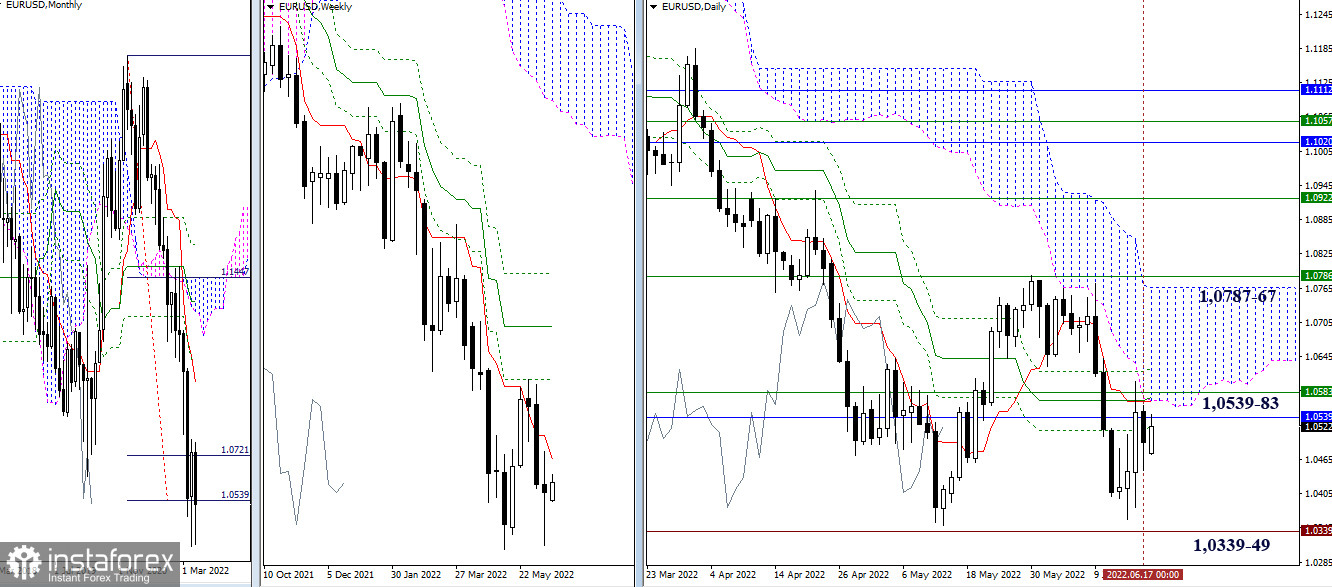

EUR/USD

Higher timeframes

Last week was closed with a candle of uncertainty. Bears failed to complete the correction and return to the downward trend. The local lows of 1.0339 – 1.0349 remained unconquered. For bulls to develop and consolidate the advantage, they first need to overcome the accumulation of resistance in the area of 1.0539 – 1.0583. As a result, the pair will restore support for the daily Ichimoku cross and the weekly short-term trend, while entering the daily cloud. The next important step is to overcome the resistance of the weekly Fibo Kijun (1.0787) and enter the bullish zone from the daily cloud (1.0767). If the bulls can complete these tasks, then it will be possible to assess the future targets.

