The Federal Reserve is not going to save the financial markets, on the contrary, it is acting in such a way that they themselves do all the dirty work for the central bank. Aggressive tightening of monetary policy is likely to lead to either a recession or serious pain during a soft landing. 70% of Financial Times analysts predict a recession in the US economy in 2023, Bloomberg models estimate the chances of a recession a year later at 72%. But who, if not the markets, is to blame that the Fed raised the rate by 75 bp at its June meeting? CME derivatives gave an 89% chance that this would happen. The central bank just did what the investors asked.

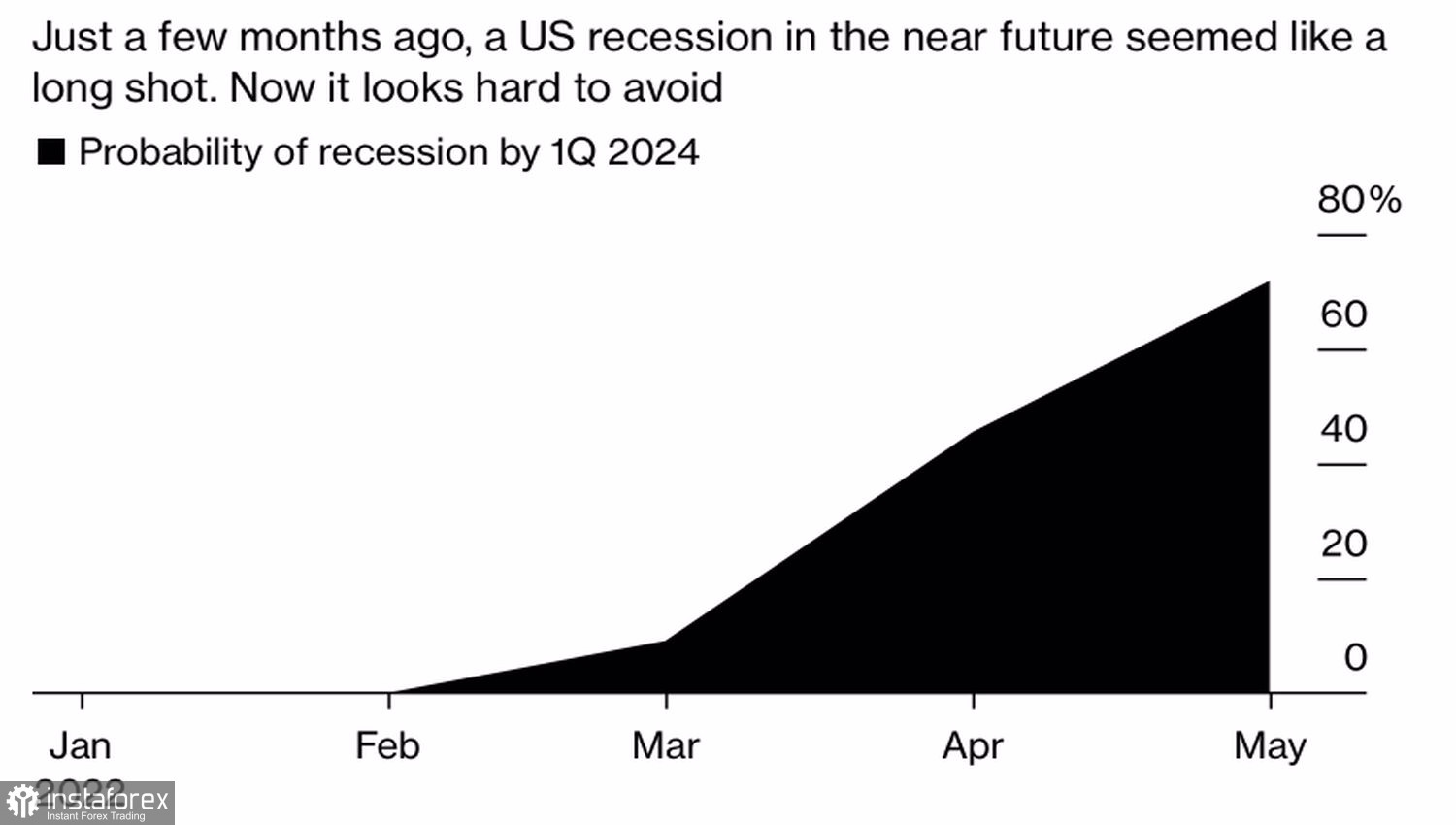

Dynamics of the likelihood of a recession in the United States

Indeed, when the singular FOMC hawk Esther George votes in favor of the old plan to raise borrowing costs to 1.5%, it comes as a surprise. Why not Rafael Bostic, who called for a pause in the monetary tightening process in September? Fed Chairman Jerome Powell seems to have infected the Committee with a common message: the Fed should follow the lead of the market so as not to provoke a sharp rebound, which will improve financial conditions and increase inflation expectations and inflation.

