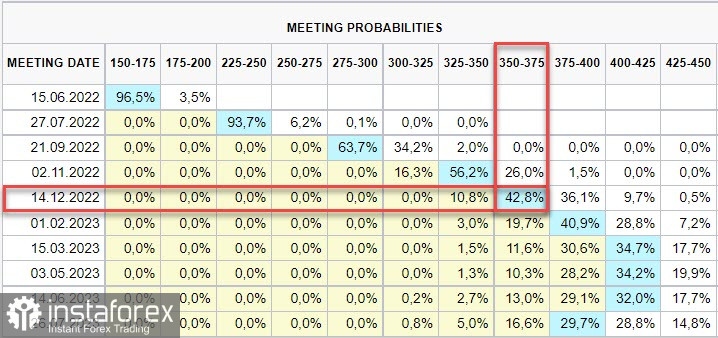

Never before has the rate forecast been so aggressive. In just less than two days, the market abandoned its previous forecast of a 50p rate hike, and now believes in a confident 75% increase. With this, the rate will surely range 3.50/ 3.75% by the end of the year.

As such, there is a fairly strong increase in volatility in the stock and debt markets, with US Treasuries continuing to sell off. 10-year UST yields have risen to an 11-year high of 3.47%, while major European bond yields showed gains.

The Bank of England is also projected to push up rates by 50 percentage points this week, while the ECB is treading in a cautious manner. The recent statements of ECB members Isabel Schnabel hint that a new anti-crisis tool is ready, though it is unlikely to be presented before its introduction is considered necessary.

In any case, the dollar is on the rise due to the outpacing rate growth, and is unlikely to turn around even if the Fed resorts to a 0.75% rate increase.

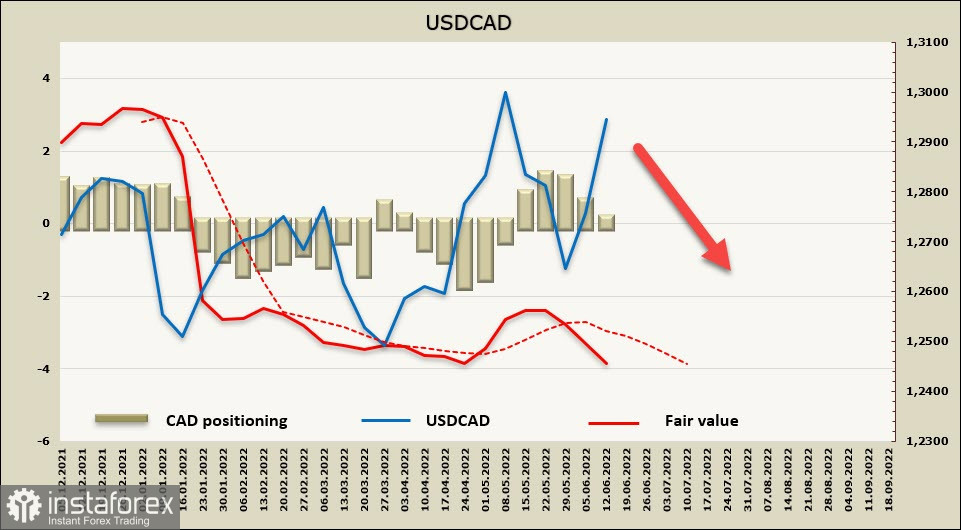

USD/CAD

According to latest reports, average wage in Canada rose by 4.45% y / y in April, higher than expected and supports inflation. At the same time, the unemployment rate fell to 5.1%, indicating that the Canadian labor market is stronger than the US labor market. The figures show that the Bank of Canada is correct in implementing its current strategy, and now has a little more room for maneuver.

In terms of USD/CAD, the net short position in loonie, as follows from the CFTC report, has risen by 469 million, strengthening the bearish stance of the currency. The settlement price is down, but the rate itself followed the global trend and went up.

Nevertheless, the growth of USD/CAD can be stopped either at the nearest resistance of 1.3074, or at the border of the channel at 1.3240/70. Attempts will most likely be made to return the pair to the lower border of the channel at 1.2530/60.

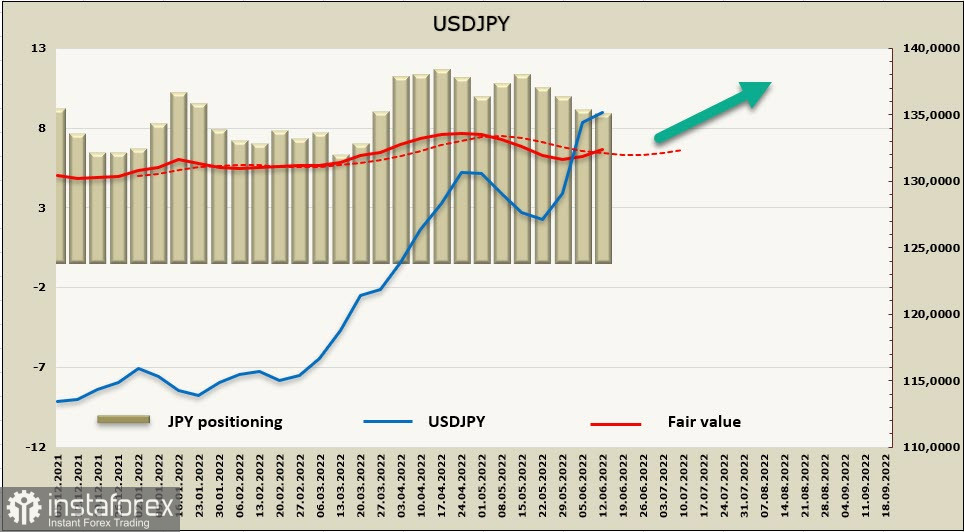

USD/JPY

USD/JPY continues to be driven by the monetary policy divergence between the Fed and the Bank of Japan, as well as by the widening yield gap between the US and Japan. Given that QQE is essentially locked for the remainder of BoJ Chairman Haruhiko Kuroda's term (with the support of Prime Minister Fumio Kishida), any change in the exchange rate will be driven by changes in the Fed's stance under its chairman Jerome Powell. Or, in other words, follow the Fed to understand where the yen will move.

Therefore, the meeting of the Bank of Japan on Friday, July 17, will be held in the manner that will be set tonight in the US. The Bank of Japan has already stepped up its bond buying activity to keep yields low and bought even longer maturing 30+ year JGBs. The volume of purchases amounted to 2.2 trillion yen (16.3 billion USD), which is a record amount of purchases in 1 day.

In terms of the CFTC report, net short positions in JPY narrowed slightly again, showing a weekly change of 535 million. The overall bearish margin is -8.64 billion.

The pair also reached the multi-year high of 135.19, and there is no reason to believe that a reversal will begin to form at this level. Most likely, it will continue to move to 147.50/148.00, unless dollar demand decreases.