The euro and the dollar are trying to find a balance post-FOMC. Yesterday, the US central bank lifted interest rates by 75 basis points. As a result, the greenback plummeted, and the euro attempted to consolidate.

The US Fed announced a 0.75% rate hike at the Wednesday FOMC meeting. The interest rate peaked at 1.75%, the highest since 1994. The regulator said it would remain aggressive in 2022 and act decisively to tame galloping inflation if needed.

After the meeting, the greenback tumbled from its 20-year high. The US central bank softened its projections, saying such swings in USD would remain in the past.

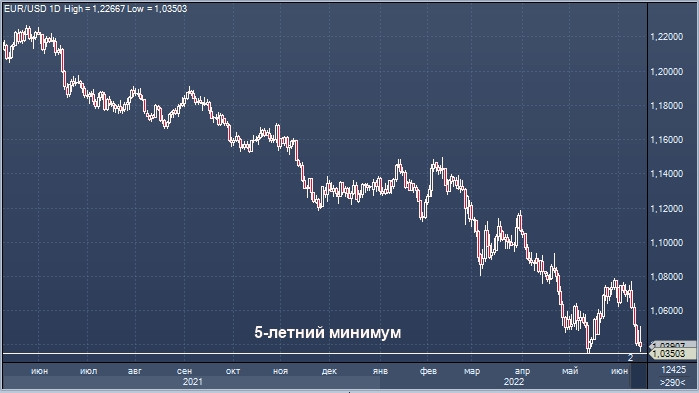

The ECB meeting on Wednesday provided some support for the euro and exerted additional pressure on the dollar. The situation changed after the FOMC meeting but the euro kept looking for a pivot point. EUR/USD plunged to 1.0359 and somewhat retraced but failed to break through the 5-year low recorded in the middle of May 2022. Back then, the pair traded around 1.0350.

Early on Thursday, EUR/USD was still under pressure from the Fed's decision. Support and resistance are seen at 1.0350 and 1.0400 respectively. Early on Thursday, EUR/USD hovered around 1.0438.

At the press conference, Chairman Powell noted that the regulator can achieve a successful outcome with inflation on its way to 2% and the unemployment rate at4.1%. Fed policymakers say that maintaining a strong labor market without stability in prices is a failed strategy. At the same time, it would be more challenging to bring inflation to the 2% target.

Earlier, the Fed received severe criticism for missing the right moment for hiking rates and a delayed reaction to a surge in inflation to the 40-year high. The regulator has now updated its forecasts for interest rates and inflation (the so-called dot plot).

The Fed now sees interest rates at 3.4% this year and at 3.8% in 2023. Meanwhile, five Fed officials expect the benchmark rate to peak above 4%. The futures market foresees a 50 basis points rise in the federal funds rate in July (with 100% probability) and another increase of 75 basis points (with 90% probability). Preliminary estimates show that the benchmark rate will come in at 3.65% at the end of this year.

The US regulator expects inflation to soar to 5.2% and GDB to grow by 1.7% this year. The Fed is keeping an eye on the high level of consumer spending. According to Mr. Powell, there are some positive changes in the level of consumption, but they are still insignificant. The US economy has somewhat slowed down, but this does not mean its growth stops in the long term. If necessary, the Fed will raise rates to appropriate levels in the coming months.