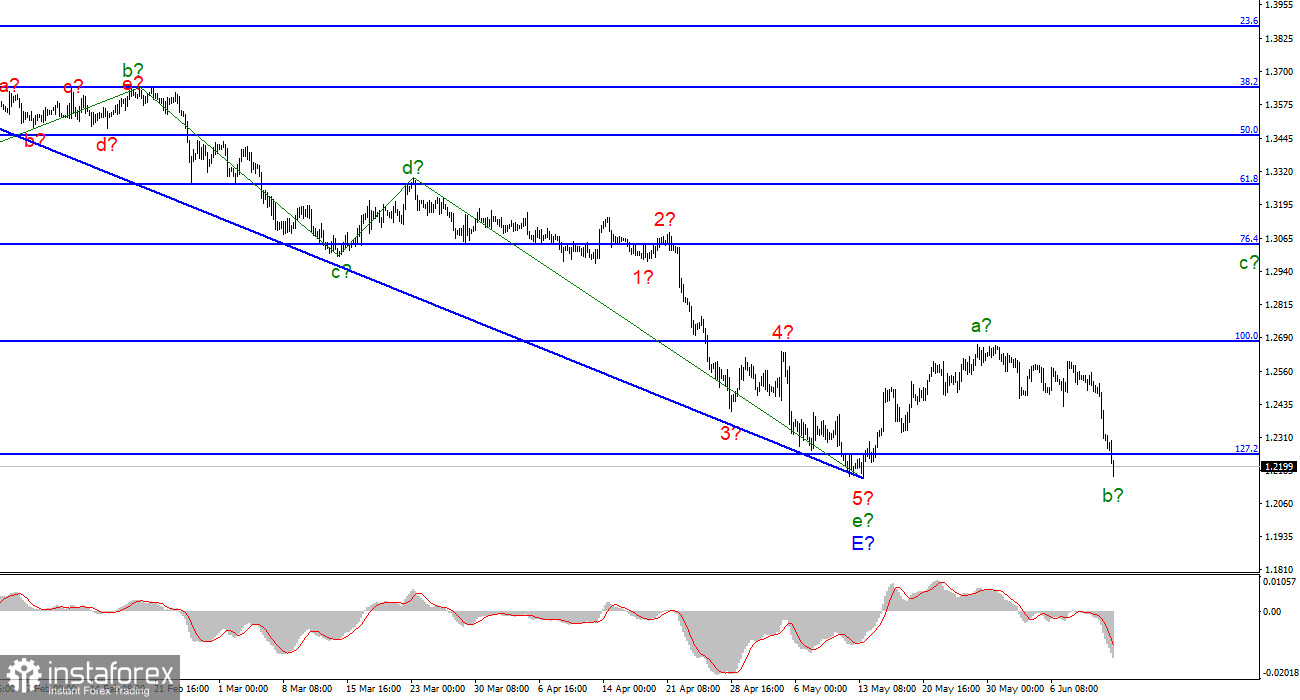

For the pound/dollar instrument, the wave markup continues to look convincing and does not need any adjustments yet. The downward section of the trend is completed, and the wave e-E, although it has taken a rather complex form, however, is also a five-wave in the structure of the five-wave downward section of the trend, as well as for the euro/dollar instrument. Thus, both instruments presumably completed the construction of downward trend sections. According to the British, the construction of an upward section of the trend has begun, which I currently interpret as a corrective one. I believe that it will turn out to be three-wave, but there is also a second option, in which it will take a pulsed, five-wave form. The construction of the corrective wave b is presumably continuing, within which five waves are already visible. Thus, in the near future, the construction of wave c with targets located around 30 figures may begin. At the same time, at the moment, the instrument has stopped only 6 points from the low of the entire downward trend section. A successful attempt to break through 1.2155 will require adjustments to the wave markup. A breakthrough should be exactly a breakthrough, a false breakdown does not count. So far, the pound still retains the opportunity to grow to the 30th figure.

Everything bothers the pound and everything is bad.

