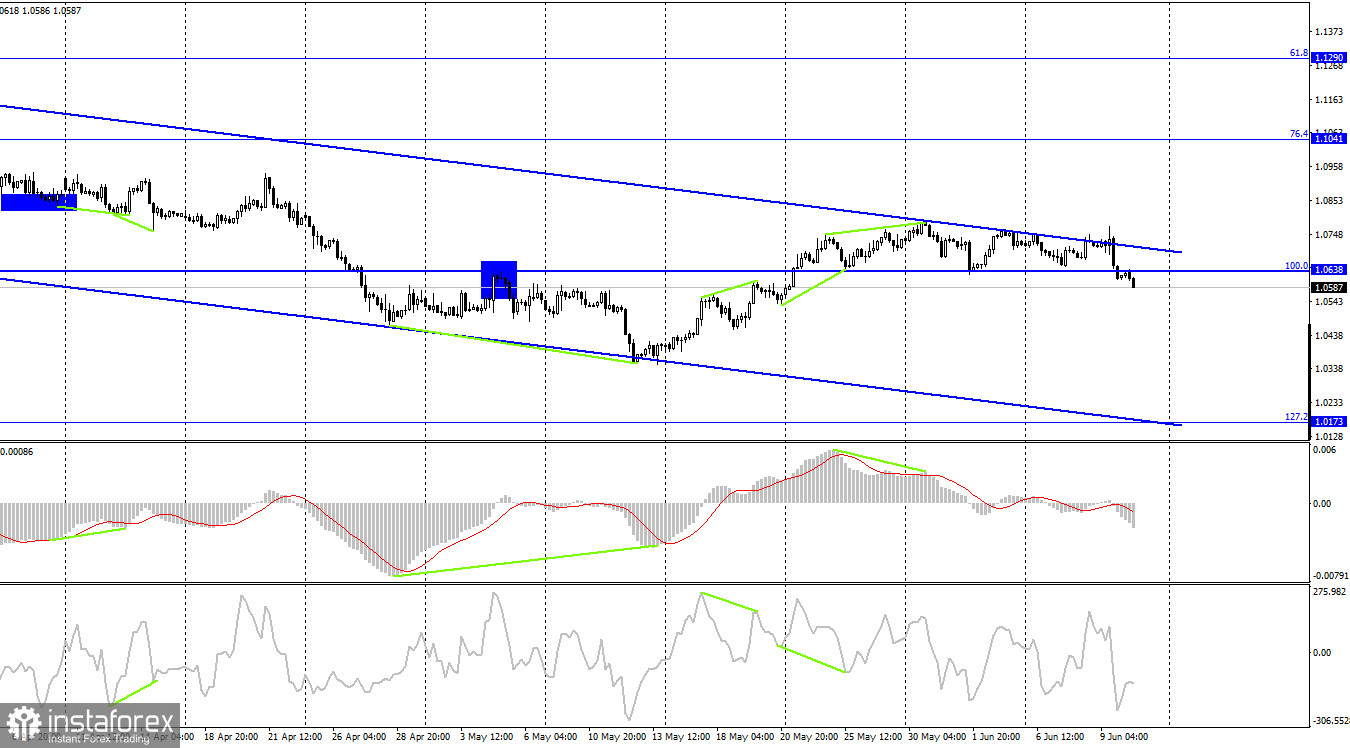

On the H4 chart, the pair rebounded from the upper line of the descending channel around which it has been moving for the past two weeks. Today, the pair also closed below the 100.0% correction level at 1.0638. Therefore, the pair will likely further fall towards the 127.2% correction level at 1.0173. If the pair consolidates above the descending channel, it will favor the euro and will resume its growth towards the 76.4% Fibonacci level at 1.1041.

