EUR/USD

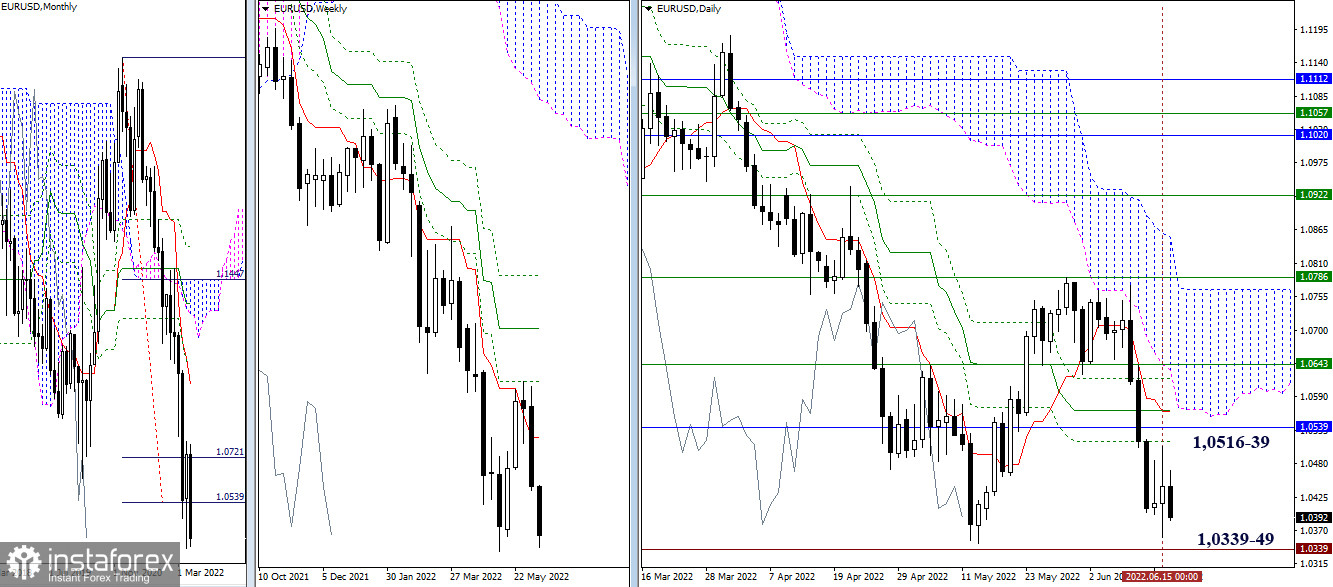

Higher timeframes

Even though bulls managed to rise almost to the nearest resistances 1.0516–39 yesterday, the day as a whole does not have a pronounced bullish mood. As a result, uncertainty dominates, the lower and upper shadows of the daily candle of the previous day are approximately equal. A reliable exit beyond the borders that currently restrict movement—1.0516–39 (daily + monthly level) or 1.0339–49 (May 2022 and January 2017 local low)—will help change the situation.

