The price of gold extended its sell-off as expected. You knew from my previous analysis that XAU/USD is bearish and it could approach and reach new lows. It has dropped as much as 1,817 where it has found temporary support and demand.

Fundamentally, the revised US GDP came in worse than expected while Unemployment Claims and Prelim GDP Price Index reported better-than-expected data. Still, the yellow metal maintains a bearish bias after the FOMC Meeting Minutes. The FED is expected to deliver at least a 25 bps hike in March again.

Tomorrow, BOJ new Governor's Ueda's speech could have a big impact. Also, the US Core PCE Price Index, New Home Sales, and Revised UoM Consumer Sentiment should move the price as well.

XAU/USD 61.8% As Critical Support!

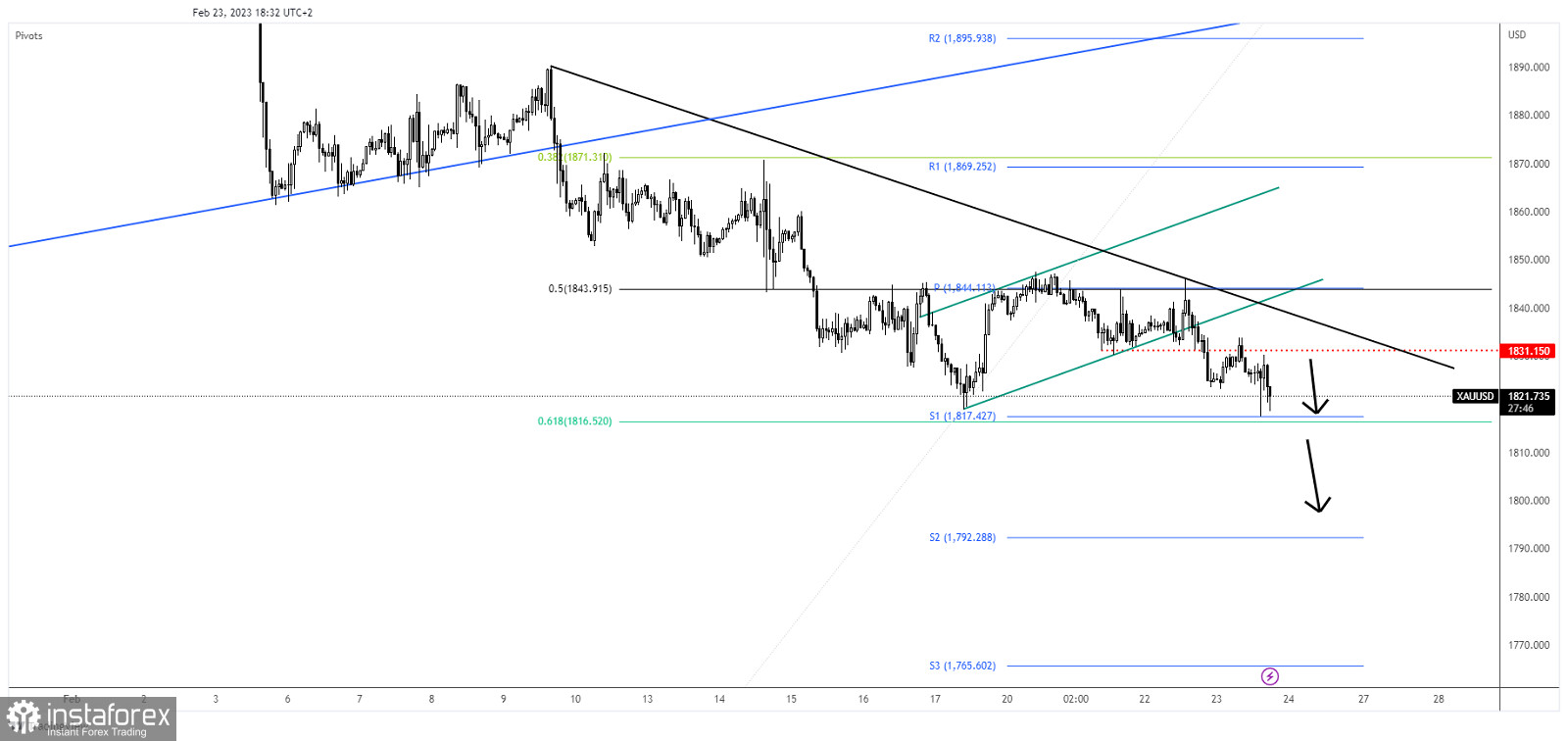

XAU/USD dropped deeper after escaping from the up-channel pattern. I've told you that this is seen as a downside continuation pattern. As long as it stays below the downtrend line, the yellow metal should extend its sell-off.

The S1 (1,817) and the 61.8% Fibonacci level (1,816) represent downside obstacles. It remains to see how it reacts, false breakdowns may announce a minor rebound.

XAU/USD Outlook!

A valid breakdown below the 61.8% Fibonacci level (1,816) activates a larger drop and represents a new selling opportunity with a next downside target at the 1,800 psychological level.