Index futures signaled a rout in US stocks on Thursday after the Federal Reserve announced its willingness to accept a recession and rise in unemployment in its resolve to contain elevated inflation.

September contracts on the S&P 500 and Nasdaq 100 gauges dropped at least 2.2% each, with traders giving up their initial optimism over Fed Chairman Jerome Powell's comments that super-sized rate hikes won't be the norm. Renewed concerns about the impact of monetary tightening on economic output and asset valuations sparked a rout in Treasuries and sent the dollar up for the sixth time in seven days.

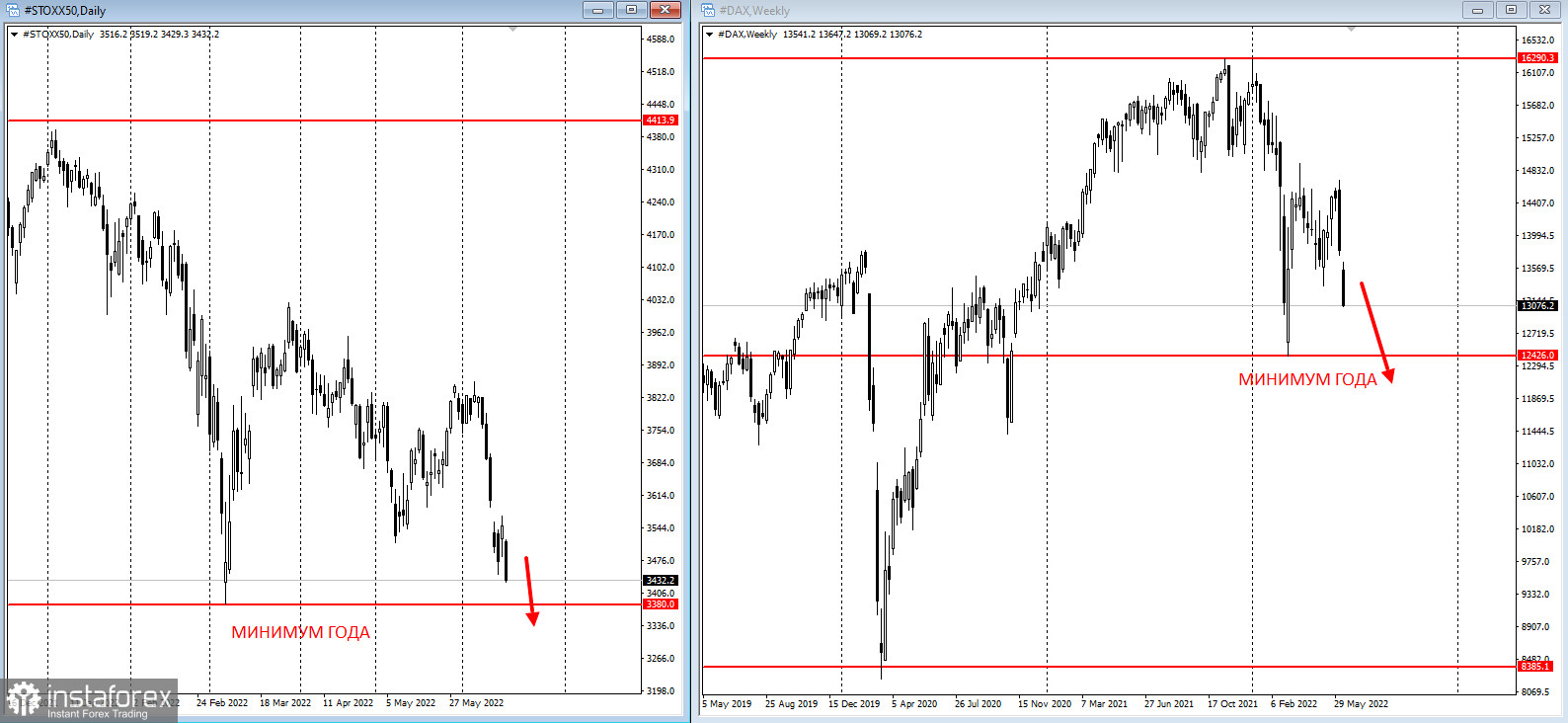

European stocks headed for a 16-month low, and Chinese Internet shares dropped in premarket New York trading.

German two-year bond yield jumped 16 basis points. For investors in the region, worries over monetary policy revolved around the European Central Bank's perceived delay in starting a rate-hike cycle.

European equities slumped, and the Stoxx 50 benchmark fell to its lowest since February 2021.

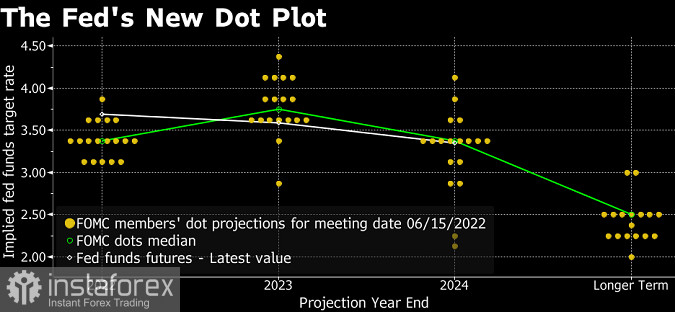

Following the Fed's decision to raise interest rates at the highest rate since 1994, Powell pointed to a monetary stance similar to that of Paul Volcker, who stopped inflation rising four decades ago. However, this led to rising unemployment and a credit squeeze. Powell's comments signalled the Fed's determination to continue its aggressive path of rate hikes - and that bond yields and equity risk premiums must rise to adjust to the new reality.

"It hasn't taken long for the post-Fed bounce in stocks to fade, and given the gloomier outlook for growth that is hardly surprising," Chris Beauchamp, chief market analyst at IG Group, wrote in a note. "We are still living in the same world we were 24 hours ago, one where growth is slowing, earnings are still falling and prices keep on rising. This is not a great environment for stocks," he added.

Powell and colleagues on Wednesday lifted the target range for the federal funds rate to between 1.5% and 1.75%. They projected raising it to 3.4% by year-end. The median official saw a peak rate of 3.8% in 2023. The Fed reiterated it will shrink its massive balance sheet by $47.5 billion a month, a move that took effect June 1, stepping up to $95 billion in September.

Traders focus their attention now on the UK, where the Bank of England is expected to raise rates for a fifth consecutive time on Thursday. Gilts shares climbed ahead of the decision at noon London time as monetary markets cut rates amid concerns about the economic outlook and the Brexit controversy.

The 10-year Treasury yield rose 10 basis points Thursday, erasing half of the 19 basis-point plunge on Wednesday.

Chinese Internet companies NetEase Inc. and Pinduoduo Inc. fell at least 4.9% each in early trading in New York. On Thursday, stocks of technology companies were among the biggest losers globally, as their higher valuations compared with other sectors became unattractive amid rising bond yields.

Key events this week:

- Bank of England rate decision, Thursday.

- US housing starts, initial jobless claims, Thursday.

- Bank of Japan policy decision, Friday.

- Eurozone CPI, Friday.

- US industrial production index, Friday