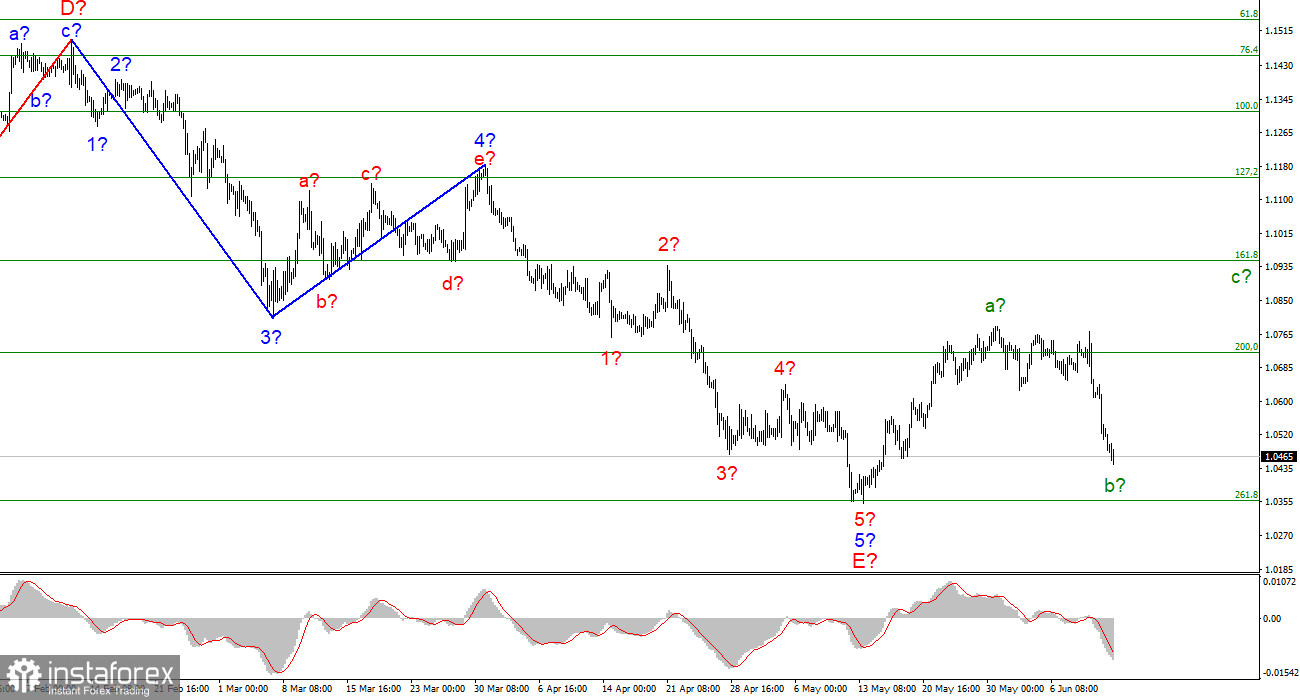

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments yet. The instrument has completed the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then at this time the construction of a new upward section of the trend has begun. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave a is completed, and wave b takes a three-wave form, as I expected, and the decline in the quotes of the instrument has resumed and is currently even stronger than I expected. Wave b has already taken on a rather deep look, but the wave marking is not broken yet - the instrument can decline even to the low of the downward trend section, which is recognized as completed. The only option now in which the decline of the euro can resume for a long period is the rapid completion of the correction section of the trend and the construction of a new downward impulse. However, I still believe that to identify this option, you need at least the completion of the ascending wave c, the targets of which are located about 9-10 figures.

The euro currency failed to cope with market pressure

The euro/dollar instrument fell by 105 basis points on Friday, and by another 60 on Monday. On Monday, there was no news background for the euro currency, but it did not matter to the market - the increase in demand for the dollar continued. The only thing that pleases now is that the dynamics of the instrument's decline have slightly decreased, which gives hope for the imminent completion of the construction of the expected corrective wave b. In this case, the construction of the upward trend section may still resume. A successful attempt to break through the low of the descending trend section, located near the 261.8% Fibonacci level, will lead to the need to make adjustments and changes to the wave markup, which we would like to avoid.

