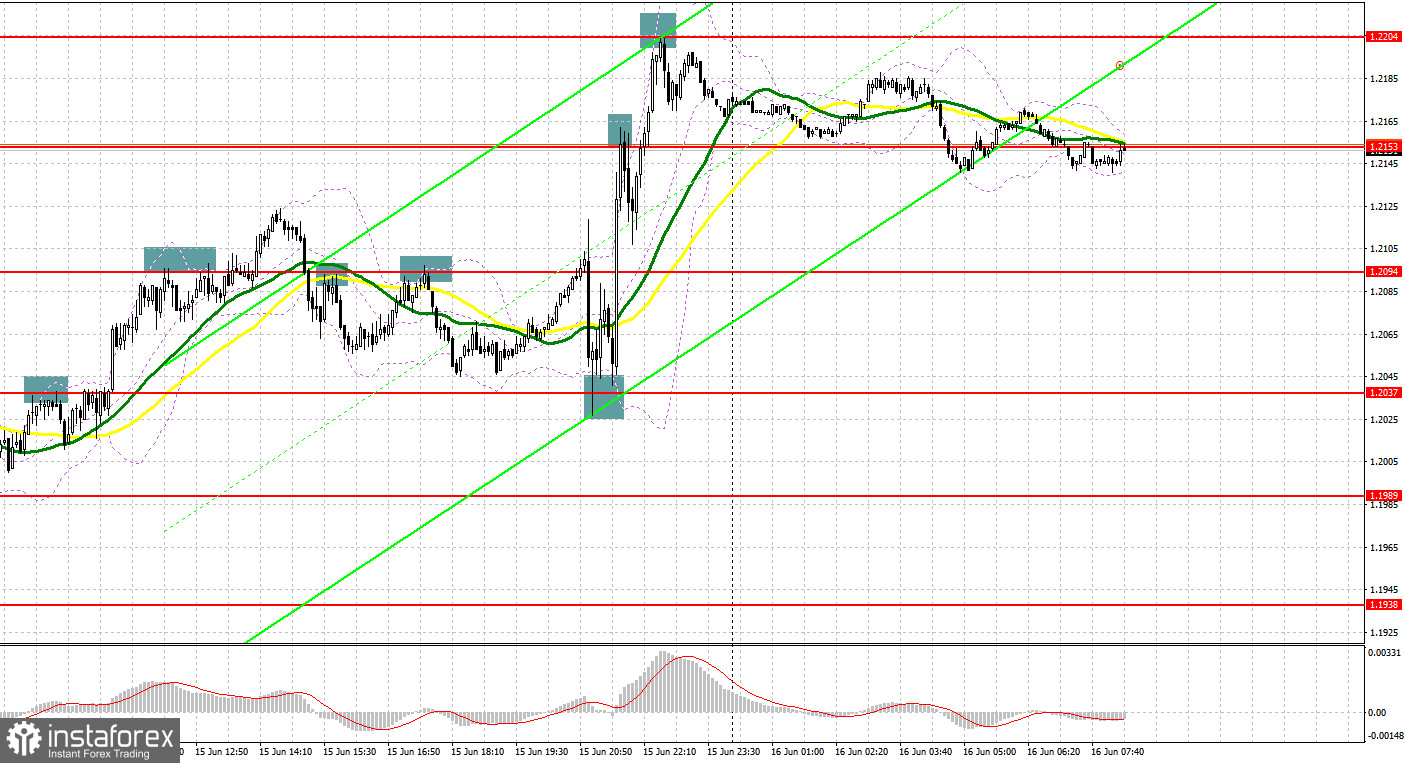

Yesterday, a huge number of market entry signals were formed. Let's take a look at the 5-minute chart and see what happened. I paid attention to 1.2037 in my morning forecast and advised you to make decisions from it. The bears managed to achieve a false breakout on the first test of this range, which led to a signal to open short positions and, it seems, to the resumption of the bear market. However, the pair went down only about 20 points, then returning back to 1.2037. After surpassing 1.2037, I did not wait for this level from top to bottom, so I had to miss the upward correction at 1.2094. Several false breakouts and sell signals from 1.2094 gave an entry point to short positions, but I did not see any downward movement there either. After rising and returning to the area under 1.2094 in the afternoon on a reverse test from below 1.2094, several excellent market entry points were formed. As a result, the pound fell by more than 50 points. After the announcement of the Federal Reserve's decision to raise rates, a false breakout at 1.2037 resulted in an excellent buy signal. As a result, the pair rose by 120 points and rested at 1.2153. There, a false breakout and a sell signal brought about 30 points of profit, after which the demand for the pound returned. Selling for a rebound at 1.2204 led to a correction of the pair by 40 points to the downside.

When to go long on GBP/USD:

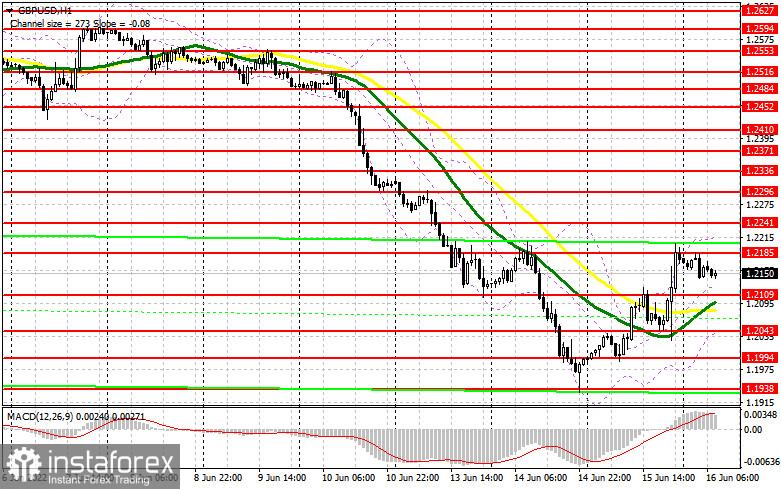

Yesterday, the Fed raised interest rates by 0.75% at once, which was expected. All this allowed the pound to correct properly before the Bank of England announces its decision on monetary policy today. It is obvious that traders do not expect serious changes in the central bank's plans, so the continuation of the upward correction of the pair is not ruled out. To do this, you need