EUR/USD

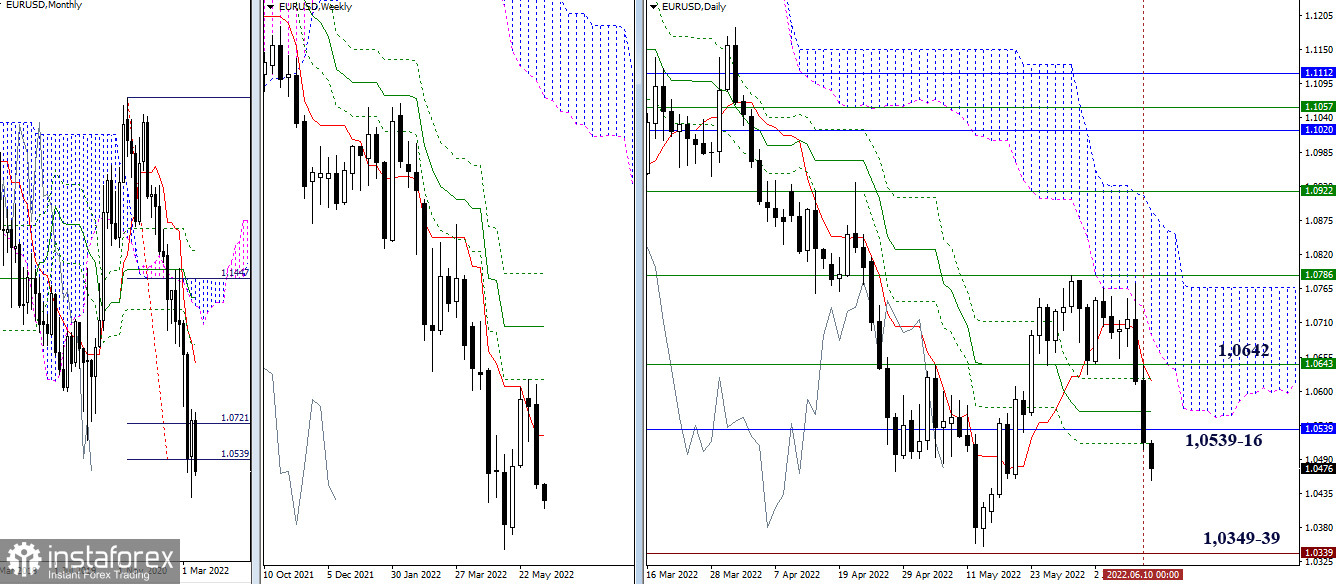

Higher timeframes

Bears closed last week very optimistically. At the moment, their main task is to eliminate the daily golden cross (1.0516), which will open the road to the restoration of the downward trend on the weekly and monthly timeframes. The local lows of May 2022 (1.0349) and January 2017 (1.0339) serve as benchmarks in this direction. In case bulls want to regain their lost positions, they will first have to interact again with the levels of the daily cross, today they are at 1.0516 – 1.0568 – 1.0620, as well as with cross-strengthening resistances of 1.0539 (monthly level) and 1.0642 (weekly short-term trend).

