Futures on US stock indexes rose slightly on Wednesday after another sell-off observed yesterday during the regular session. Investors continue to expect aggressive actions by the Federal Reserve System to curb rising inflation, so this growth can be ignored. Futures for the Dow Jones Industrial Average rose 90 points or 0.3%. S&P 500 futures gained 0.4% and Nasdaq 100 futures jumped 0.5%.

Yesterday's big sell-off was the final one before today's publication of the results of the meeting, an increase in interest rates, and the release of economic forecasts that could turn the market around if the Fed, of course, takes a more hawkish policy. If nothing unexpected happens, the stock market may cheer up and investors will start buying the bottom – the very bottom that everyone was counting on at the end of May this year.

Yesterday, the S&P 500 experienced a five-day losing streak, further delving into the bear market territory. The benchmark stock has already fallen by more than 4% this week and is now showing a 22% gap from its record high in early January. The Dow Jones blue-chip index fell by about 150 points on Tuesday, also for the fifth day in a row.

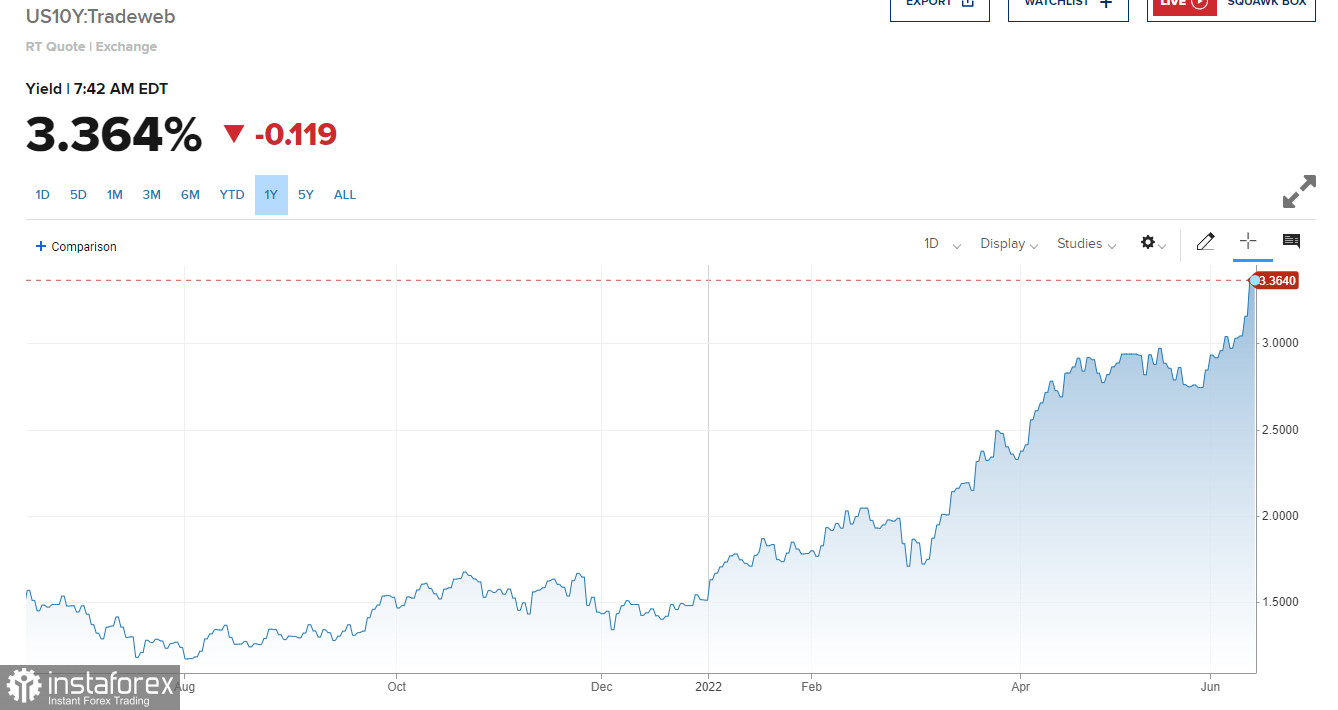

Today, the Federal Open Market Committee will conclude its two-day meeting. The market is betting on a more than 95 percent probability of an increase in the cost of borrowing by 75 basis points at once, which is the largest increase since 1994. The need for such a transition to a higher rate of rate hikes occurred after inflation data came out last week, showing unexpectedly high rates. The deteriorating economic outlook is also one of the reasons for the Fed's response.

Today, the Federal Open Market Committee will conclude its two-day meeting. The market is betting on a more than 95 percent probability of an increase in the cost of borrowing by 75 basis points at once, which is the largest increase since 1994. The need for such a transition to a higher rate of rate hikes occurred after inflation data came out last week, showing unexpectedly high rates. The deteriorating economic outlook is also one of the reasons for the Fed's response.

Raising rates by 75 basis points instead of 50 reflects the harsh reality, but also reflects the Fed's determination to emphasize its commitment to the mandate to maintain price stability. The central bank is now acting under compulsion, and not according to plan, which is what exerts such sharp pressure on the markets. Any uncertainty and abrupt interference in the work of the markets are always met with negativity, which you can observe now. After the publication of the decision, Fed Chairman Jerome Powell will hold a press conference. Investors will be watching the tone regarding the tightening of the Fed's policy.

As for the technical picture of the S&P500

The bulls will continue to defend the nearest support of $ 3,755. Weak data on retail sales in the US will certainly lead to its re-update. The immediate target of buyers of risky assets is the resistance of $ 3,788. A breakthrough of $ 3,788 will push the trading instrument up to a new active movement, to the area of $ 3,826, where large sellers will return to the market again. At least there will be those who want to fix profits on long positions. A more distant target will be the $ 3,866 level, but this is less realistic. In case of pessimism and regular talk about high inflation and the need to fight it against the background of speeches by representatives of the Federal Reserve System with statements about more aggressive steps by the Fed, as well as the absence of bulls at $ 3,755, we will see another major sell-off in the area of $ 3,731. A decrease in the trading instrument under this level will quickly push it to new lows: $ 3,708 and $ 3,677.