Today, we will focus on the USD/CAD currency pair. Last Friday, Statistics Canada released last month's new jobs data. It beat analysts' expectations of 30,000 and came in at 39,800. Such a positive labour market data could signal a possible continuation of the Bank of Canada's key interest rate hike. In addition, wages are also rising. The possibility of a tightening of monetary policy by the Canadian central bank therefore seems even more likely. Notably, the economic situation in Canada is very favourable for a further aggressive tightening of monetary policy by raising the main interest rate. However, a neutral range is specified as 2-3%. However, if inflation does not slow down, the Bank of Canada may go over the upper end of the neutral interest rate range. Given that the Canadian economy is predominantly export-oriented, there are still risks of overheating, mainly due to rising commodity and energy prices.

Meanwhile, the discussion on a further 50 basis point rate hike by the US Federal Reserve (Fed) continues. The US central bank plans to raise the federal funds rate at least twice more by 50 bp, after which it will pause and evaluate its actions. However, market forecasts, which can also be called speculation, are driving the Fed ahead with a fourfold increase of the key interest rate. I believe that such inflated expectations, as well as upcoming events, could play a cruel trick on the US dollar.

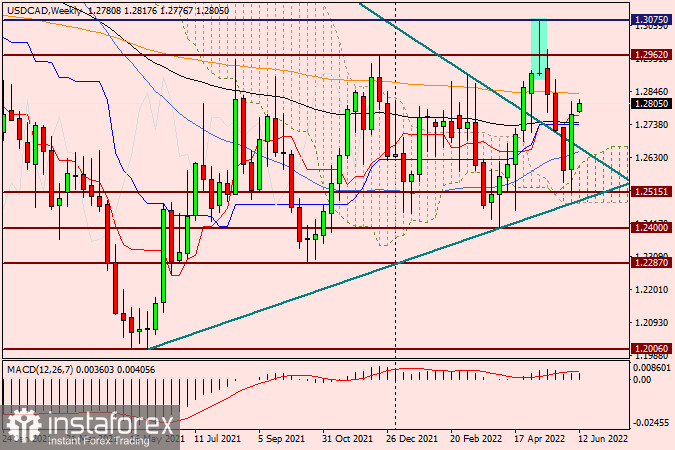

Weekly

Looking at the weekly USD/CAD chart, you can see that this is not happening yet. However, at first the Canadian dollar gets stronger and then the US dollar shows a similar trend. So, in the June 6-10 trading the pair USD/CAD has shown a significant rally. This led to important changes in the technical picture of this trading instrument. The pair got quite strong support near the psychological level 1.2500 and soared. As a result, the 50 MA was broken, the green resistance line 1.4667-1.2899, the Tenkan and Kijun lines of the Ichimoku indicator as well as the black 89 exponential moving average were tested again. However, the orange 200 EMA, which goes through 1.2840, has yet to be tested for a breakout. One can see how strong resistance it used to provide, and how the pair failed to break above it in three successive and/or more weekly candlesticks. Thus, the bulls' objectives for the USD/CAD include real breakout of the 200 EMA and the subsequent breakout of the key resistance level of the sellers at 1.3075. Interestingly, it is from this level that the reversal of the highlighted Gravestone Doji candlestick pattern was eventually formed.

It can be assumed that this model has already been tested by market participants. However, they are not quite sure what to do with the pair yet. This week started with growth, but the most important thing will happen on Wednesday, when the Fed will make its rate decision and Jerome Powell will hold a press-conference. At the moment, the pair is trading near the strong technical level of 1.2800, a breakout of which, as well as a breakout of the 200 EMA, would open the way to 1.2900, 1.2960, 1.3000 and 1.3040. With the Fed meeting, it is difficult to speculate on the market reaction even if the US rate is raised by 50bp. Notably, before the two previous Fed rate hikes, the US dollar was rising. However, when the rate was actually raised, the US dollar found itself under selling pressure across a broad spectrum of the market. Overall, I have a bearish view on this pair. I will refrain from specific trading recommendations today. Those who agree with the author's viewpoint should look out for short positions from the levels listed above, especially if there are distinctive candlestick signals on the shorter time frames.