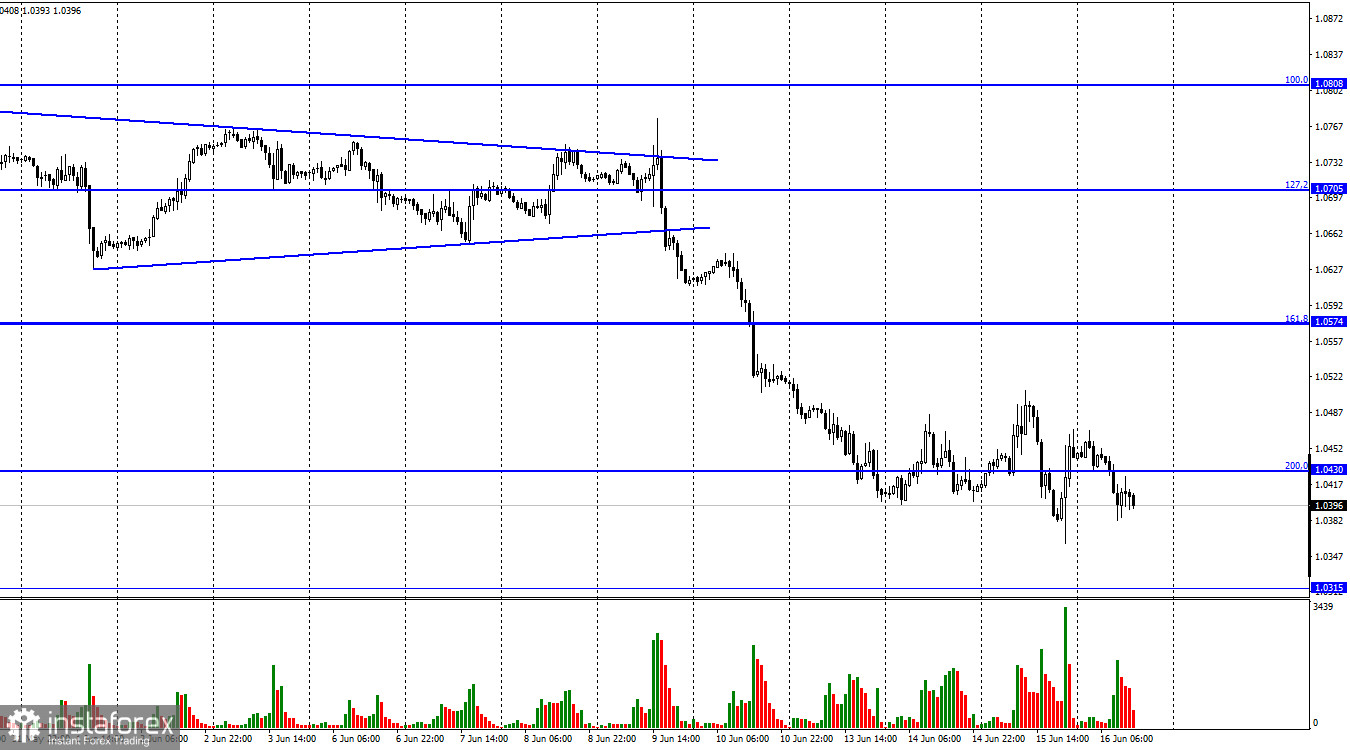

The EUR/USD pair changed the direction of trading all day on Wednesday. At first, the pair rose by 90 points, then fell by 150, and after the Fed meeting and its results, increased by 60 points. It's not for nothing that I listed the scale of the pair's movement during the day. It turns out that before the results of the Fed meeting became known to traders, the pair was trading much more actively than after? Such a picture would not cause any surprise if the American regulator did not immediately raise the rate by 0.75%. It should also be clarified that traders expected an increase of 0.5%. Thus, the Fed did not fulfill the forecast, exceeded it, raised the rate by the maximum value over the past 28 years, and traders reacted with a movement of 60 points? Moreover, these 60 points were passed in the direction of the European currency. Therefore, after the interest rate increased by an unexpected value, the US dollar fell? From my point of view, all this is very strange. Already today, a reversal was made in favor of the US currency and the pair fell by 60 points, completely regaining yesterday's movement in the evening.