to stay above 1.2109. Forming a false breakout there will give a signal to open long positions in anticipation of growth to the nearest resistance 1.2185. An equally important task is to regain control of this level, which will reduce pressure on the pair and lead to a change in market sentiment. A breakthrough and downward test of 1.2185 will give a signal to buy in anticipation of an update of 1.2241, where I recommend taking profits. A more distant target will be the area of 1.2296, but it will be possible to reach this area only after the BoE meeting and a more aggressive policy, or hints of it.

If the GBP/USD falls and there are no bulls at 1.2109, and moving averages, playing on the bulls' side, pass below this level, the pressure on the pair will increase. Obviously, without a major intervention in interest rates, it will be quite difficult to cope with record inflation. Therefore, I advise you to open new long positions only on a false breakout from 1.2043. You can buy GBP/USD immediately on a rebound from 1.1994, or even lower - in the area of 1.1938 with the goal of correcting 30-35 points within the day.

When to go short on GBP/USD:

The bears no longer control the market, but they will certainly try to regain control over it this morning. To do this, they need to return under the level of 1.2109 as quickly as possible and consolidate below. It will be possible to do this after the BoE meeting and in the event that very negative prospects for further growth of the UK economy are announced at it. Consolidation below 1.2109 and a reverse test from below will provide an entry point into short positions with the prospect of a return to 1.2043. A more distant target will be the 1.1994 area, where the bulls will try to build the lower border of the new ascending channel, counting on touching the bottom. I recommend taking profit there.