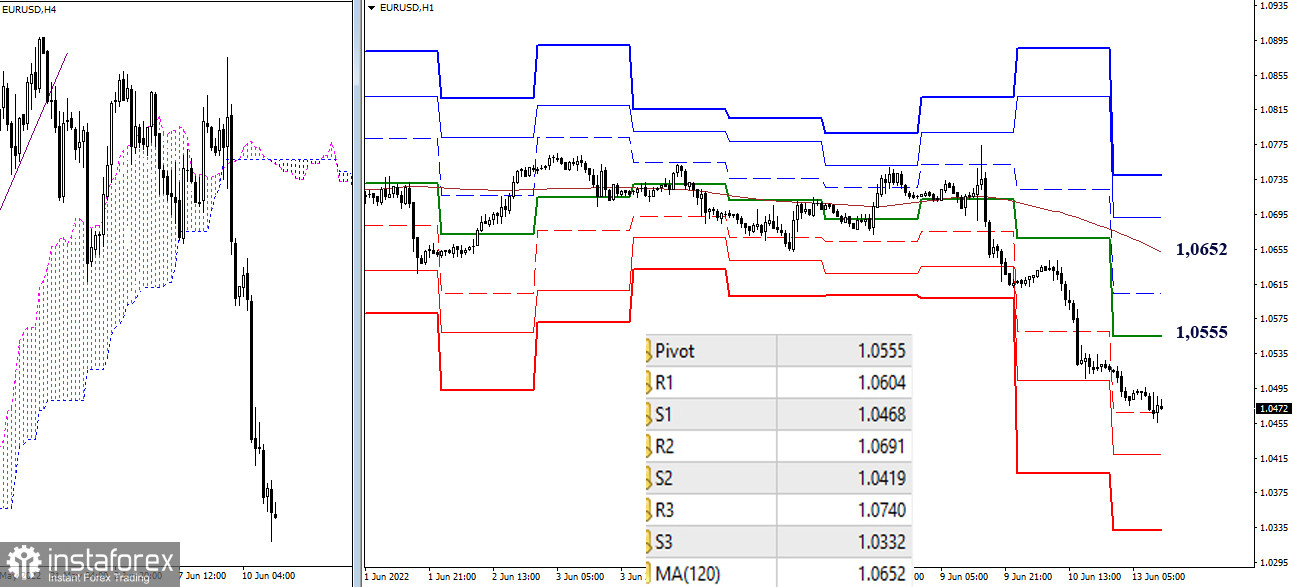

H4 – H1

In the lower halves, there is an active development of a downward trend. Now the first support of the classic pivot points (1.0468) is being tested, then S2 (1.0419) and S3 (1.0332) will serve as benchmarks. The key levels of the lower timeframes today act as resistances and are now located at 1.0555 (the central pivot point of the day) and 1.0652 (the weekly long-term trend). The rise and testing of levels is possible only in the case of active development of an upward correction.

