Gold is once again under pressure as expectations of higher interest rates sent dollar to a 20-year high and bond yields to an 11-year high.

Market analysts say inflation concerns continue to dominate financial markets, and expectations are growing that the Federal Reserve will have to act even more aggressively to bring down inflation.

The bank is due to announce its decision on monetary policy on Wednesday, and recent statements from members hint that it might raise interest rates by 50 basis points at this and July meetings.

Commodity analysts at TD Securities believe that an aggressive rate hike could put pressure on gold in the short term, especially if the Fed also increase rates by 75 basis points in September.

Last week's report by the US Department of Labor indicated that CPI rose 8.6% year-on-year in May, hitting a new 40-year high. Inflation may even hold longer than expected after average US gas prices reached a new all-time high on Sunday, rising above $5 a gallon.

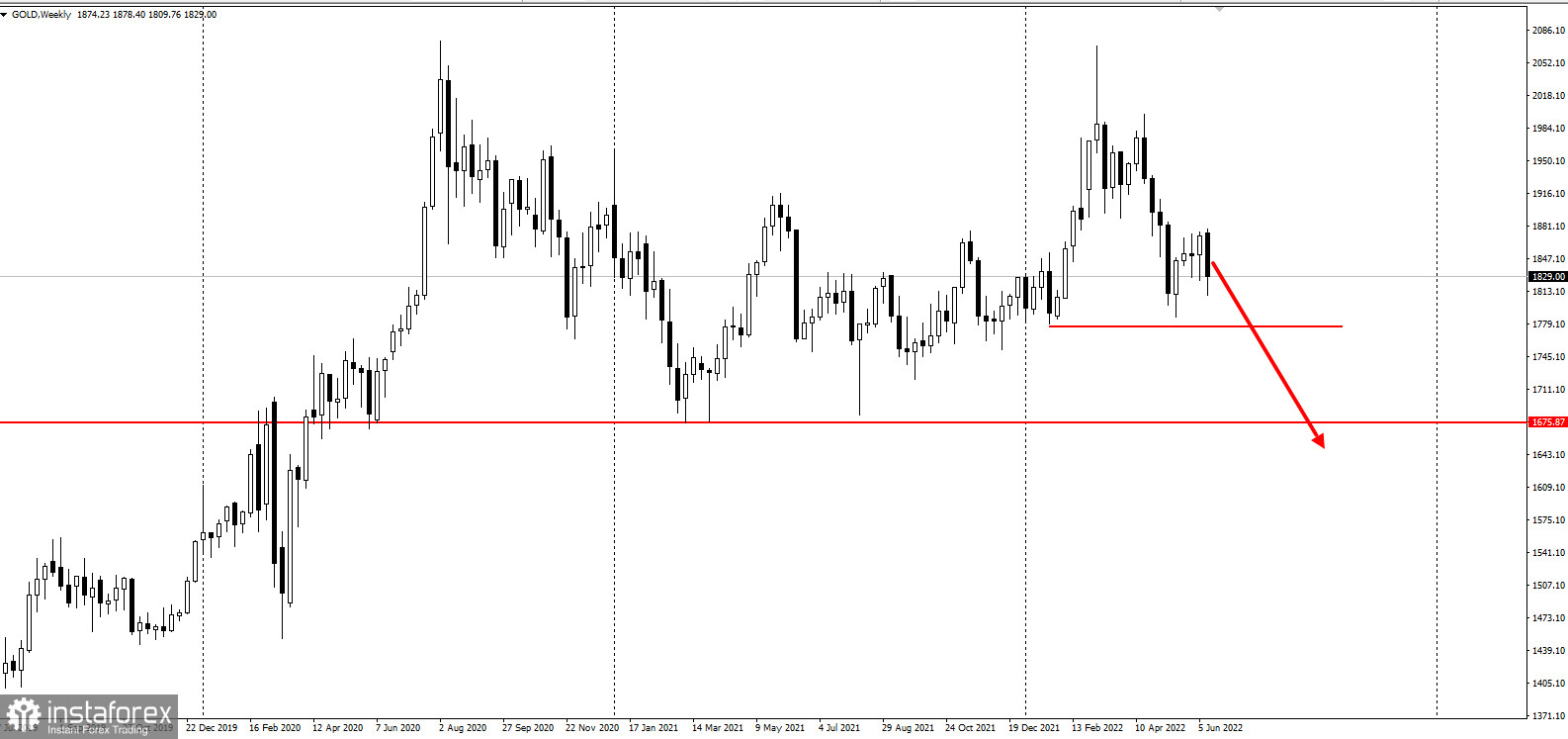

Analysts at TD Securities warn that a rate hike will be negative for gold in the short term, that is, prices may drop below $1,800 per ounce in the near future.

But despite short-term volatility and weakness, TDS still sees long-term potential in precious metals, forecasting an average annual gold price of around $1,841 an ounce.

Bart Melek, head of commodity strategy at TDS, said the question remains on whether the Fed can outpace the inflation curve. He said the central bank already seems exhausted.