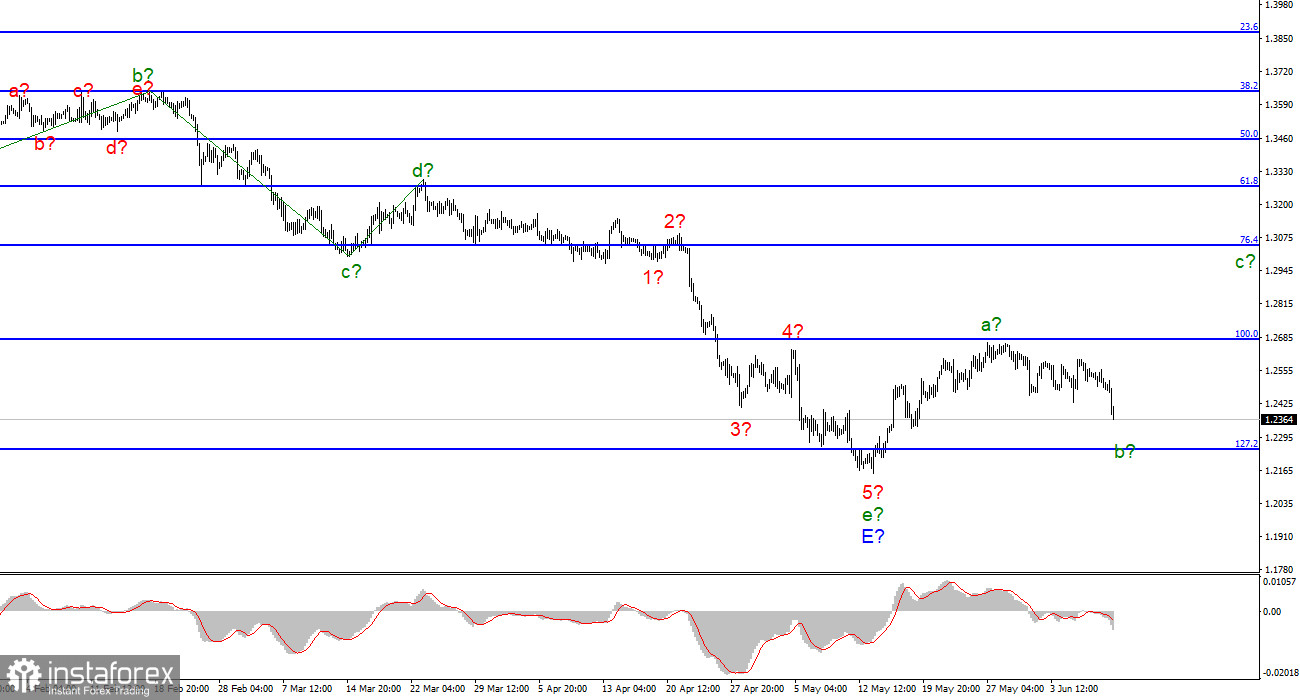

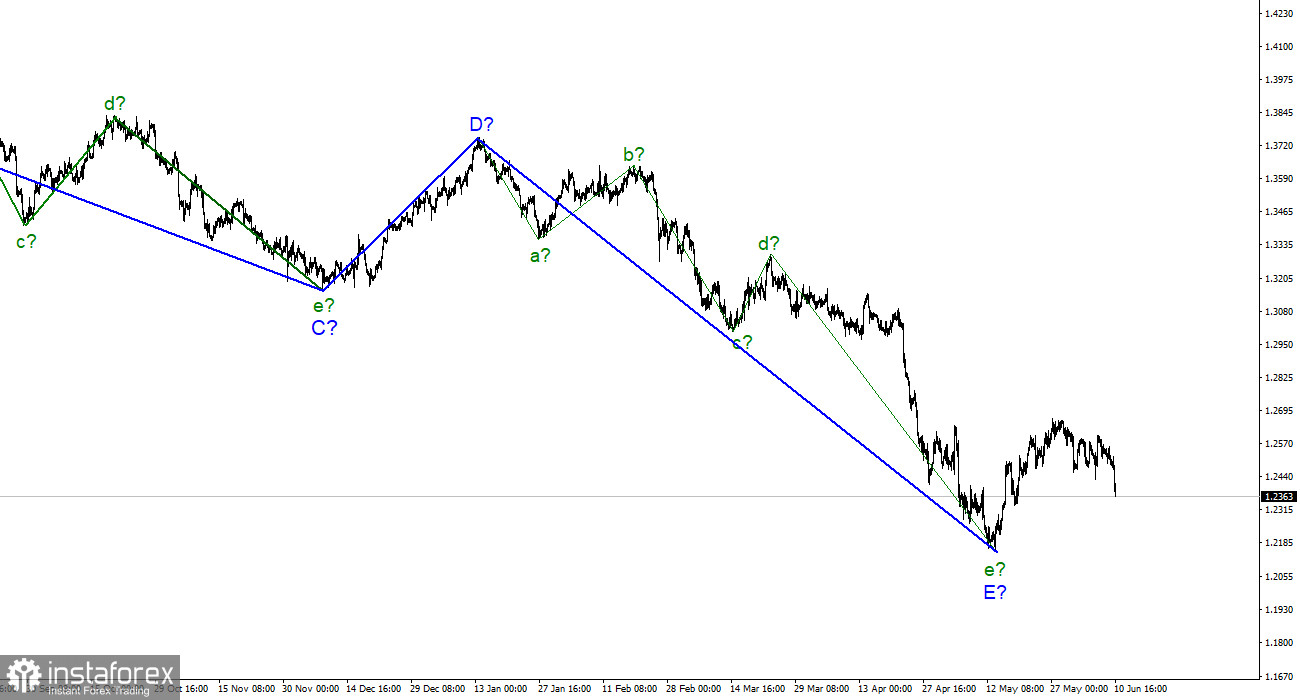

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend is completed, and the wave e-E, although it has taken a rather complex form, however, is also a five-wave in the structure of the five-wave downward section of the trend, as well as for the euro/dollar instrument. Thus, both instruments, presumably, have completed the construction of downward trend sections. According to the British, the construction of an upward section of the trend has begun, which is currently interpreted as a corrective one. I believe that it will turn out to be three-wave, but there is also a second option, in which it will take a pulsed five-wave form. Now, presumably, the construction of the corrective wave b is continuing, within which five waves are already visible. Thus, in the near future, the construction of wave c with targets located around 30 figures may begin. I will note once again that the wave markings of the euro and the pound are very similar now, so we can expect that both currencies will move approximately the same in the next few weeks.

The US inflation report also hit the pound

The exchange rate of the pound/dollar instrument has already decreased by 145 basis points on June 10 and continues to fall. The decline in quotes was expected since the inflation report exceeded market expectations and since wave b for the euro/dollar instrument should have taken at least a three-wave form, and a similar wave for the pound/dollar instrument was already three-wave at that time. Thus, so far everything corresponds to the current wave markup, but I will not hide that I did not expect such a strong decline in the instrument. Let me remind you that the euro currency had reasons to decline last night and this morning since the results of the ECB meeting could be regarded differently. The market decided that the