***

GBP/USD

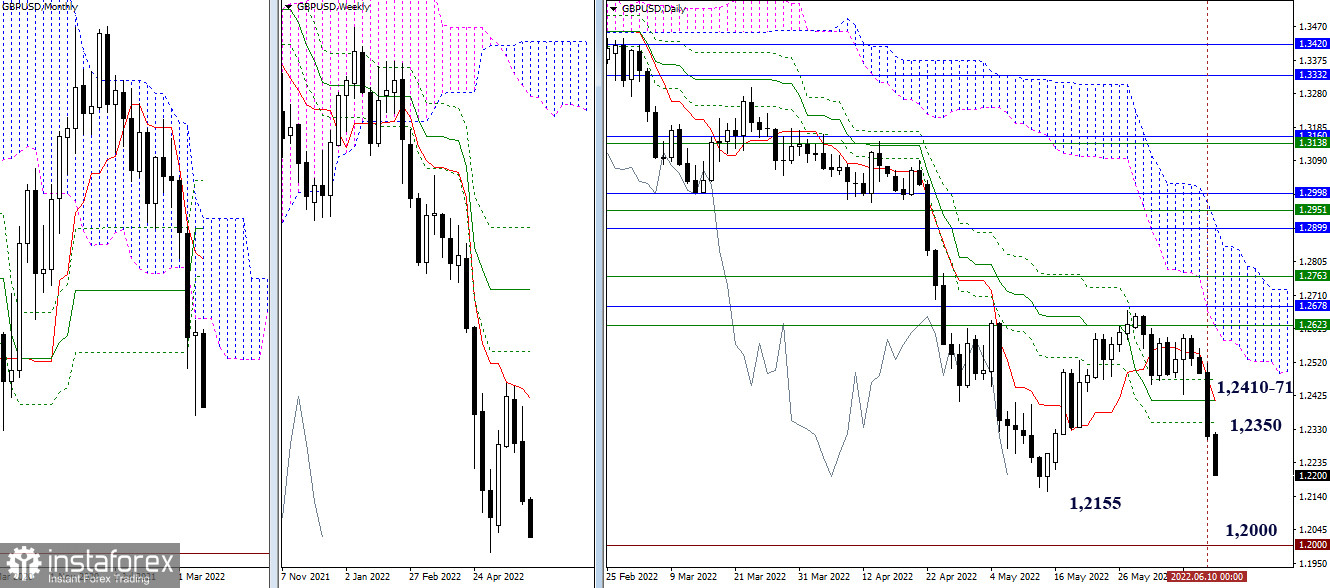

Higher timeframes

Sellers are on the move and are close to updating the local low (1.2155) and restoring the bearish trend. The next downward target may be the psychological level of 1.2000. The daily cross passed the day before now works as a resistance zone, which will meet bulls in case of their activity in the area of 1.2350 – 1.2410 – 1.2471.

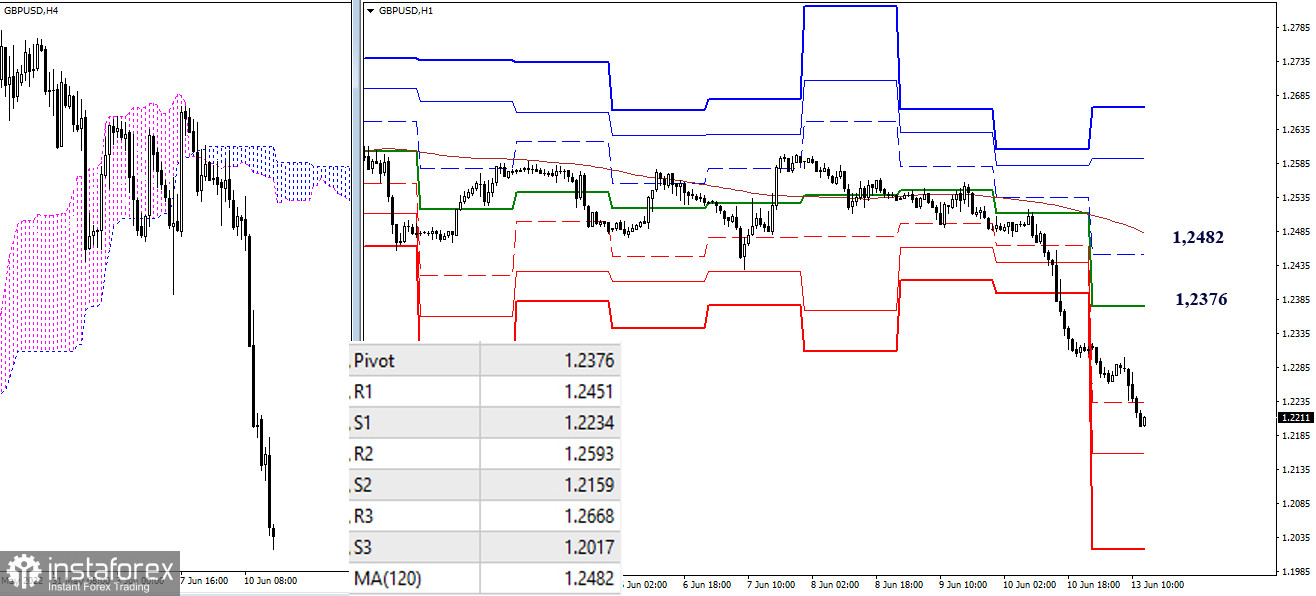

H4 – H1

A downward trend is developing in the lower halves. The benchmarks for the intraday decline are 1.2159 and 1.2017 (supports of classic pivot points). In case of a change of priorities and the development of an upward correction, the important levels of the lower timeframes today are at the boundaries of 1.2376 (the central pivot point of the day) and 1.2482 (the weekly long-term trend). These levels are responsible for the balance of power and the distribution of preferences. Their loss can change the current trend and priority.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)