What are the markets dealing with: with the peak of hawkish sentiment or that obstinate inflation will not allow the central bank to reduce the monetary degree?

The dollar plunged significantly following the results of trading on Thursday, while on Friday it began to recover its positions, gaining more than 1% against the basket of competitors within the session. The sharp reversal was facilitated by fresh comments from the Federal Reserve, issued during the hours of the US session on Friday.

Fed Chairman Jerome Powell gave grounds for discussing possible monetary scenarios at the July meeting. The head of the central bank did not rule out another sharp increase in the rate by 75 bp, if the situation requires it.

Much will depend on the input data. Inflation showed no significant signs of slowing down. If it rises higher, it may be necessary to continue raising rates beyond what is now projected.

Minneapolis Fed chief Neil Kashkari said it would be prudent to support another 75bp rate hike. in July. At the same time, in his opinion, you need to be careful about too much burden on raising rates. After the July meeting, as a preliminary strategy, Kashkari proposed to continue raising rates by 50 bp.

Kansas City Fed chief Esther George disagrees with the 75bp rate hike, seeing the move as increased political uncertainty as the balance sheet begins to run out. The speed with which the discount rate is adjusted is important. Significant and abrupt moves can cause concern for households and small businesses. George said she shares the FOMC's strong commitment to lowering inflation, but the distance should not be too steep.

The dollar index after these comments continued its upward trend. The indicator attracted demand on dips below 104.00 and should now catch up with previous highs. A breakthrough of the 105.50 mark will return a significant appetite for buying the dollar and rush the indicator to new, previously predicted peaks above 107.00.

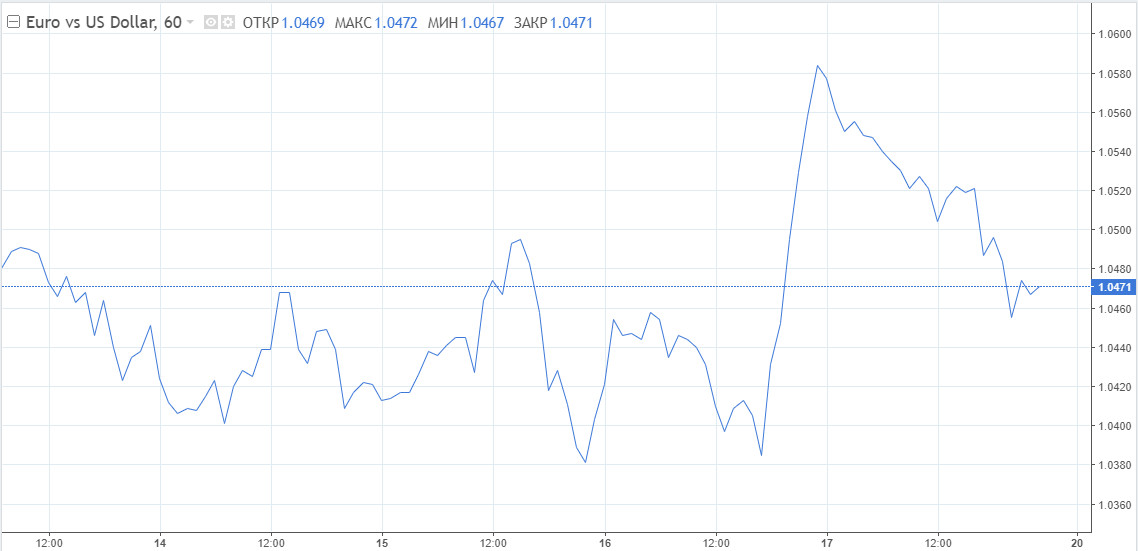

The EUR/USD deepened the fall during the hours of the US session after breaking below 1.0500 and touched a new daily low below 1.0450. As the US currency continues to gain strength, the euro looks set to close for the second week in the red zone.

The dollar's rally ahead of the weekend is fueling risk aversion, rising Treasury yields and hawkish comments from the Fed.

The nearest bearish target for the EUR/USD pair is the level of 1.0460, followed by 1.0400 (static, psychological level).

The role of intermediate resistance before 1.0600 is played by 1.0560. If the upward movement strengthens, the next target for the bulls may be 1.0640.