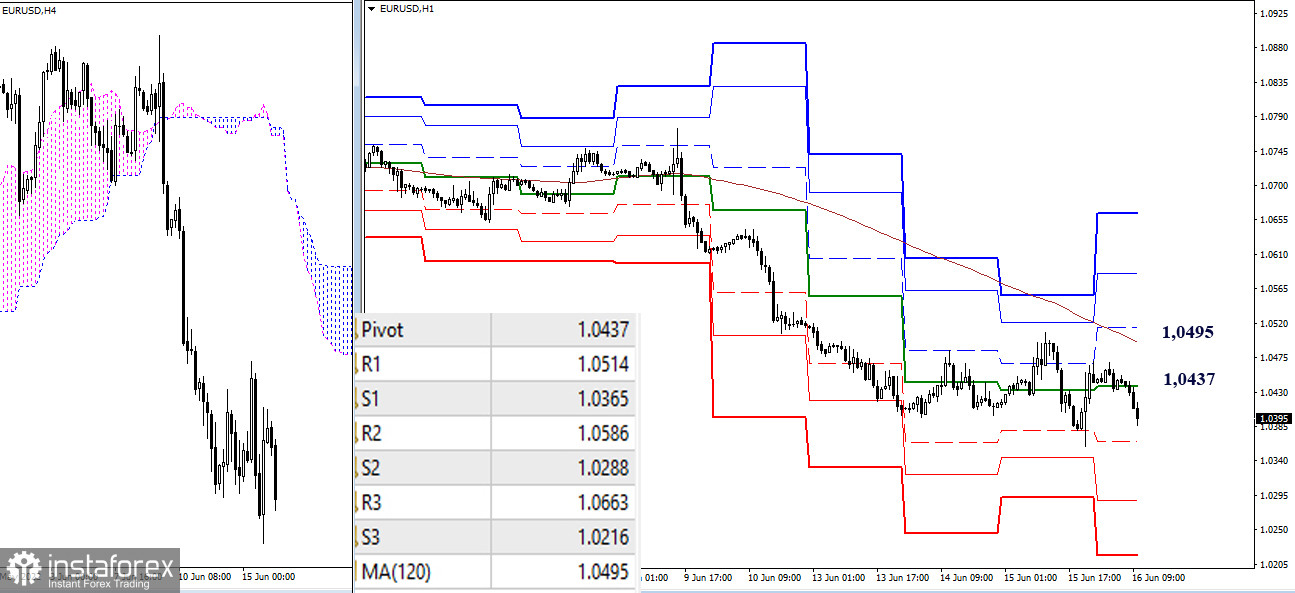

H4 – H1

At the moment, the pair is in the correction zone at the lower timeframes. The exit and recovery of the downward trend can be implemented through the renewal of yesterday's low (1.0359). The levels of 1.0365 – 1.0288 – 1.0216 (support of the classic pivot points) also serve as reference points for the bears within the day. As for the bulls, their main task for the development of an upward correction and a change in priorities is the breakout of the central pivot point of the day (1.0437) and the weekly long-term trend (1.0495). Consolidation above and reversal of the moving average will change the current balance of power. In this case, the reference points for the continuation of the rise will be the resistance of the classic pivot points, which today are located at 1.0514 – 1.0586 – 1.0663.

