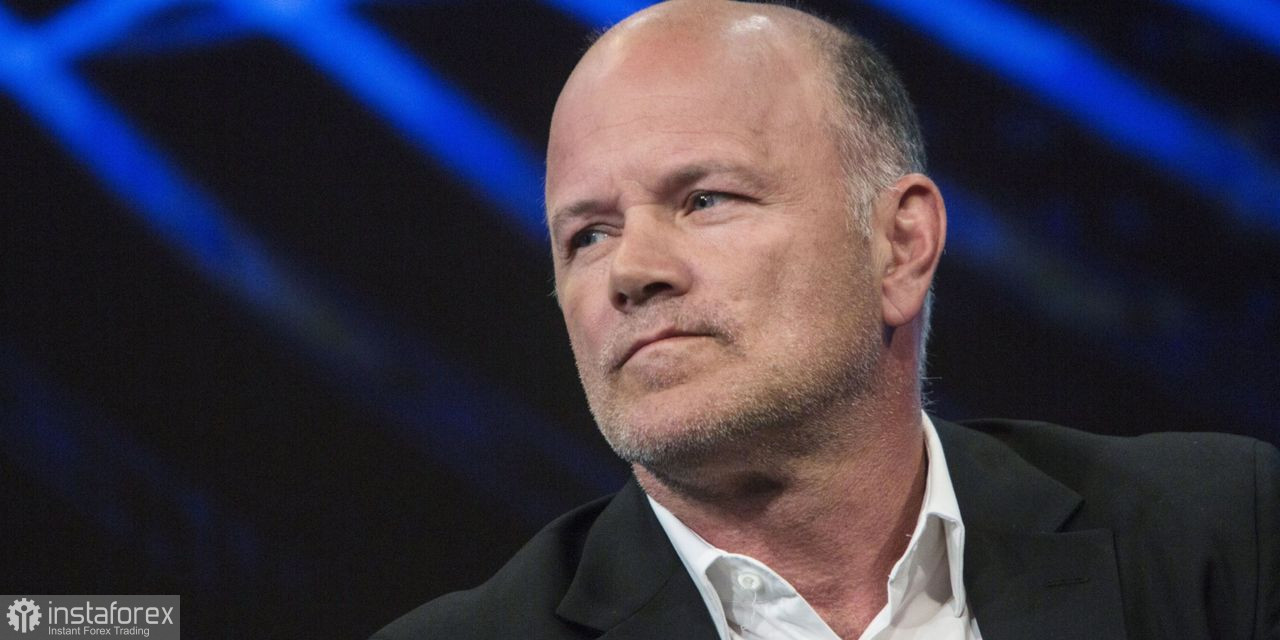

Most of the crypto enthusiasts, who were talking so much about the prospects of digital assets and urging us to invest in crypto last year, stopped making any announcements very quickly. Cathy Woods' funds have gone silent, and nothing has been heard from Cathy since then. Michael Saylor of MicroStrategy also recently tried to defend his company in the face of the looming crisis, which is about to become mired in margin calls. Nevertheless, in this article, I'd like to talk about a recent speech by Mike Novogratz, founder and CEO of Galaxy Digital Holdings Ltd. In his opinion, two-thirds of hedge funds investing in cryptocurrencies will collapse because of the current market downturn.

It has been said many times before that if bitcoin plummets below $20,000, the world's largest companies investing in this asset will start having serious problems. Yesterday, Three Arrows Capital had a rather troubled time. It had to liquidate over 13,000 ETH. This happened right after Ethereum plummeted to $1,020. By the way, Three Arrows Capital is one of the largest $5 billion crypto funds in the world.

"Volume will go down, hedge funds will have to restructure," Novogratz said at the Piper Sandler Global Exchanges & Brokerage Conference in New York. "There are literally 2,000 crypto hedge funds. My guess is two-thirds will go out of business."

According to Novogratz, the financial market's reaction to the Federal Reserve's withdrawal of stimulus was one of the reasons cryptocurrency assets have collapsed over the past six months as well. Bitcoin has fallen by more than 50% from its November 2021 all-time high. Novogratz also attributed the collapse of the Terra blockchain last month to broader macroeconomic factors, rather than the project's shortcomings. Notably, Galaxy was one of the company's investors.

However, despite the difficult situation, the company said it would continue to expand even during the economic downturn. The cryptocurrency billionaire also noted that his cryptocurrency and asset management firm wants to be "in the right place at the right time" after the economic downturn ends.

As for the short-term prospects of bitcoin, there are not many willing to buy even at the current lows. Bulls need to show strong activity in the area of $22,800 to push the pair higher, but before that, it is necessary to try to return the price above $21,800. Only fixing above this range may quickly drag the trading instrument back to $24,200, allowing investors to breathe out. A breakthrough of $20,700 and a consolidation below this level is likely to cause a drop in the trading instrument to the low of $19,200, and then to $18,500 and $17,600.

At the same time, traders are in no hurry to buy ETH near the bottom. Yesterday's drop once again made investors nervous, as the trading instrument was one step away from a breakthrough of the psychologically important level of $1,070. It will be possible to talk about building an upward correction only after it comes back to $1,070, which will quickly bring Ethereum back to $1,282, or even $1,406, which will be a serious problem for traders. Only fixing above this level may allow the asset to build an uptrend with the prospect of hitting new highs near $1,548 and $1,721. If the pressure on ETH remains, buying near the nearest support of $1,070 is not excluded. A breakthrough of this range will be the reason for a new collapse to $997. In this case, it is better to count on new lows of $925 and $876, where large players will be active again.