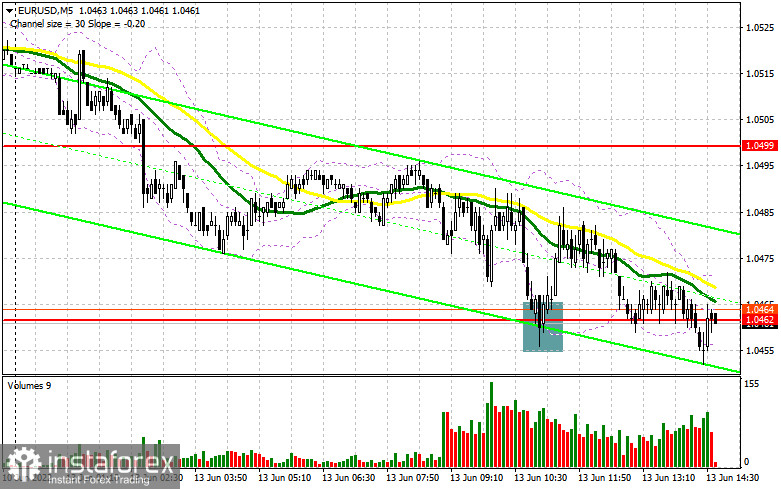

In the morning article, I highlighted the level of 1.0462 and recommended taking decisions with this level in focus. Now let's look at the 5-minute chart and try to figure out what actually happened. As expected, bears failed to push the pair below 1.0462. It led to a false breakout and a buy signal. As a result, the pair climbed by more than 20 pips. After that, the upward movement stopped. Bulls are unwilling to make new attempts to push the pair higher. A return to 1.0462 and a breakout of this level is now a matter of time. The technical outlook has not changed as well as the strategy.

What is needed to open long positions on EUR/USD

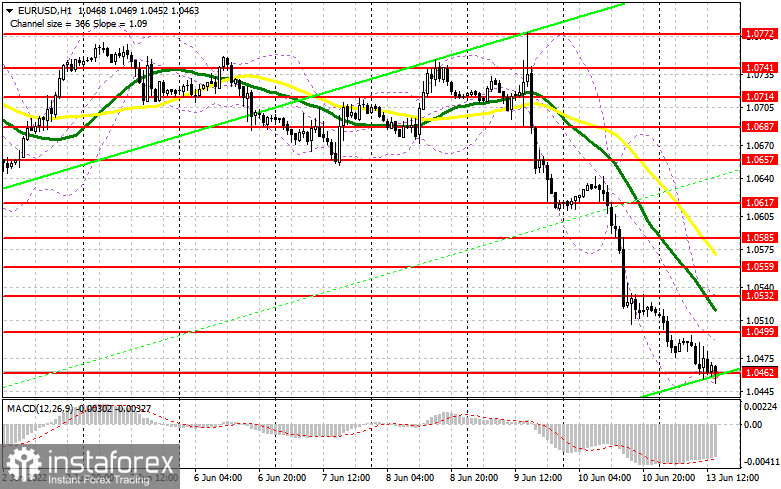

EUR bulls are staying away from the market now. A false breakout of 1.0462 is another attempt to check how many buyers are still in the market before the next wave of a big decline. There are no fundamental reports in the afternoon. It means that bulls are lacking drivers to resume an upward trend. They are unlikely to be able to protect 1.0462. I would advise traders to stick largely to technical analysis, betting on the downtrend. The main task of the bulls is to defend the nearest target level of 1.0462, which has already been broken in the morning. Only a false breakout of 1.0462, similar to the one I mentioned above, as well as the forming divergence of the MACD indicator, will give a buy signal. If so, bulls may try to regain control over the resistance level of 1.0499 that appeared last Friday. A breakout and a downward test of this level will hardly cause a sharp drop in stop-loss orders of sellers. However, it will provide a new buying opportunity with a prospect of a correction to 1.0532. The moving averages are also passing slightly higher, which will limit the upward movement of the pair. A more distant target will be the 1.0559 level where I recommend locking in profits. Yet, the pair is unlikely to test this level. If EUR/USD declines in the afternoon and bulls show no activity at 1.0462, which is more likely, the pressure on the euro will only escalate. A drop in buyers' stop-loss orders below this level will push the pair to 1.0423. If this scenario comes true, it is better to open long positions only after a false breakout of this level. You can buy EUR/USD immediately at a bounce from the 1.0391 level or even a low of 1.0353, keeping in mind an upward intraday correction of 30-35 pips.