In case the pound grows, the bears will most likely show themselves in the area of the nearest resistance at 1.2185, and a false breakout at this level will provide a good entry point into short positions, counting on the resumption of the downward trend. In case traders are not active at 1.2185, a slight upsurge may occur amid the removal of stop orders of speculative bears. In this case, I advise you to postpone short positions until 1.2241. But even there, I advise you to sell the pound only in case of a false breakout, since going beyond 1.2196 can break the short-term downward trend for the pair. You can open short positions immediately for a rebound from 1.2336, or even higher - from 1.2371, counting on the pair's rebound down by 30-35 points within the day.

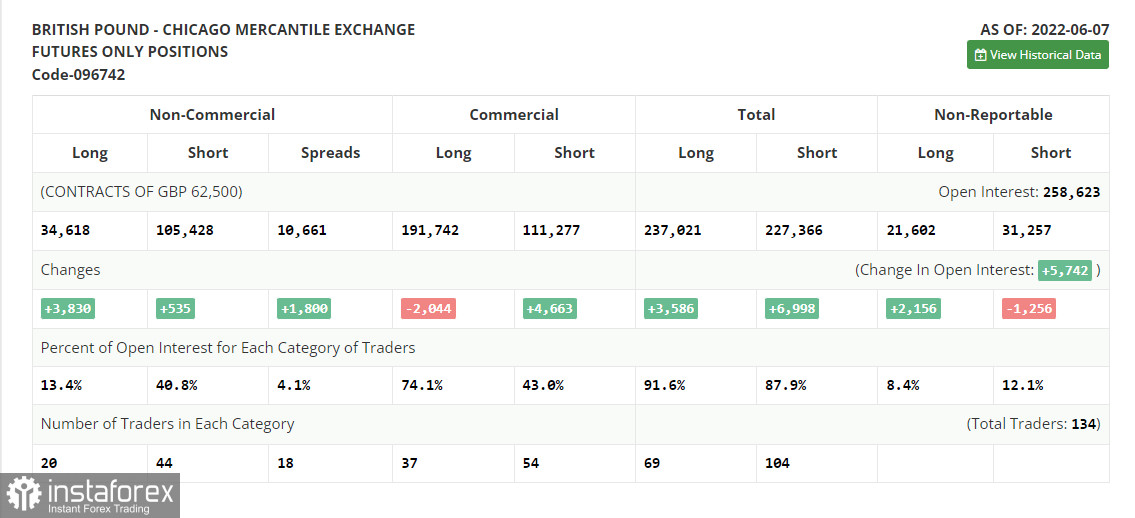

COT report:

The Commitment of Traders (COT) report for June 7 logged a sharp increase in long positions and only a small growth in short ones. However, as I think you understand, at the moment the picture is completely different: the last three trading days have turned the market upside down. The pair's succeeding direction, which is in the area of annual lows, depends on the Federal Reserve meeting and on the decisions taken at it. A more aggressive policy will push GBP/USD further down, as the UK economy, as the latest data showed, is gradually reducing the growth rate, which does not give confidence to investors. The Bank of England meetings are unlikely to help the pound in any way, since the central bank will not abandon the policy of raising rates. I very much doubt its further aggressive actions aimed at combating inflation by sacrificing the growth rate of the economy. Although BoE Governor Andrew Bailey continues to say that the central bank is not going to give up on raising interest rates yet, however, there are also no hints of a more aggressive approach to monetary policy.

The COT report indicates that long non-commercial positions increased by 3,830 to the level of 34,618, while short non-commercial positions increased by 535 to the level of 105,428. This led to a decrease in the negative value of the non-commercial net position from the level of -74,105 to the level of -70,810. The weekly closing price rose 1.2481 to 1.2511.

I recommend to read:

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, which indicates the bulls' attempt to continue the growth.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator around 1.2043 will act as support. In case of growth, the area of 1.2215 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.