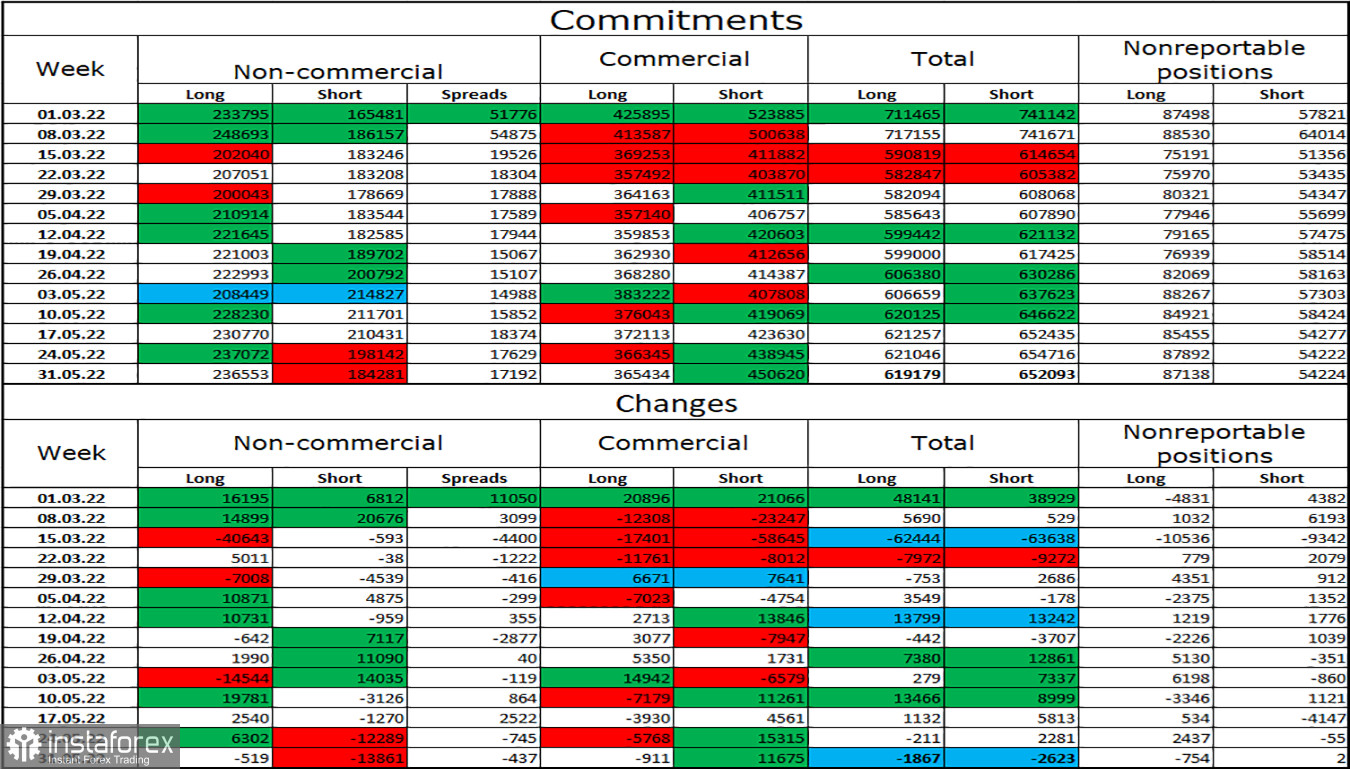

COT report:

Speculators closed 519 long contracts and 13861 short contracts during the last reporting week. This means that the bullish sentiment of major players has strengthened again. The total number of long contracts held by them is now 236,000, while the number of short contracts totals 184,000. As seen, the difference between these figures is not significant. Therefore, it is hard to believe that the euro has been constantly declining for the last few months. As for the euro, the sentiment of "non-commercial" traders remained bullish during this period. However, this fact did not favor the currency. Currently, the prospects for the euro are more promising day by day as major players continue to buy more than sell. Moreover, the euro has risen slightly. If bull traders carry out their plans in the near future, the euro may outperform the dollar in the long term.

US and the EU economic news calendar:

US - Consumer Price Index (12-30 UTC).

EU - ECB President Christine Lagarde will deliver a speech (13-45 UTC).

US - University of Michigan Consumer Sentiment Index (14-00 UTC).

The most significant events are scheduled on June 10. First, the inflation report will be released. Secondly, Christine Lagarde will give her speech. However, the euro has already been declining significantly. On Friday, the news background may have a profound impact on traders' sentiment.

EUR/USD outlook and recommendations for traders:

I recommended selling the pair when it closes below the level of 1.0638 on the H4 chart with the targets of 1.0574 and 1.0430. These trades should be held now. I recommend buying the euro in case it consolidates above the channel on the H4 chart with the target of 1.1041.