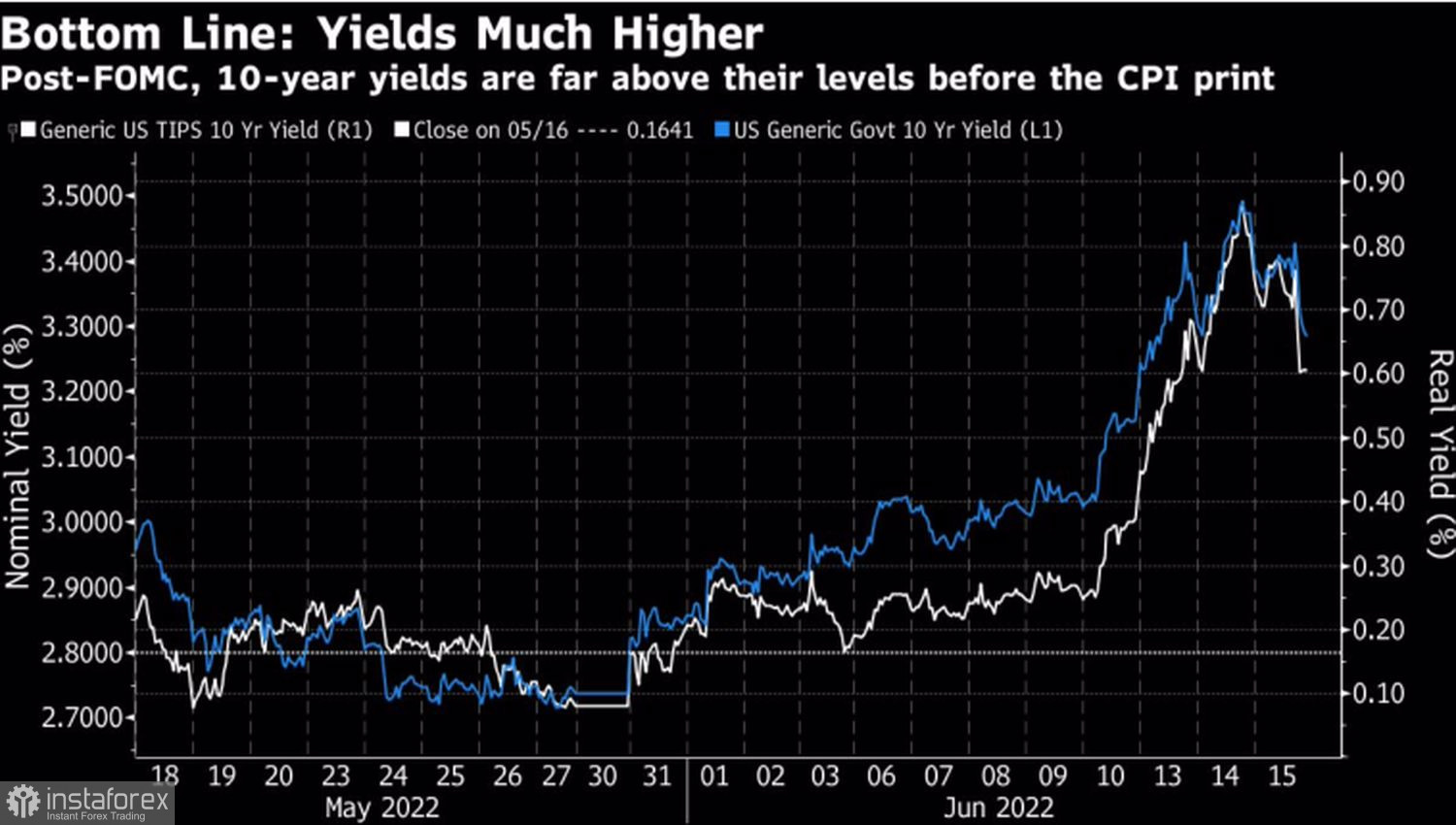

Investors demanded a rate increase by 75 bp, they got it. They will demand another +75 bp in July, no problem, the central bank will do it. Anyway, the implementation of the second part of the principle "buy the rumor, sell the fact" will follow, which in June led to a decrease in the real yield of treasury bonds and to the stabilization of stock indices.