rhetoric of the ECB and Christine Lagarde was not "hawkish" enough, it cannot be blamed for this. The British dollar fell by only 50 points yesterday, which is not so much. But today, the report on American inflation caused an increase in demand for the dollar, which led to elongation in the waves b for both instruments.

Now I expect that these waves will complete their construction in the near future since otherwise, it will be necessary to make adjustments to the wave layout. And it looks quite holistic, and I would not like it to become more complicated. Nevertheless, the difficult news background for the euro and the pound may lead to the fact that the market will continue to increase demand for the dollar. Let me remind you that the Fed will also hold a meeting this month, and the US regulator has almost decided to raise the interest rate by 50 basis points. Moreover, today's inflation report can assure them that the rate needs to be raised quickly, so it can rise by 50 points in July and September. All this can lead to an even greater increase in the US dollar.

General conclusions

The wave pattern of the pound/dollar instrument still assumes the completion of the construction of wave E and the entire downward trend segment. Thus, I now advise buying the British for each MACD signal "up" with targets located above the peak of wave a, not lower than the estimated mark of 1.3042, which corresponds to 76.4% Fibonacci. Under certain circumstances, wave marking can become much more complicated, but there is no reason to assume this right now.

On the higher scale, the entire downward trend section looks fully equipped. Therefore, the continuation of the decline of the instrument below the 22nd figure is postponed indefinitely for the time being. Wave E has taken a five-wave form and looks quite complete. The construction of a minimum three-wave ascending trend section has begun.