Thus, now, if readers look at the chart, they will not even be able to immediately say that there was an important event at all last night. Despite such strange behavior of traders, it is necessary to admit that the dollar has received long-term support from the Fed. Jerome Powell said during his speech that the main goal of the regulator was and will be the return of inflation to the level of 2%, and the American economy is strong enough to cope with a strong tightening of monetary policy. As early as next month, Powell admits, the rate will be raised again. Either by 0.5% or 0.75%. Thus, the pair's decline may continue in the coming weeks. Even if this does not happen (due to a different information background), it is very difficult to believe in the growth of the European currency now. The ECB also promises to raise the rate in 2022, but we are talking about an increase of 0.25% once or twice. In this case, the ECB rate will be 0.5%, and the Fed rate is already 1.75%.

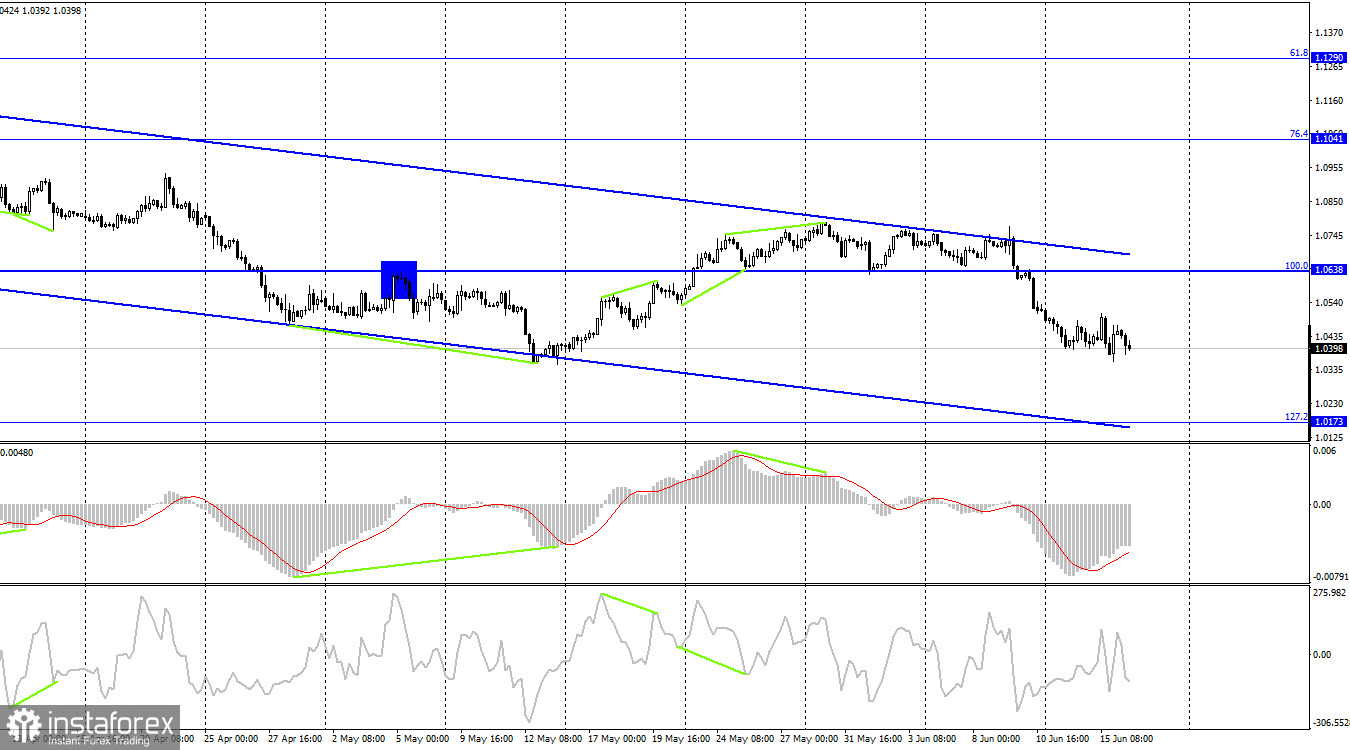

On the 4-hour chart, the pair performed a rebound from the upper line of the descending trend corridor and closed under the corrective level of 100.0% (1.0638). Thus, the process of falling may continue in the direction of the corrective level of 127.2% (1.0173). Only consolidation over the descending corridor will work in favor of the EU currency and some of its growth in the direction of the Fibo level of 76.4% (1.1041). Emerging divergences are not observed in any indicator today.