The US dollar, according to Rabobank economists, will continue to strengthen, including due to the demand for safe assets. As a result, the euro, as well as the pound and the yen, will weaken against it.The bank maintains the forecast that the EUR/USD pair is at risk of returning to the 1.0300 area in the next three months.

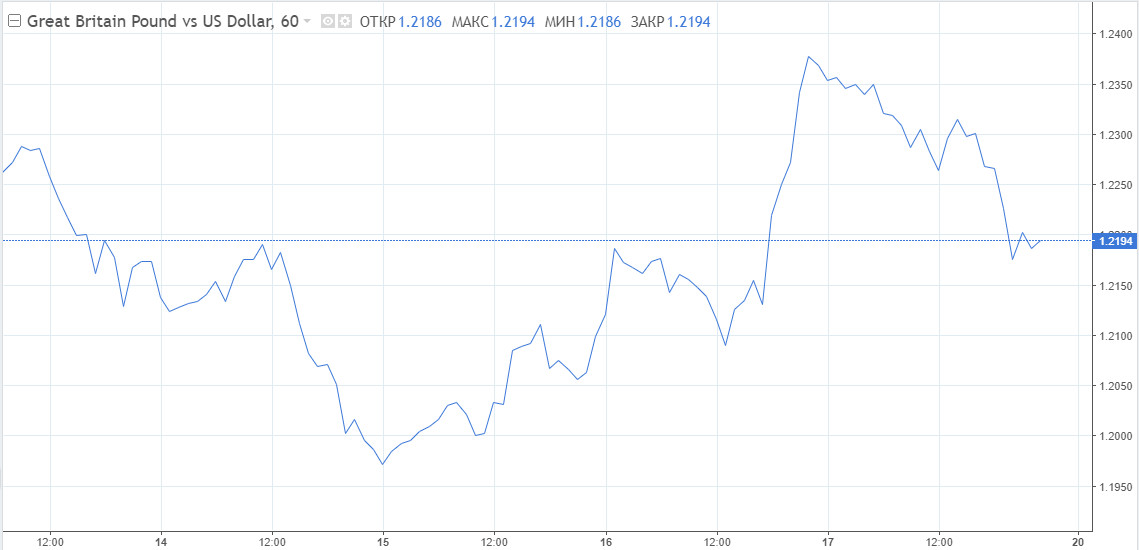

The pound, according to Rabobank estimates, will return to 1.2000 and possibly lower. Here, too, we are talking about a three-month time period.

The British currency perked up and managed to bounce off a dangerous low around 1.2000. The Bank of England, while not raising rates more aggressively at Thursday's meeting, promised to raise rates much steeper at the next July meeting. This managed to fuel bulls of the pound.

It is worth noting that the BoE refused to indicate the need for further gradual rate hikes in the future. Now it will react strongly if inflation continues to rise unexpectedly. The phrase, used in previous meetings, that "some degree of further tightening may still be appropriate" has been removed. It was replaced by another: "The Committee will be especially alert to signs of more persistent inflationary pressures and will act decisively in response if necessary."

Such rhetoric has spurred market players to lay down more interest rate hikes in the future, as well as boosting expectations for a 50bp rate hike in August. These expectations supported the pound well.As for the June meeting, Morgan Stanley generally favors a 25 bp hike. A larger move, a 50 bp increase, could be seen by the market as an overreaction, which would exacerbate concerns about economic growth in the UK. The country's growth remains a key driver of the pound.

However, by the end of the week, the GBP/USD pair lost most of its profits, falling by more than 1% within the day.

The recession in the UK has not been canceled, there is reason to believe that this country will enter a recessionary scenario earlier than other major economies. The prospect of a weaker macroeconomic environment is on the horizon as discretionary spending comes under pressure from falling real incomes. GDP in the second and third quarters is expected to be negative.

Such circumstances may not justify expected rate expectations. The GBP/USD pair is at risk of returning to 1.2030 due to the fact that the macroeconomic environment remains difficult. In addition, the pound remains inversely proportional to risk. When stock markets fall, so does the British currency, which does not bode well for it in the current bear market in stocks.