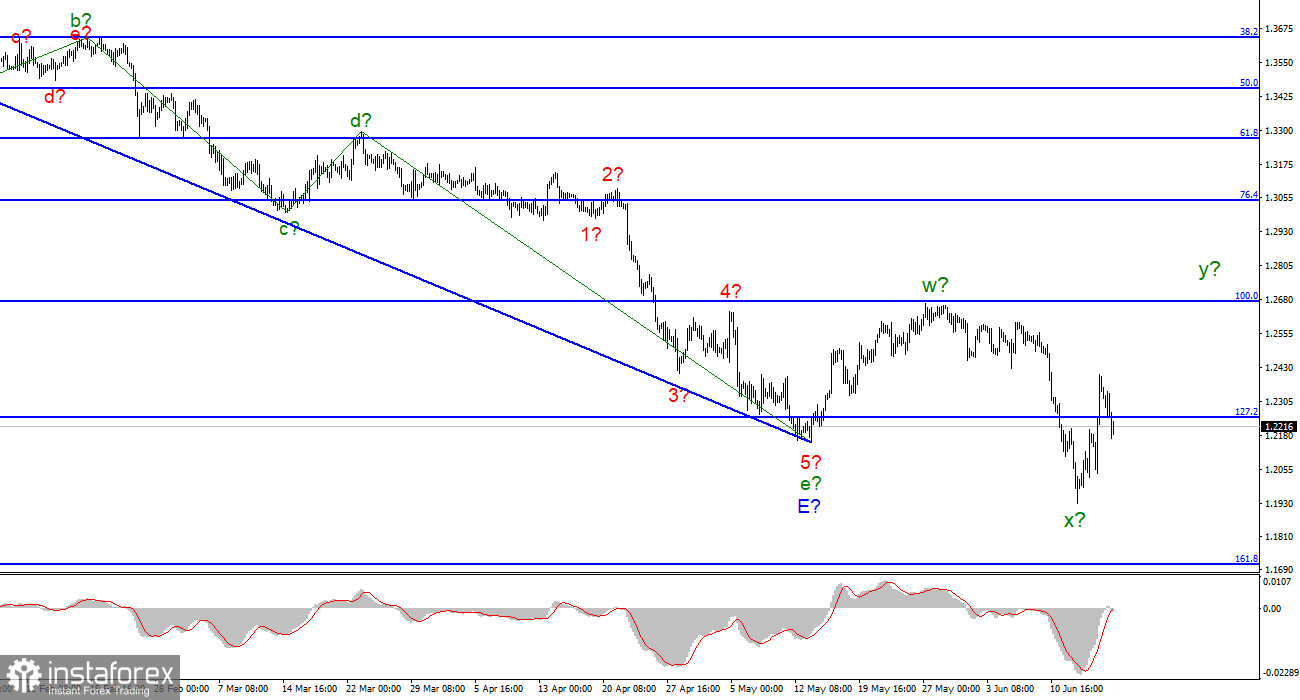

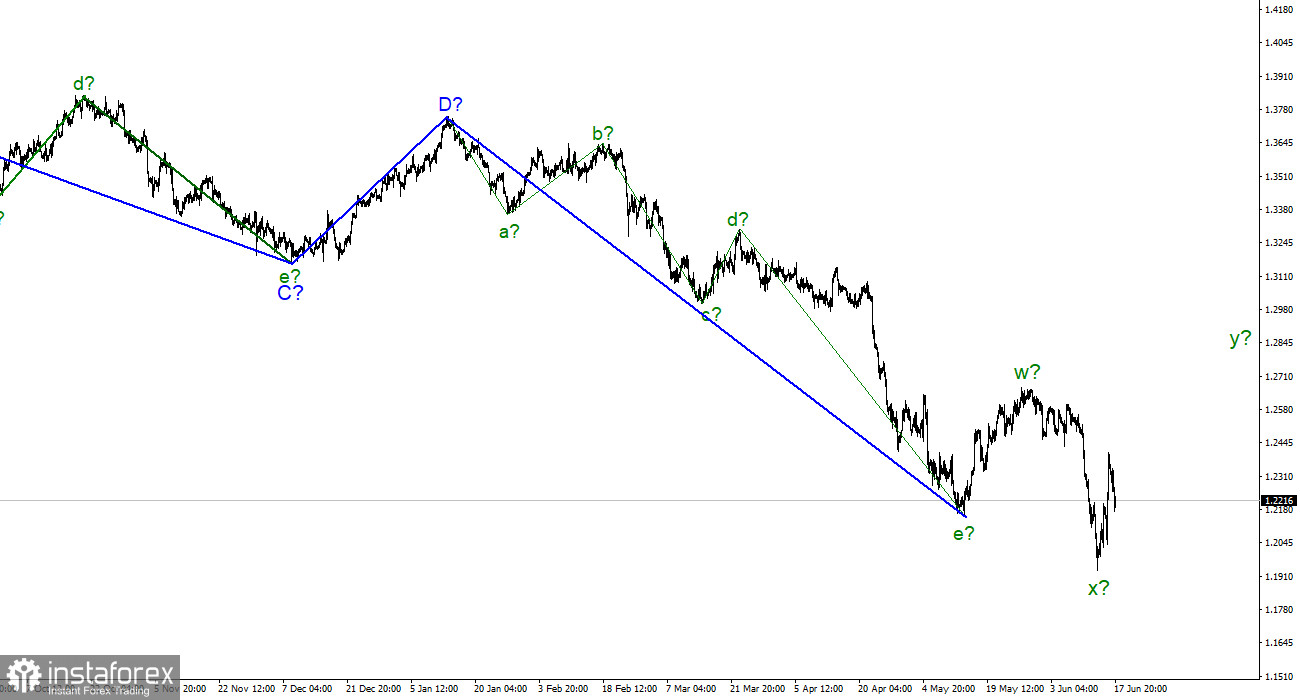

For the pound/dollar instrument, the wave markup already requires additions and adjustments, but it may still take on a more or less digestible form. At the moment, the last downward wave has gone beyond the low of the expected downward trend segment, which I consider completed. Thus, we will no longer see the classical correction structure a-b-c. Nevertheless, wave analysis allows for the construction of various correction structures, so a more complex three-wave formation w-x-y can be constructed. Anyway, the pound and the euro continue to show a very high degree of correlation, and both instruments should build approximately the same structures. At the same time, according to the euro currency, it can be a classic a-b-c, and according to the pound, a rarer w-x-y. But in both cases, the instruments should now build an ascending wave, which should go beyond the peak of the previous ascending one. The wave marking on the British now looks not quite unambiguous, but still has the right to life. The fact that a stronger appreciation of the US currency did not begin after the Fed meeting is encouraging and gives chances for building the necessary upward wave.

The topic of inflation is starting to depress the markets.

The exchange rate of the pound/dollar instrument decreased by 140 basis points on June 17. Since I expect an upward wave to be built at this time, this decline was a surprise. On Friday, from the news background, I can only highlight the report on industrial production in the United States, which turned out to be much weaker than market expectations - +0.2% versus 0.7%. However, the demand for the US currency grew throughout the day, so this report did not affect the market mood in any way. The same applies to Jerome Powell's speech at the economic forum in Washington. He said that the Fed considers its main task to slow down inflation to the target of 2%. He also called the preservation of the world's confidence in the US dollar one of the priorities.

