The European currency slightly strengthened its position against the US dollar, as did the British pound, following yesterday's meeting of the Federal Reserve System, at which Chairman Jerome Powell took another step towards trying on the role of a fighter against inflation in the style of Paul Volcker. The head of the Fed almost admitted that the fight against rampant price pressure could lead to a recession in the economy. His words and the actions of the committee were not something unexpected for the market. The demand for risky assets and their rebound took place even against the background of the application of a more aggressive policy by the Central Bank. This suggests that traders need more specifics and confidence in the future – even if it will not be as sunny as many expected.

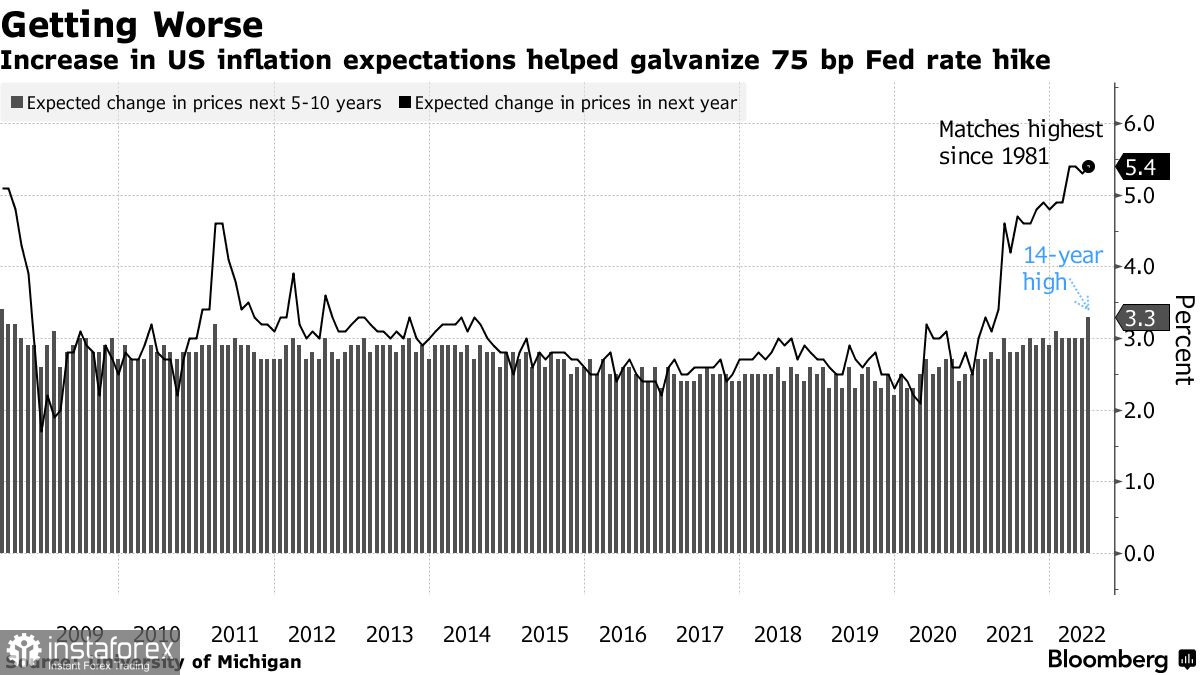

Stating that it is necessary to reduce inflation, Powell resorted to the largest interest rate increase by the Central Bank since 1994, while pointing to the clear possibility of another such giant increase by three-quarters of a percentage point in July. "Our goal is to bring inflation down to 2% while the labor market remains strong," Powell told reporters. "I think it's becoming increasingly clear that many factors that we don't control play an important role in making future decisions."

Following yesterday's meeting, the committee decided to raise the key interest rate immediately by 0.75% to cool the labor market and increase unemployment — a strategy that in the past often led to an economic downturn. Changing the position poses a danger not only for the economy and financial markets but also for US President Joe Biden and his Democratic Party, which will become the "hero of the occasion" in the current difficult economic situation. Republicans will now put pressure on the Biden administration, saying that during its term it failed to do anything useful to increase the pace of economic growth, but only on the contrary, achieved the highest level of inflation in the last 40 years. Biden's popularity has already plummeted due to rising inflation. The recession and the associated increase in unemployment will deprive the president of one of his few topics for discussing the benefits of his policies.

Everyone will try to transfer it to the shoulders of Jerome Powell, who is no less to blame than others in the current situation – if not more. Next week, lawmakers will ask him why the Fed misjudged the severity of inflation and why it now believes that its eradication requires such harsh measures as an economic recession. Now more and more economists are predicting a recession next year. Almost 70% of economists surveyed by the Financial Times and the University of Chicago predict a reduction in gross domestic product next year.

Yesterday, the forecasts of the Fed's economists were also published: in them, experts expect that the economy will continue to grow this year and next year, although not at the same pace as previously stated. They also foresee an increase in unemployment, which usually only occurs during a recession: unemployment is projected to rise to 4.1% at the end of 2024 from 3.6% currently. Economists also forecast a sharp increase in interest rates in the coming months. The federal funds rate is expected to rise to 3.4% by the end of this year and to 3.8% by the end of 2023. This is much higher than the 2.5% rate, which they consider neutral for the economy.

As for the prospects for the euro, it is obvious that the upward rebound will not last long. The Fed's policy will not allow bulls to keep the market under their control for a long time, thus, be careful with purchases even at current levels. Bulls need to show something around 1.0400, otherwise, the pressure on the trading instrument will only increase. Having missed 1.0400, you can say goodbye to hopes for the recovery of the pair, which will open a direct road to 1.0360. A breakthrough in this support level will certainly increase the pressure on the trading instrument, opening an opportunity for the test of 1.0310 and 1.0260. It is possible to talk about purchases and bulls' attempts to correct the situation, but only after an obvious return to 1.0460. Only after that, prospects for recovery in the areas of 1.0540 and 1.0585 will open.

The buyers of the pound have no fewer problems than the Bank of England. If the bears break below 1.2100 following the results of the Bank of England meeting, then the pound will go straight to 1.2040. Going beyond this range will lead to another downward movement, already to the lows of 1.1990 and 1.1940. It is possible to talk about a correction only after a breakout of 1.2190, which will lead to an instant breakthrough at 1.2240, where buyers will face much greater difficulties. In the case of a larger upward jerk of the pound, we can talk about updating 1.2300 and 1.2350.