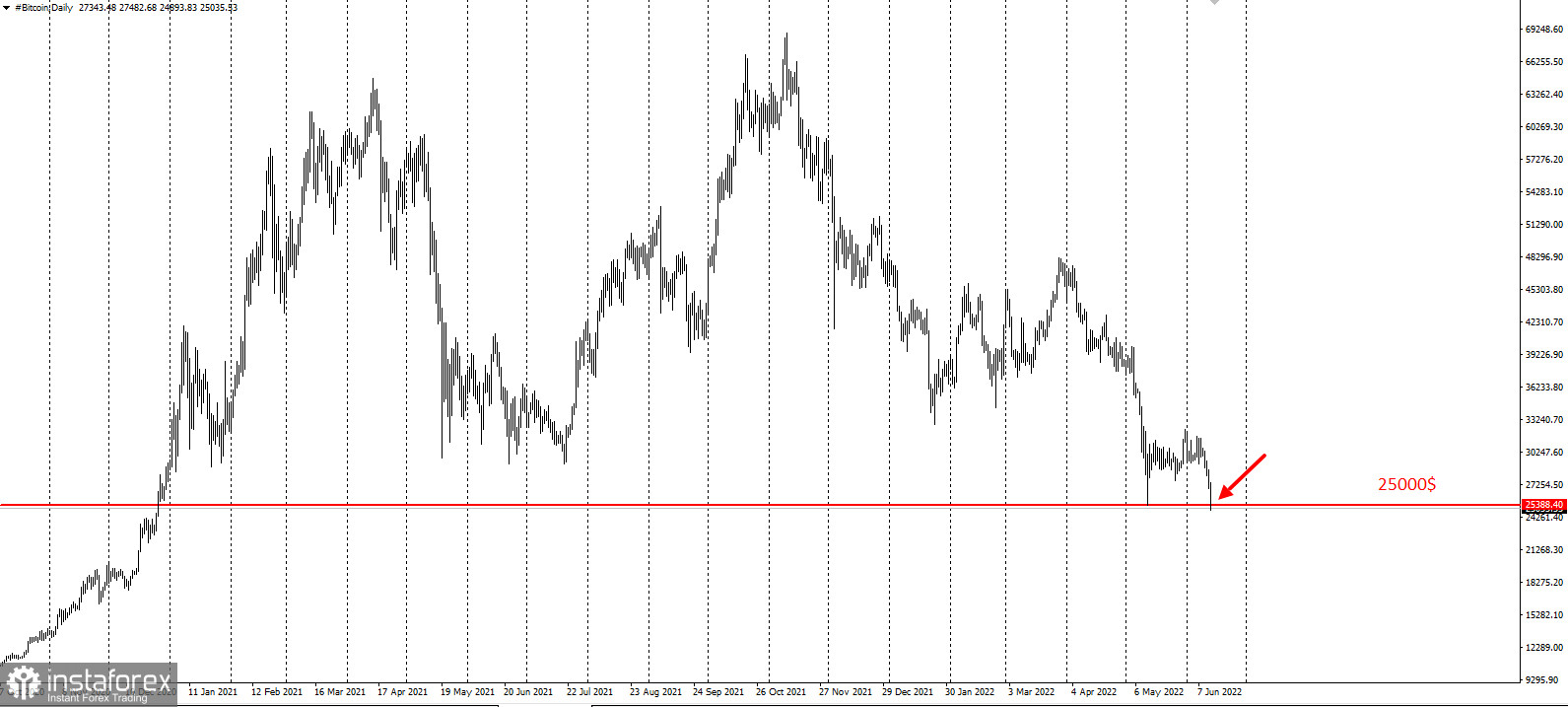

Bitcoin fell to its lowest level in about 18 months in Asia on Monday as the impact of Friday's U.S. inflation data continued to reverberate on global risk assets.

The world's largest digital token fell 8.9% to $24,903.49, its lowest since December 2020. Other cryptocurrencies also declined. The MVIS CryptoCompare Digital Assets 100 Index, which measures the top 100 tokens, fell as much as 9.7%.

Traders are raising bets on a more aggressive pace of Federal Reserve tightening after data on Friday showed US inflation jumped to a new 40-year high in May. Cryptocurrencies, which have struggled amid the Fed's policies in recent months, have been hit particularly hard. The collapse of the Terra/Luna ecosystem last month and the suspension of withdrawals by crypto lender Celsius, on Monday morning, Asian time, further damaged confidence in the crypto space.

