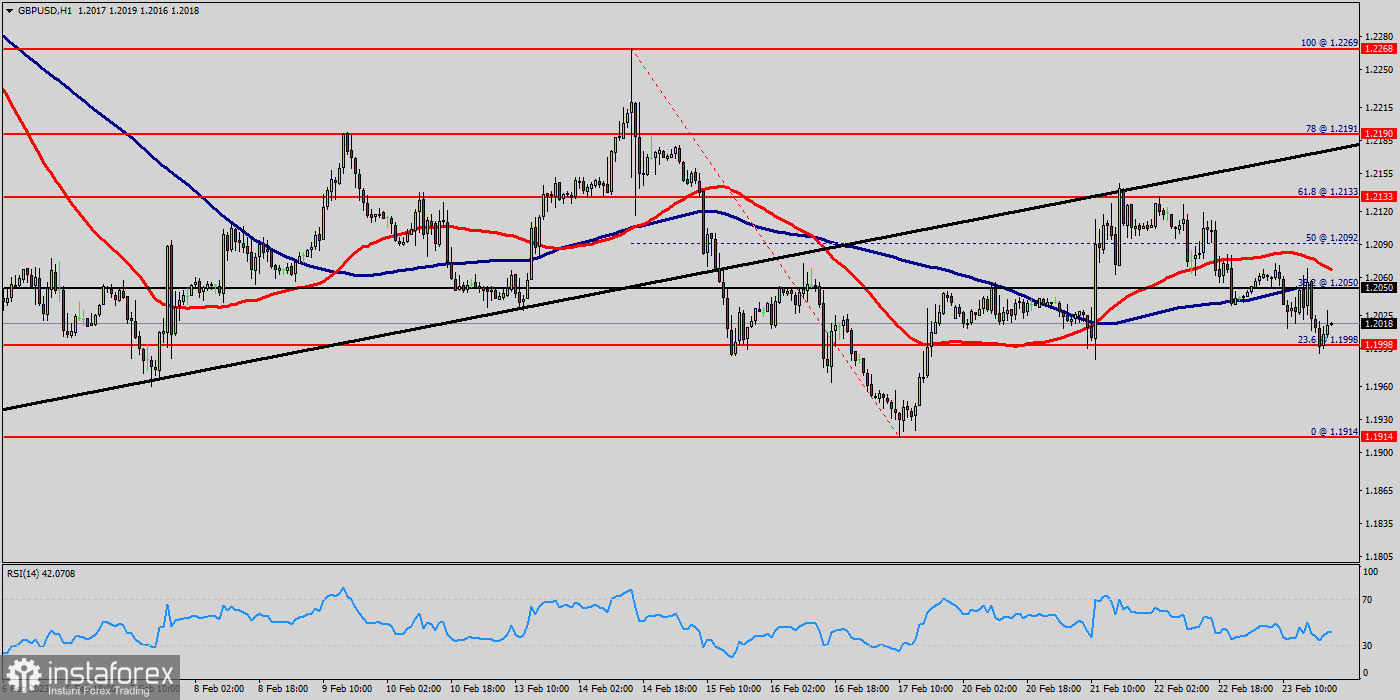

The GBP/USD pair continues to move downwards from the areas of 1.2050 and 1.2092. Yesterday, the pair dropped from the level of 1.2050 to 1.1998, which coincides with a ratio of 23.6% Fibonacci on the H1chart. Today, resistance is seen at the levels of 1.2050 and 1.2092.

So, we expect the price to set below the strong resistance at the levels of 1.2050 and 1.2092; because the price is in a bearish channel now.

Amid the previous events, the price is still moving between the levels of 1.2050 and 1.1914. In overall, we still prefer the bearish scenario as long as the price is below the level of 1.2050. Hence, the price will fall into a bearish trend in order to go further towards the strong support at 1.1914 to test it again

Currently, the price is moving in a bearish channel. This is confirmed by the RSI indicator signaling that we are still in a bearish trending market. The price is still below the moving average (100) and (50),

Furthermore, if the GBP/USD pair is able to break out the bottom at 1.1998, the market will decline further to 1.1914 (daily support 2).

If the pair fails to pass through the level of 1.2050, the market will indicate a bearish opportunity below the level of 1.2050. So, the market will decline further to 1.2050 in order to return to the daily bottom (1.1914 ). Moreover, a breakout of that target will move the pair further downwards to 1.1900.

On the other hand, if the price closes above the strong resistance of 1.2092, the best location for a stop loss order is seen above 1.2150. The level of 1.1914 will form a double bottom.