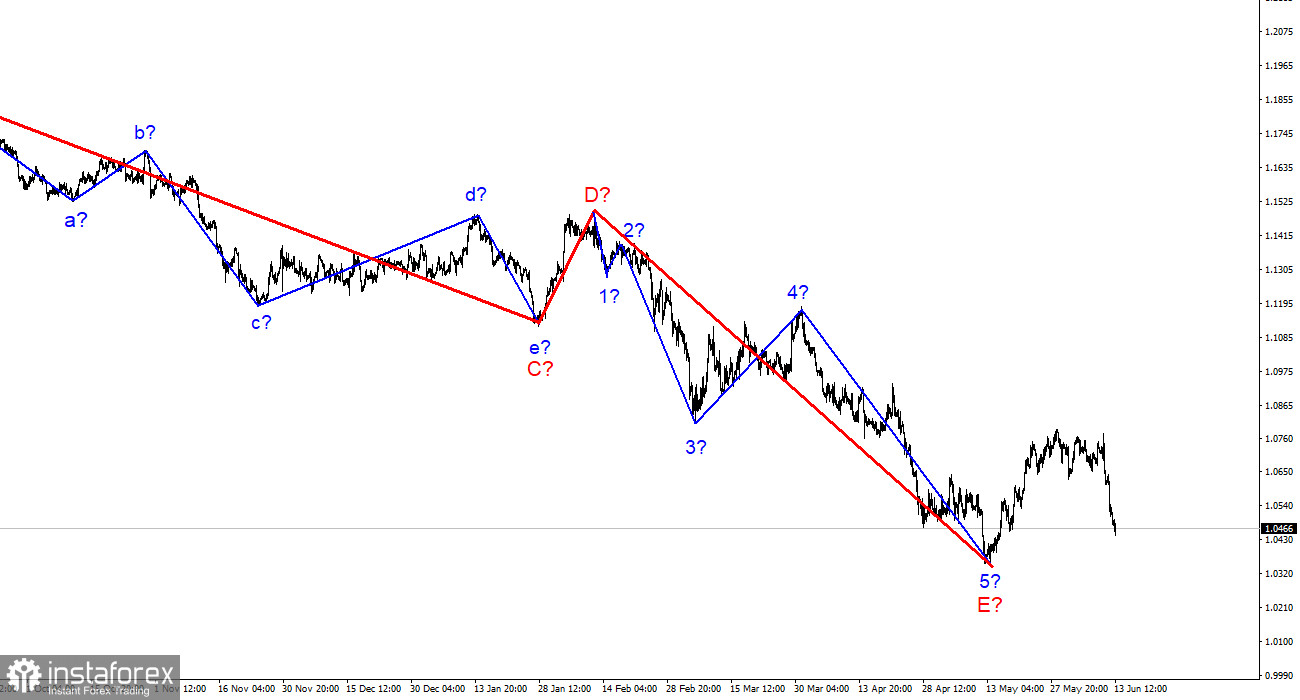

All the most interesting events of this week are scheduled for the second half. There will be few reports, but there will be a Fed meeting, the results of which will be announced on Thursday. Many analysts are now of the opinion that the rate will be raised by 50 basis points in any case, which, in turn, should lead to an increase in demand for the dollar. I think the opposite will happen. The current wave marking is still working and assumes the construction of an upward wave. This is one time. The instrument has decreased by 300 points over the past few days, so the Fed's rate hike may have already been won back. That's two. Important decisions taken at meetings of central banks do not always lead to the reaction you expect. That's three. The market can expect more from the Fed than it can offer, so there may be disappointment at the outcome of the meeting. That's four. Instead of an increase in the dollar, we may well see its decline. Thus, I still do not give up on the euro currency yet. It still has chances to increase to the area of 10-12 figures.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". It is best to first wait for the completion of the construction of wave c-b.

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downtrend has acquired a complete look. If this is indeed the case, then in the future for several months the instrument will rise with targets located near the peak of wave D, that is, to the 15th figure.