When to go long on EUR/USD:

Several excellent market entry signals were formed yesterday. I suggest you take a look at the 5-minute chart and figure out what happened. I paid attention to the level of 1.0462 in my morning forecast and advised you to make decisions on entering the market from it. The bears' failure to break through below 1.0462 was quite expected, which resulted in a false breakout and a buy signal. As a result, the pair went up a little more than 20 points, but that was it. We saw 1.0462 in the afternoon after a breakthrough and reverse test, which resulted in forming a sell signal. However, interpreting the entry point was quite tricky, and if you missed it, you were basically right. A good buy signal was formed in the middle of the US session after a false breakout at 1.0423, which led to the pair jumping by more than 30 points.

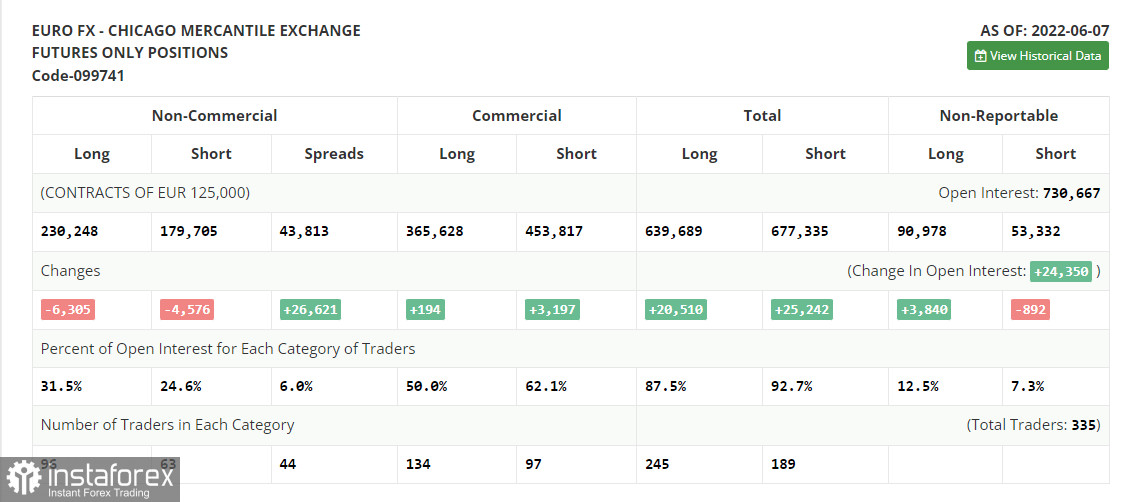

COT report:

Before talking about the further prospects for the EUR/USD movement, let's look at what happened in the futures market and how the Commitment of Traders positions have changed. The June 7 Commitment of Traders (COT) report logged a sharp decline in both long and short positions. Many traders were rather wary of the European Central Bank meeting. And so the market refused to be active for this reason. As time has shown, being out of the market was the ideal scenario. The ECB's Board of Governors said last week it would raise rates at its next meeting, but even that didn't save the euro in the face of the highest US inflation in 40 years. Friday's data last week led to a fall in all risky assets, which also affected the euro. The EUR/USD's succeeding direction will depend on the Federal Reserve's decisions on monetary policy and on the forecasts made for the coming years. If the central bank's actions continue to be seen as aggressive, most likely the euro will sink even more, which will lead to updating annual lows.

The COT report shows that long non-commercial positions fell by 6,305 to 230,248, while short non-commercial positions fell by 4,576 to 179,705. Despite the weak euro, this does not make it particularly attractive. As a result of the week, the total non-commercial net position decreased and amounted to 50,543 against 52,272 a week earlier. The weekly closing price dropped to 1.0710 against 1.0742.

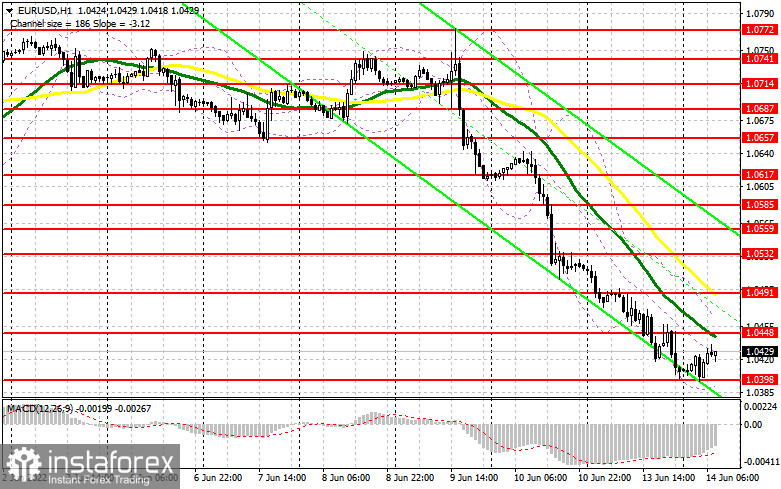

Although the euro is ready to demonstrate a correction, it needs good reasons, which it does not have. It is quite possible that today's reports on the consumer price index and the economic sentiment index of Germany will be able to provide some support for the pair for a while, but one can hardly count on a strong bullish momentum - especially before tomorrow's Fed meeting. Data on the volume of industrial production in the euro area will also be important, but are unlikely to lead to major market changes. Of course, the best scenario for opening long positions will be around the monthly low of 1.0398, which was formed following yesterday's results. Considering that the trend is downward, only a false breakout at this level, along with good data on Germany, will give a signal to buy the euro in anticipation of a correction and to update the nearest resistance at 1.0448. A breakthrough and test from top to bottom of this range creates a new signal to enter long positions, opening the opportunity for recovery of EUR/USD at 1.0491, where the moving averages play on the bears' side. It is unlikely to get to a more distant target in the 1.0532 area today, especially given the bearish nature of the market.

If the EUR/USD declines and there are no bulls at 1.0398, and most likely that will be the case, the pressure on the pair will increase. The bulls will take profits in anticipation of a further major decline. In this case, I advise you not to rush into longs. I think the best option is a false breakout near the low of 1.0353. I advise you to open long positions immediately for a rebound only from the level of 1.0306, or even lower - in the region of 1.0255 with the goal of an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Bears coped with the tasks assigned to them and continued the trend at the very beginning of the week. Now they need to achieve a new weekly low, as only this will keep the market under their control. It will be possible to do this today if we receive disappointing statistics on Germany and the eurozone in the first half of the day. In case the euro moves up, and this is necessary for the accumulation of new short positions, I advise you to focus on the resistance at 1.0448. Forming a false breakout there, by analogy with what I analyzed above, creates an excellent signal to open short positions along the trend with the prospect of returning to support at 1.0398. A breakdown and consolidation below this range, as well as a reverse test from the bottom up - all this will lead to a sell signal with removing bulls' stops and a larger movement of the pair down to the 1.0353 area. A more distant target will be the area of 1.0306, where I recommend taking profits. It will be possible to reach this level today in the second half of the day after strong data on the producer price index in the US.

If the EUR/USD moves up in the first half of the day, and bears are not active at 1.0448, there is no need to panic too much - the downward trend will not go anywhere. The best option in this case would be short positions in forming a false breakout in the area of 1.0491. You can sell EUR/USD immediately on a rebound from 1.0532, or even higher - in the area of 1.0559 with the goal of a downward correction of 30-35 points.

Indicator signals:

Moving averages

Trading is below the 30 and 50 moving averages, indicating a bear market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.0398 will lead to a fall in the euro. Surpassing the upper border of the indicator in the area of 1.0448 will lead to the growth of the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.