The situation in the forex market is dynamic. At the beginning of the year, the European Central Bank did not even think about interest rate hikes, members of the Governing Council talked about some three conditions necessary for monetary policy tightening that had not yet been met, and the derivatives market signaled a modest 15 bp increase in the deposit rate. Nowadays, ECB President Christine Lagarde outlined a plan to raise borrowing costs from -0.5% to zero by the end of September, but a week later, the idea was scrapped by hawks and investors. Market participants expect the European Central Bank to increase the rate by 135 bp. by the end of 2022, which makes the euro stronger. The European currency is no longer what it used to be. However, its main rival in the face of the US dollar is still full of strength.

Of course, the fact that the ECB is going to launch its monetary policy tightening later than the Fed, the Bank of England, and other leading central banks, has come under criticism. However, some analysts, on the contrary, accuse the regulator of being too hasty as the Eurozone economic recovery is facing a price shock and a cost-of-living crisis. Moreover, the currency bloc is close to the zone of armed conflict in Ukraine. The region is highly dependent on Russian oil and gas but is forced to bite the hand that feeds it by imposing sanctions, including an embargo.

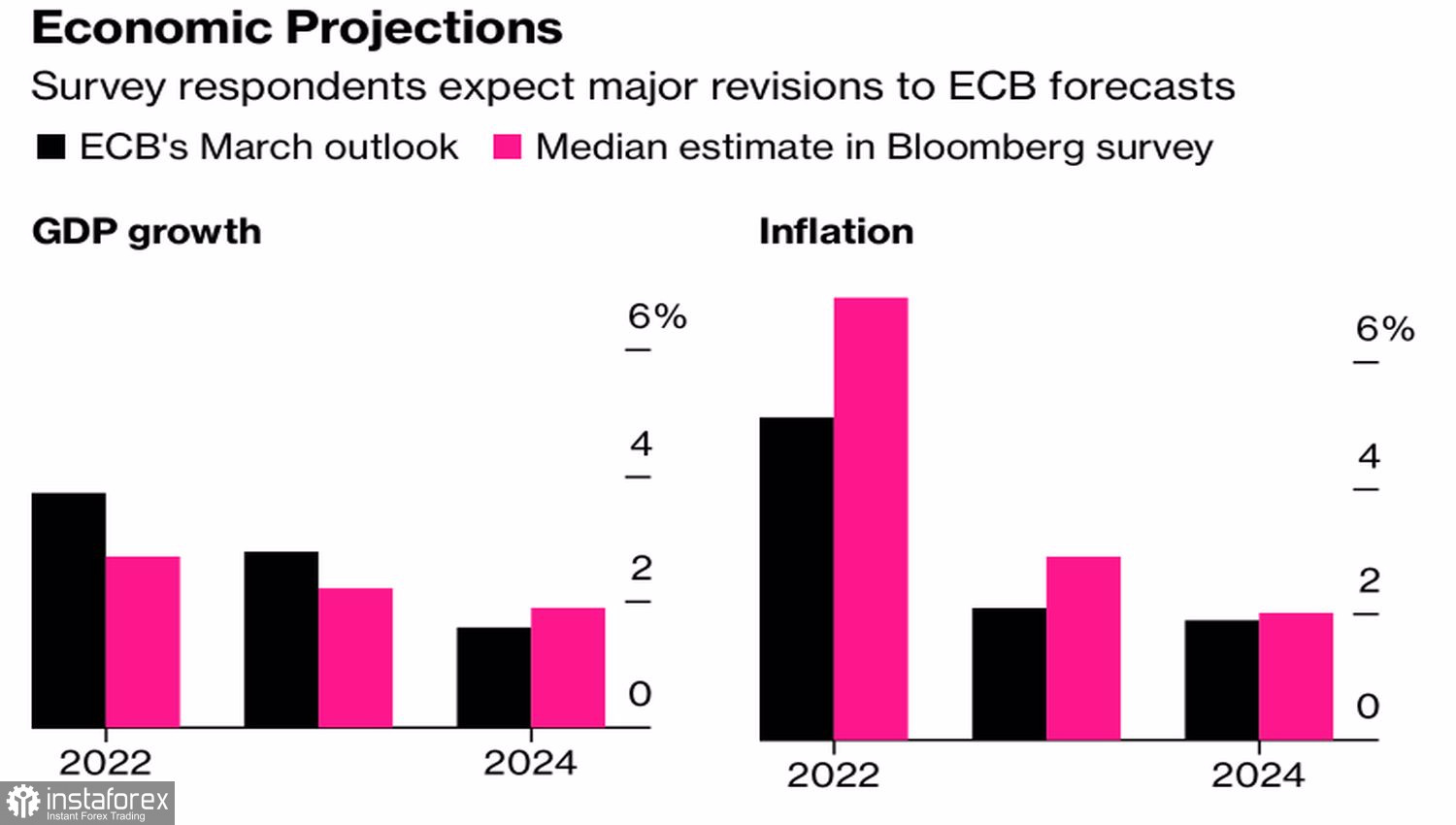

In such a situation, an acceleration in inflation to an all-time high of 8.1% and a slowdown in economic growth can be seen as an objective reality. Christine Lagarde and her colleagues realize it, as do Bloomberg experts. The latter expect significant adjustments in the ECB's projections following the outcome of the June meeting. According to forecasts, the central bank's inflation estimate for the end of 2022 will rise from 5.1% to 7%, and its outlook for GDP will decrease from 3.7% to 2.7%.