"Typically, I'd suggest being a buyer here" on Bitcoin futures, said Rick Bensignor, president of Bensignor Investment Strategies and former Morgan Stanley strategist.

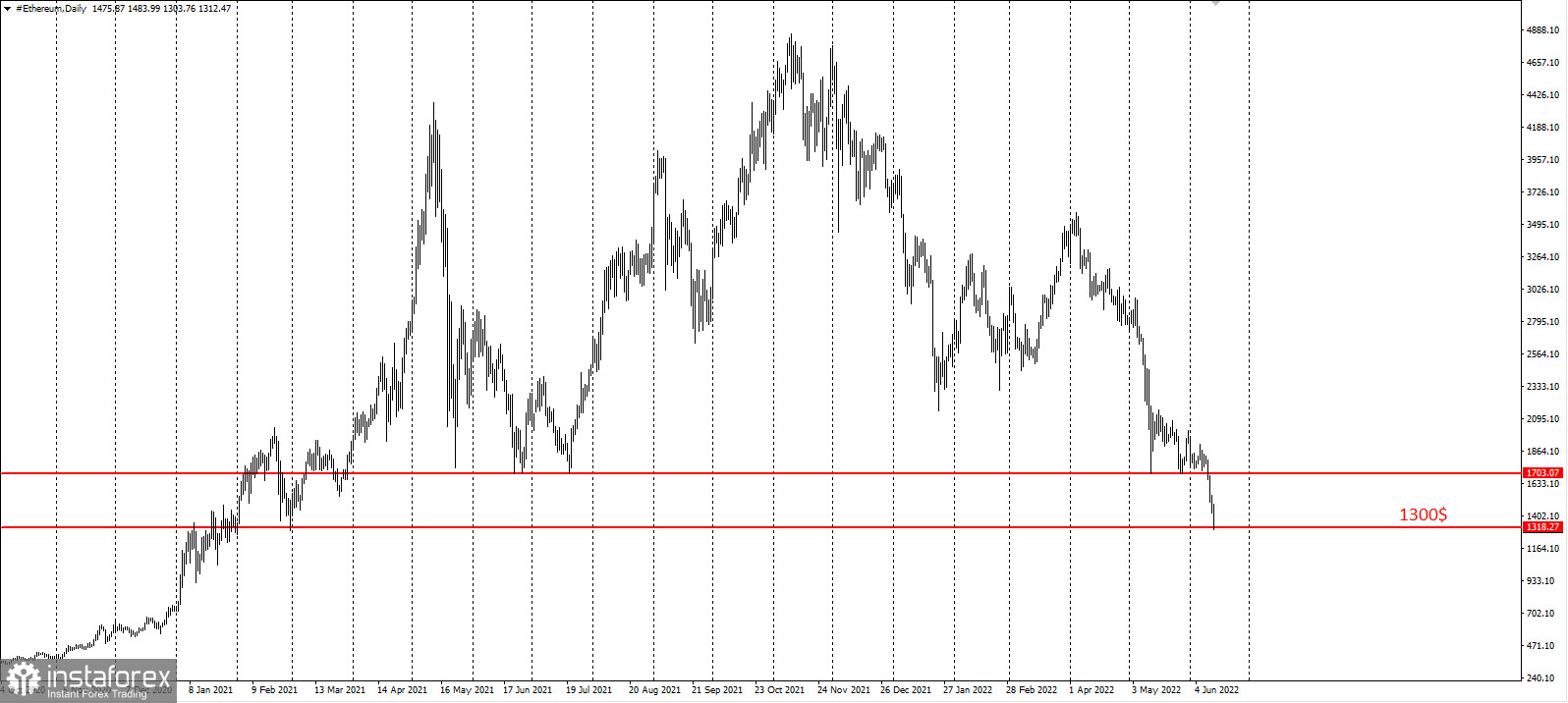

Other coins also struggled as Ethereum fell 12% to its lowest level since February 2021. Avalanche fell 15%, Solana down 14%, and Dogecoin down 11%.

"If Ethereum continues to bleed toward $1,200 (the 200-week moving average) the outlook for other altcoins becomes even bleaker," Trenchev said.