***

GBP/USD

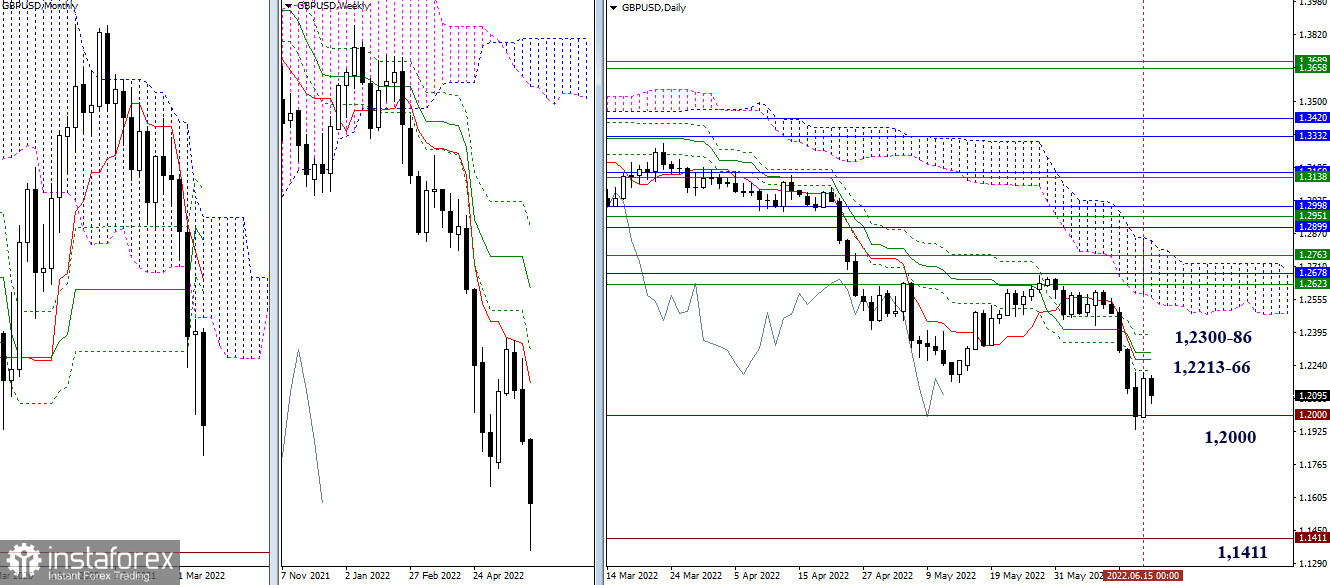

Higher timeframes

The pound sterling formed a rebound yesterday from the psychological support of 1.2000. Due to this, the pair came close to a fairly wide resistance zone formed by the levels of the Ichimoku cross (1.2213 – 1.2266 – 1.2300 – 1.2386). To develop their moods, the bulls will have to eliminate the daily death cross. For the bears, it is important to complete the upward correction and, having overcome the support of 1.2000, continue the decline. Their reference point, in this case, will be the historical low of 2020 (1.1411).

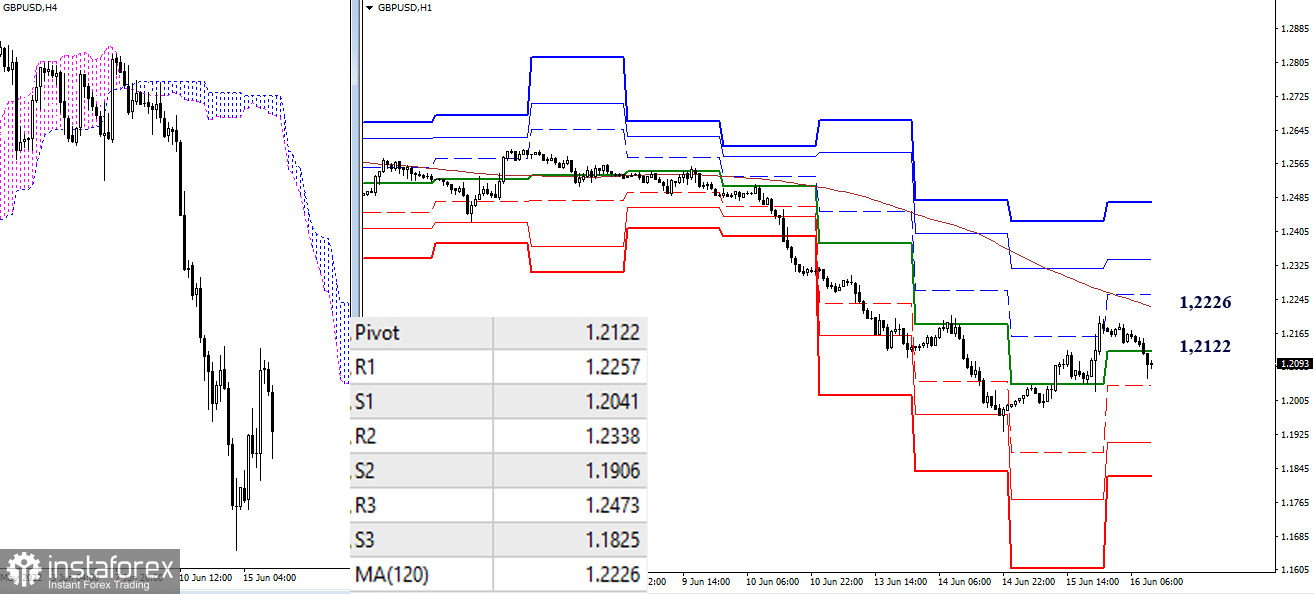

H4 – H1

In the lower halves, the pair has been in the upward correction zone for a long time. Today, the key levels, which now act as resistance, are focusing their efforts on the boundaries of 1.2122 (central pivot point) and 1.2226 (weekly long-term trend). A reliable consolidation above and a reversal of the moving average will change the current balance of power. The next upward benchmarks, in this case, within the day will be the resistance of the classic pivot points (1.2257 – 1.2338 – 1.2473). If bears manage to complete the correction, for this they will have to pass the support of S1 (1.2041) and restore the downward trend (1.1933), then intraday references for continuing the decline will be the support of the classic pivot points 1.1906 (S2 ) and 1.1825 (S3).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)