Dynamics of Real Yields on US Treasury Bonds

All this is reminiscent of when the markets show what needs to be done, and the Fed follows their lead. In fact, it is more like family relationships: investors are the head, and the central bank is the neck. It will turn the markets wherever it wants there in order to achieve its goals.

In my opinion, Powell and his team are very efficient and we will again see occasional rallies in the US dollar followed by consolidations in the near future. During the latter, EURUSD bulls will have chances for counterplay.

The euro's position looks hopeless amid the renewal of the EU's Brexit lawsuit against Britain and another jump in gas prices due to a reduction in the volume of its supplies by Russia. However, one must understand that both the trial and the approval of British Prime Minister Boris Johnson's project by the Parliament are long-term phenomena. The trade war is still months away, if it happens, of course. Moscow's actions are forcing Brussels to look for alternative sources of blue fuel supplies. And it will find them. In Israel.

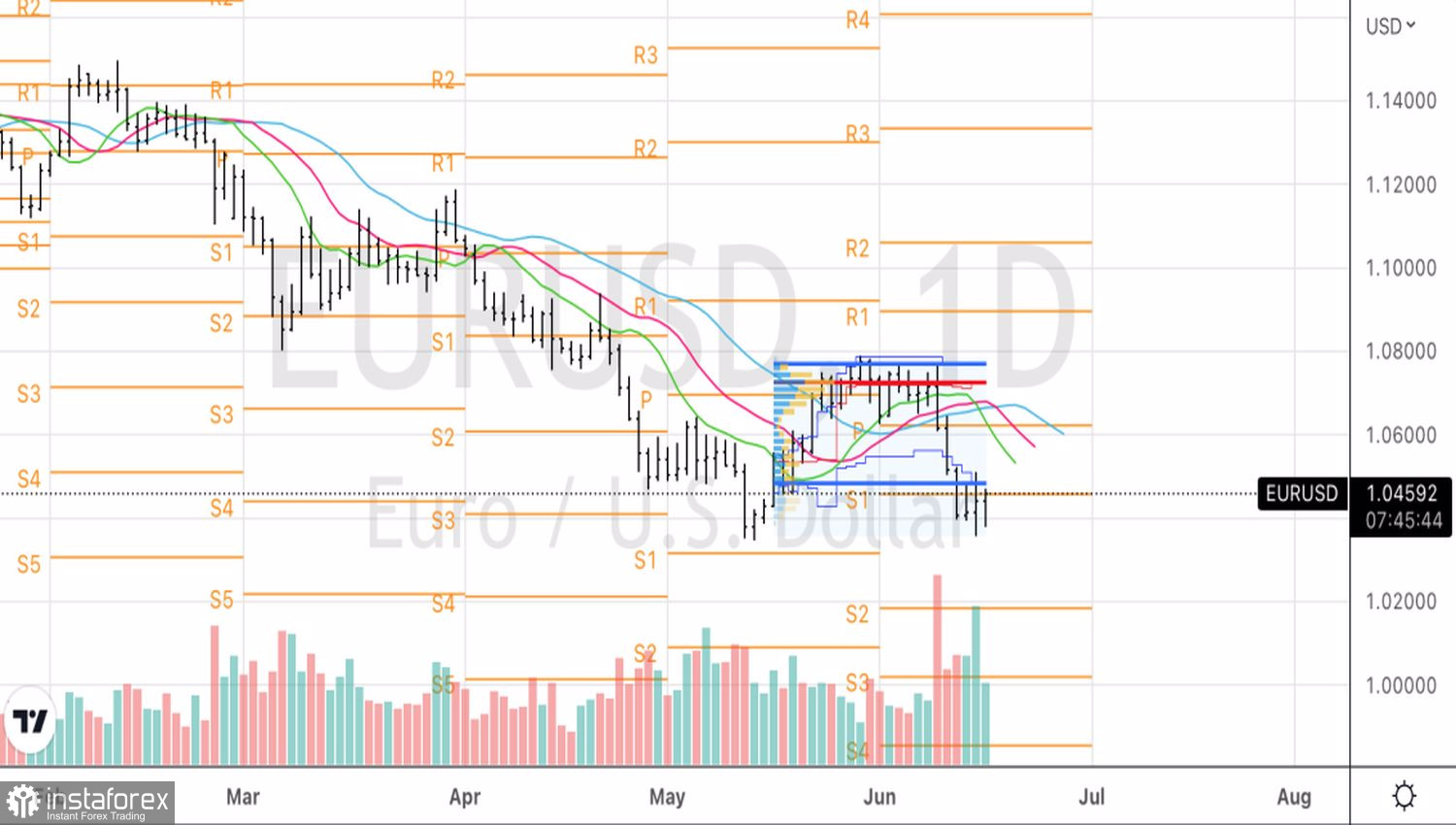

EURUSD, daily chart

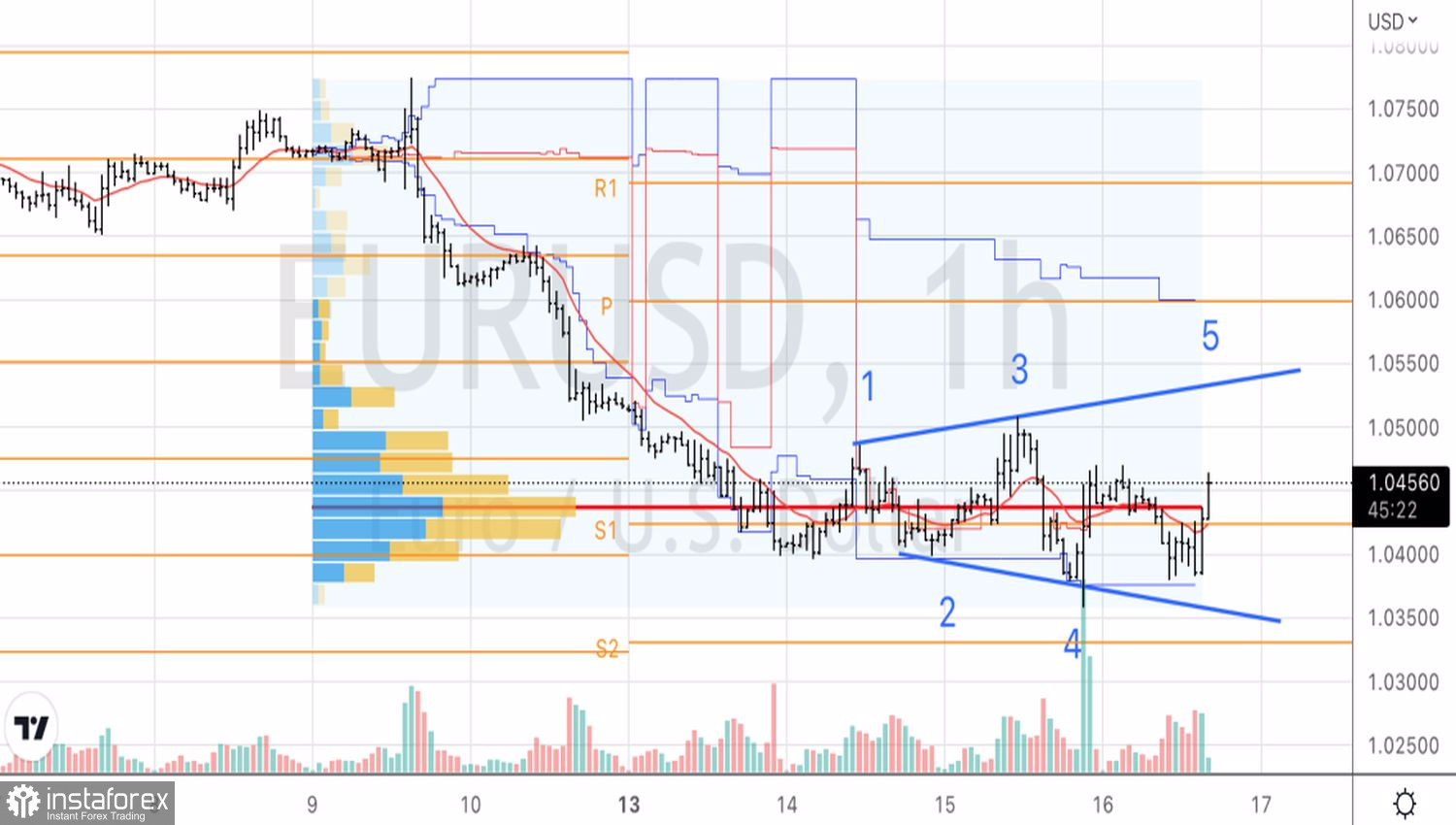

EURUSD hourly chart

Technically, EURUSD's return to the 1.049-1.077 fair value range could be good news for the bulls. At the same time, the update of point 3 in the form of a local high near 1.051 on the hourly time interval activates the Expanding Wedge pattern and will become the basis for opening long positions.