What is needed to open long positions on EUR/USD

The bulls have absolutely no chance to undermine bearish sentiment. Sellers have regained control in the first half of the day, not even allowing bulls to get to 1.0499. It clearly indicates the bear market. If the pair grows in the afternoon, a false breakout of 1.0499 will generate a sell signal with the prospect of another decline to the support level of 1.0462. A new sell signal will appear after a breakout and a dip below this level, as well as an upward test. It will lead to a big decline in buyers' stop-loss orders, pushing the pair down to the 1.0423 level. A breakout and a decrease below 1.0423 will open the path to 1.0391 and 1.0353 where I recommend closing all short positions. If EUR/USD climbs during the American session and bears show no energy at 1.0499, I would advise traders to postpone short positions to the level of 1.0532. A false breakout of this level will help bears regain ground. You can sell EUR/USD immediately at a bounce from a high of 1.0559 or 1.0585, keeping in mind a downward intraday correction of 30-35 pips.

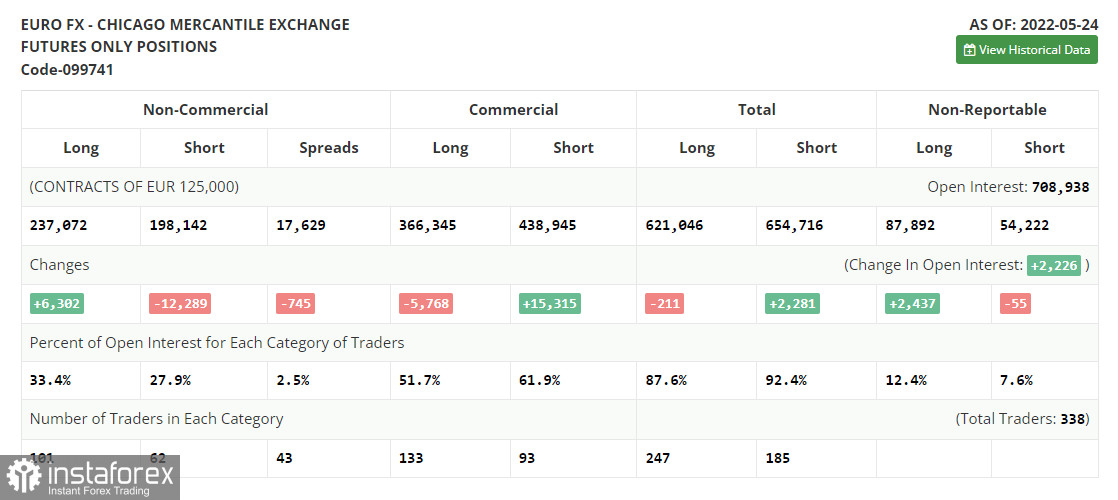

COT report

The COT report for May 24 logged a rise in the number of long positions and a decline in the number of short positions. Traders continued opening long positions, expecting a more aggressive monetary policy from the ECB. Although last week, there were fewer comments about a key interest rate hike in the near future, the euro/dollar pair managed to retain its upward potential. Now, analysts suppose that the ECB will raise the deposit rate by one-fourth of a basis point as early as July. The next two hikes will take place in September and December. By the end of the year, the benchmark rate is expected to be at the level of 0.25%. However, some experts are sure that the central bank will have to take more aggressive measures. A lot depends on the inflation report for May of this year. The indicator may jump to 7.7% on a yearly basis, thus increasing pressure on politicians. Against the backdrop, the regulator may raise the key interest rate up to 0.5% from the current zero level. The COT report unveiled that the number of long non-commercial positions increased by 6,302 to 237,072 from 230,770, while the number of short non-commercial positions declined by 12,289 to 198,142 from 210,431. The euro's low price is making the currency more attractive for mid-term traders. According to the weekly results, the total non-commercial net position increased to 38,930 from 20,339. The weekly close price jumped to 1.0734 from 1.0556.

Signals of technical indicators

Moving averages

EUR/USD is trading below 30- and 50-period moving averages, indicating the continuation of the bear market.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the upper border of 1.0532 will act as resistance.

A breakout of the upper border at about 1.1337 will trigger a new bullish wave of EUR. Alternatively, a breakout of the lower border at about 1.1305 will escalate pressure on EUR/USD.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.