The exchange rate of the pound/dollar instrument decreased by another 130 basis points on June 13. On Monday, there was an information background in the UK and it was he who played an important role in the new fall in demand for the pound. Let me remind you that the euro has fallen by only 60 points today and the British - by 130. Thus, external factors intervened, which caused new sales of this currency. You don't need to look for these factors for a long time, they lie on the surface. In the morning, a monthly GDP report for April was released, which indicated a 0.3% contraction in the British economy. The market expected a reduction of a maximum of 0.1% and hoped that there would be no reduction at all. But the British economy is now showing negative dynamics as well as the pound. The Briton, who fell by several dozen points at night, but was already thinking about completing the fall in the morning, after seeing such figures, immediately continued to decline. Now wave b has turned out to be as deep as possible. If the decline continues by another 30-40 points, which in the current circumstances is a matter of one hour, then the whole wave picture will have to be clarified. There are still chances for the completion of wave b, but they are fading before our eyes. Let me remind you that this week there will be not only a meeting of the Fed but also a meeting of the Bank of England. Since the market expects a rate hike from the British regulator, the pound may even get a little support on Wednesday. Perhaps this support will be crucial, as it urgently needs an increase in demand. However, at the same time, the FOMC may raise the rate by 50 basis points at once, which may cause an increase in the dollar. The situation is critical for the pound.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the completion of the construction of wave E and the entire downward trend segment. Thus, I now advise buying the British for each MACD signal "up" with targets located above the peak of wave a, not below the calculated mark of 1.3042, which corresponds to 76.4% Fibonacci. Under certain circumstances, wave marking can become much more complicated, but now there are no signals for such an option.

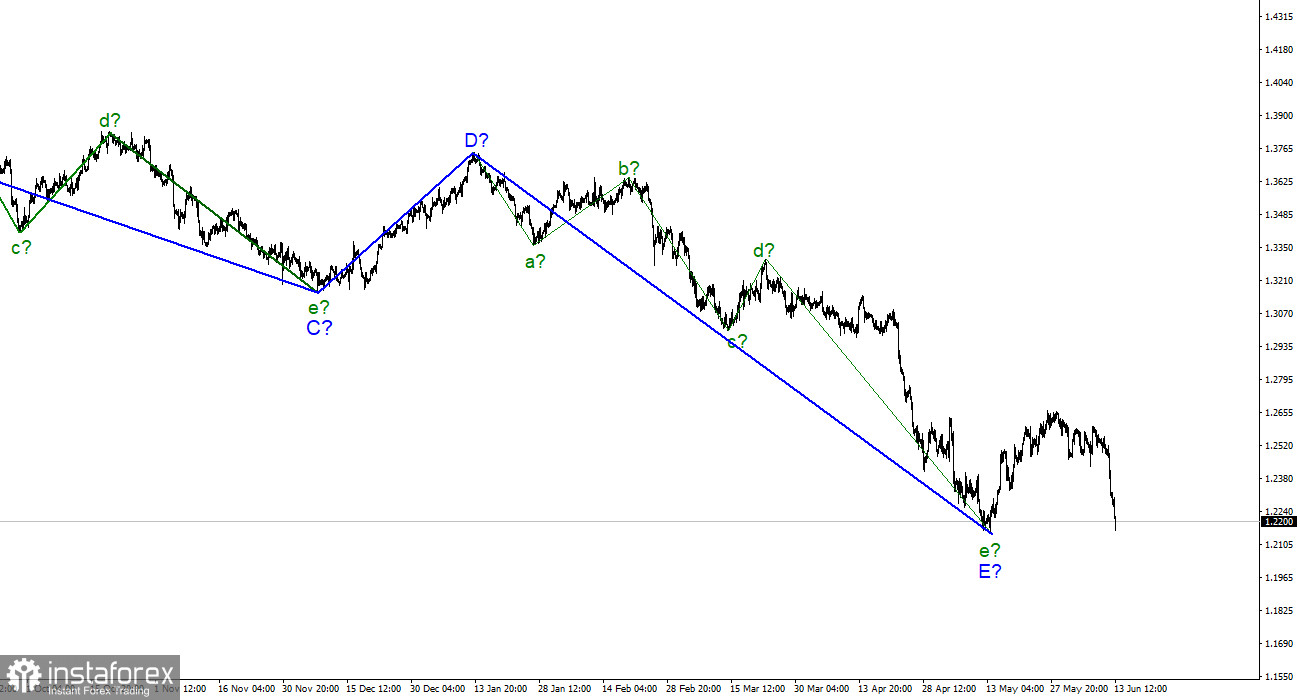

On the higher scale, the entire downward trend section looks fully equipped. Therefore, the continuation of the decline of the instrument below the 22nd figure is postponed indefinitely. Wave E has taken a five-wave form and looks quite complete. The construction of at least three waves ascending trend sections has begun.