Outlooks for EU growth and inflation

The main issue of concern for financial markets is whether Christine Lagarde will raise the deposit rate by 50 bp. in July, depending on incoming data, or not. The derivatives market expects a 37.5% increase in borrowing costs at the next Governing Board meeting, which implies a 50% chance of a 50 bp hike.

If inflation continues to rise, the ECB will most likely take a more aggressive approach to fighting high consumer prices in September. This, in turn, will help the euro stay afloat. At the very least, a fall in the EUR/USD quotes to parity is unlikely. However, market sentiment is bearish due to other fundamental factors. With US stocks falling and Treasury yields skyrocketing, the USD index is expected to edge higher.

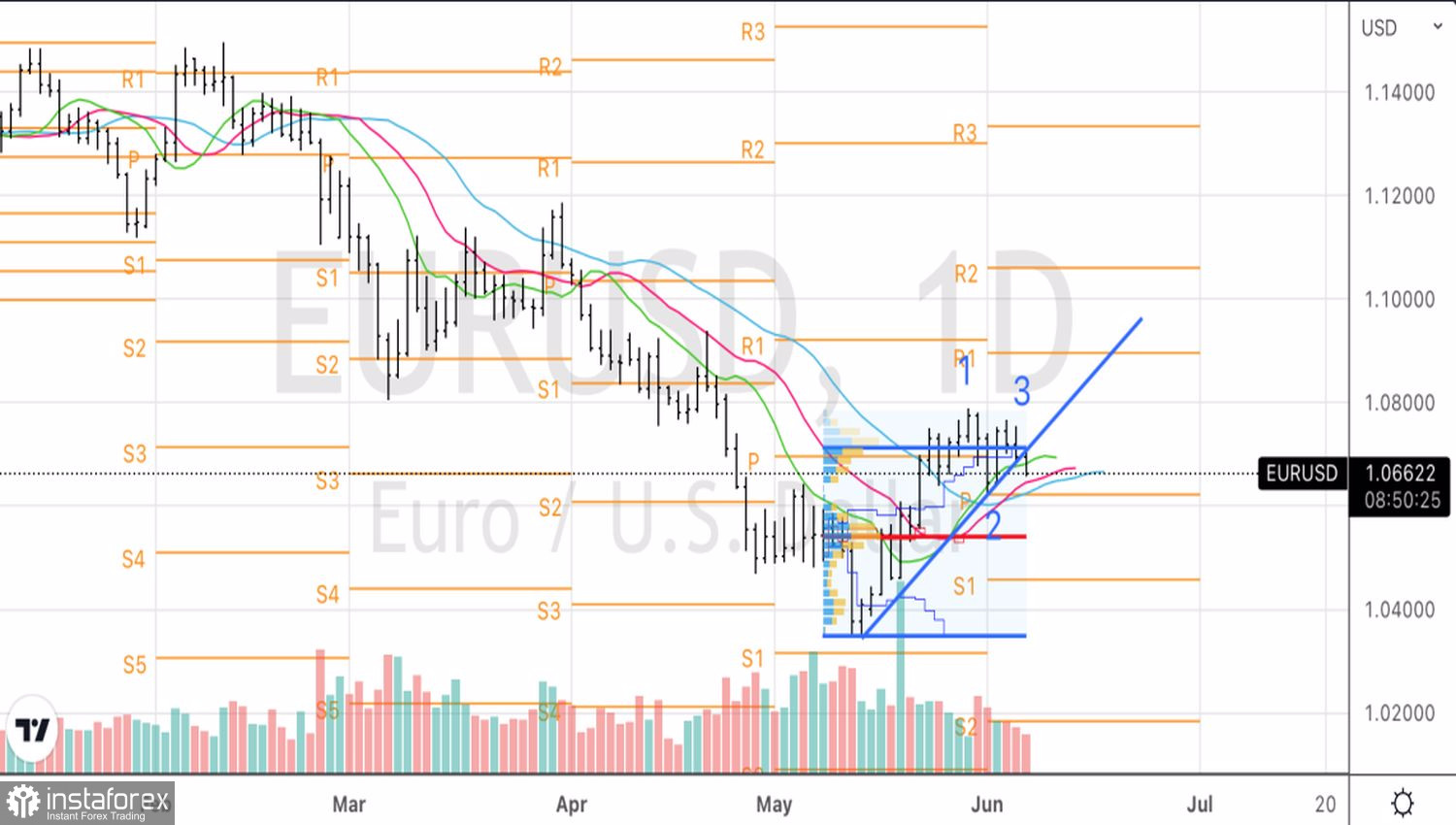

EUR/USD. Daily chart

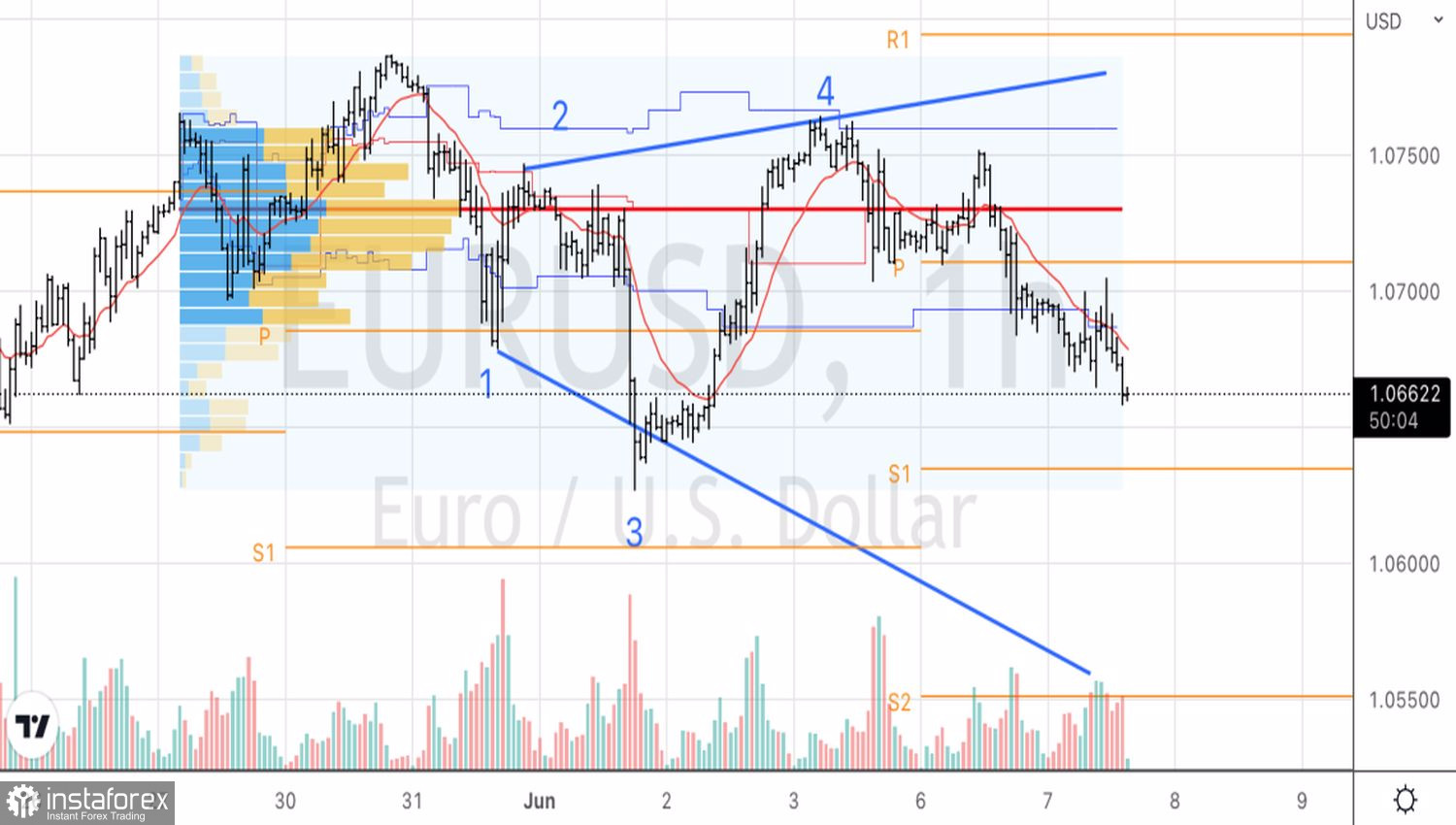

EUR/USD. Hourly chart

From a technical point of view, the EUR/USD pair continues to form the 1-2-3 pattern on the daily chart. I recommend holding short positions opened amid a breakout of the support level at 1.07. According to the hourly chart, the quotes are likely to form the Rising Wedge pattern. This scenario requires a test of the pivot level at 1.063, after which the price is expected to pull back. We will use it to open additional short positions.