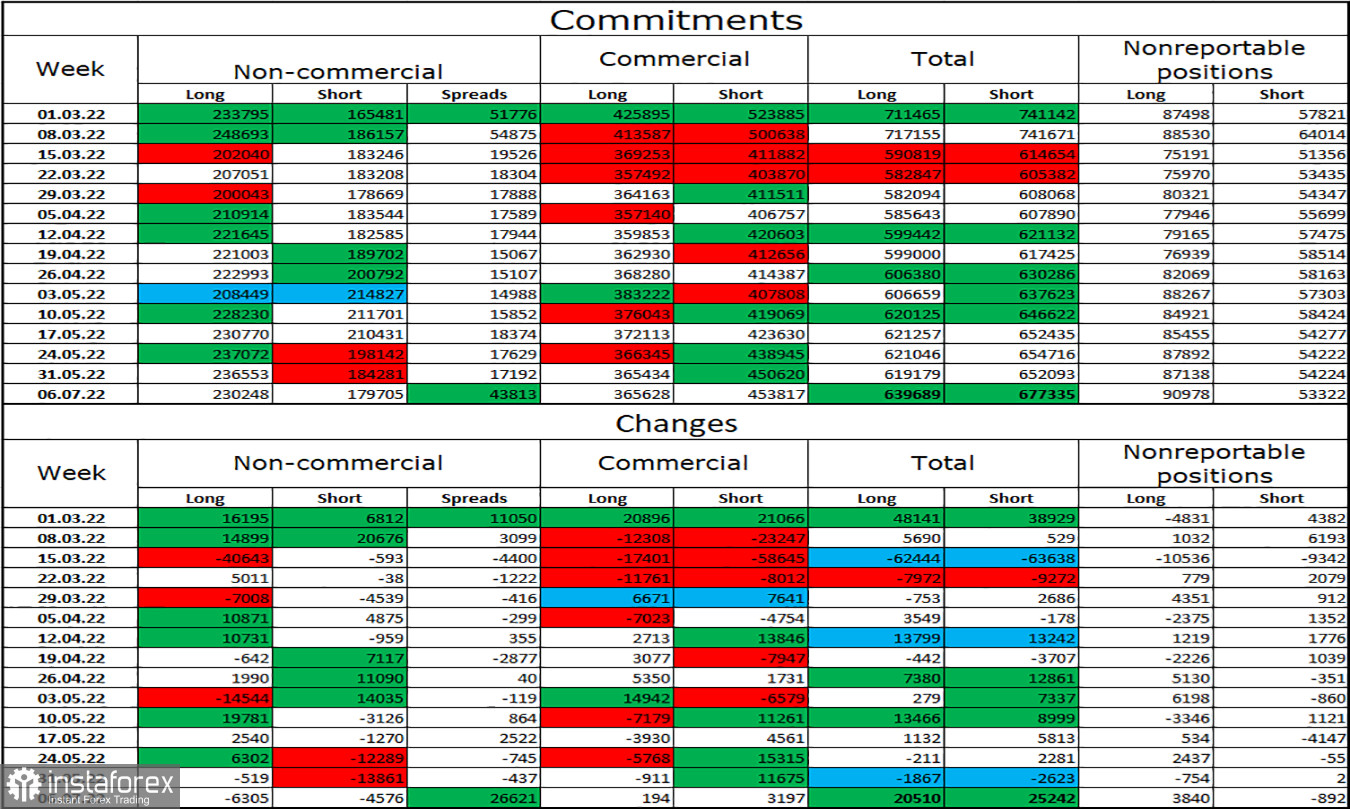

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 6,305 Long contracts and 4,576 Short contracts. This means that the bullish mood of the major players has weakened, but only slightly. The total number of long contracts concentrated on their hands is now 230 thousand, and short contracts – 179 thousand. As you can see, the difference between these figures is not very big and not in favor of bears. Therefore, it is still difficult to realize that in recent months and now the European currency has been falling very much. In recent months, the euro has mostly maintained a bullish mood in the category of "Non-commercial" traders. In the last few weeks, the chances of a rise in the euro currency have been gradually growing, but the last two days of last week ruined everything. And this week, no good news is expected for the euro currency yet. Therefore, the currency may continue to fall while speculators may continue to buy euros.

News calendar for the USA and the European Union:

On June 16, the calendars of economic events in the United States and the European Union will be empty. Several reports will be released in the USA during the day, but all of them, from my point of view, are not important and can affect the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair when closing below the level of 1.0638 on a 4-hour chart with targets of 1.0574 and 1.0430. Both goals have been fulfilled. I recommend buying the euro currency when anchoring above the corridor on a 4-hour chart with a target of 1.1041.