However, the topic of high inflation has already begun to bother the market. More and more often it tries to make decisions based on simpler indicators. For example, on interest rates. What difference does it make how much inflation has increased in the UK or the US, if it is still only growing every month? Everyone is already used to it. But rates affect the economy, economic growth, various economic indicators, investments, borrowing costs, and cash flows. Thus, in general, the logic of the market is now extremely simple. Whose bid is higher – we buy that currency. Of course, the market cannot constantly buy only the dollar. From time to time, there are still corrective waves. But the downward section of the trend has been under construction for 18 months and during this time the corrective waves were almost all, not the strongest. With the current news background, the demand for the British simply refuses to grow. I note that the Bank of England is also raising the interest rate, but it is doing it more slowly than the Fed. Therefore, even the pound continues to decline against the dollar, although there are objectively fewer reasons for this than the euro currency. Even the construction of an upward wave is now in doubt due to the news background and the actions of central banks.

General conclusions.

The wave pattern of the pound/dollar instrument has become clearer. I still expect the construction of an upward wave within the corrective upward structure. If the current wave marking is correct, then the instrument's increase will continue with targets located above the calculated mark of 1.2671, which corresponds to 100.0% Fibonacci. I recommend buying on each MACD signal "up".

On an older scale, the entire downward trend section looks fully equipped but may take on a more extended appearance. If the current correctional structure still takes an even more non-standard form, then adjustments will have to be made.