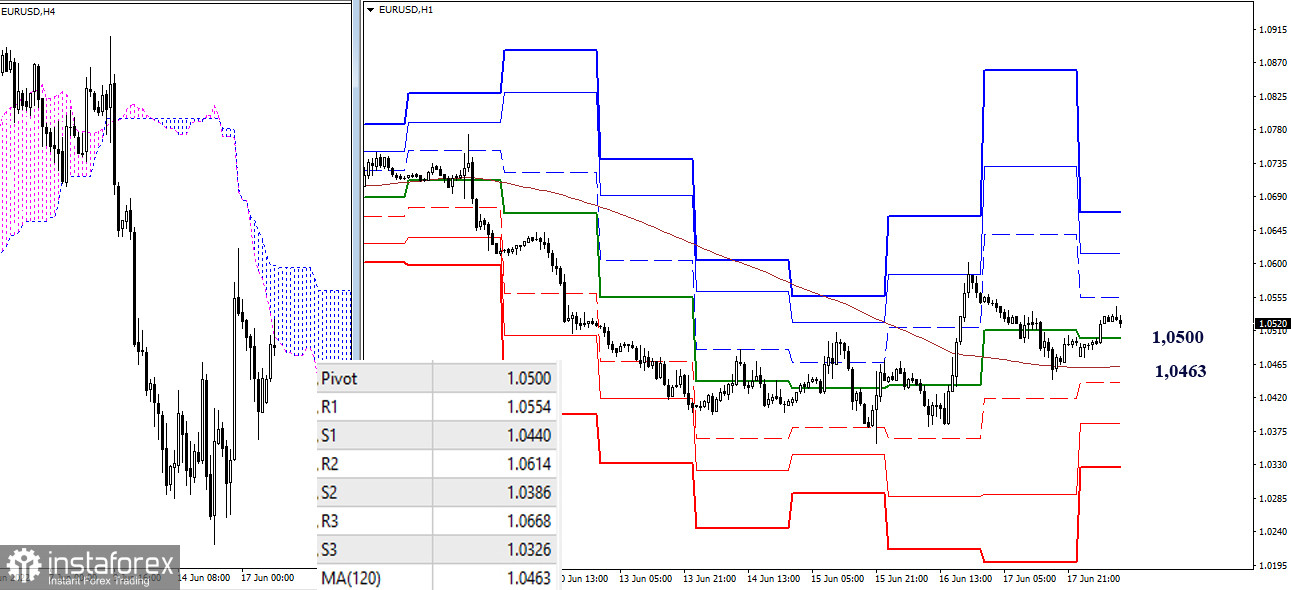

H4 – H1

The key levels at 1.0500 (the central pivot point of the day) and 1.0463 (weekly long-term trend) continue to help bulls maintain their edge. If the rise continues, the resistance of the classic pivot points will serve as upward references within the day, which today are located at 1.0554 – 1.0614 – 1.0668. The breakdown of key levels (1.0500 – 1.0463), reliable consolidation below, and reversal of the moving average can change the current balance of power in favor of bears, who will strengthen their moods, trying to restore the downward trend first on the lower timeframes, and then on the higher timeframes. The supports of the classic pivot points, which are the benchmarks for the development of the decline, are currently at 1.0440 – 1.0386 – 1.0326.

***

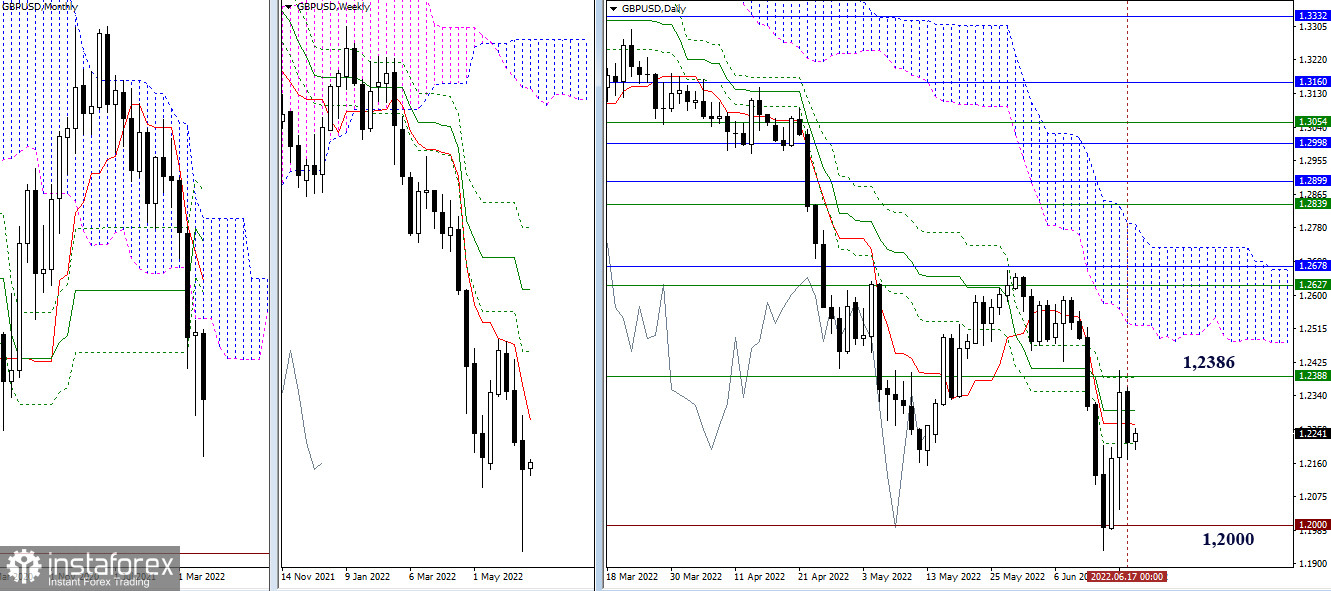

GBP/USD

Higher timeframes

Last week, having met the psychological support of 1.2000, the pair indicated a slowdown, which resulted in the formation of a weekly rebound. As a result, this level (1.2000) is still the main benchmark for bears in the current segment. For bulls in the current situation, new opportunities and targets will appear after the liquidation of the daily Ichimoku death cross (1.2213 – 1.2265 – 1.2300 – 1.2386) and the return of the weekly short-term trend (1.2386).

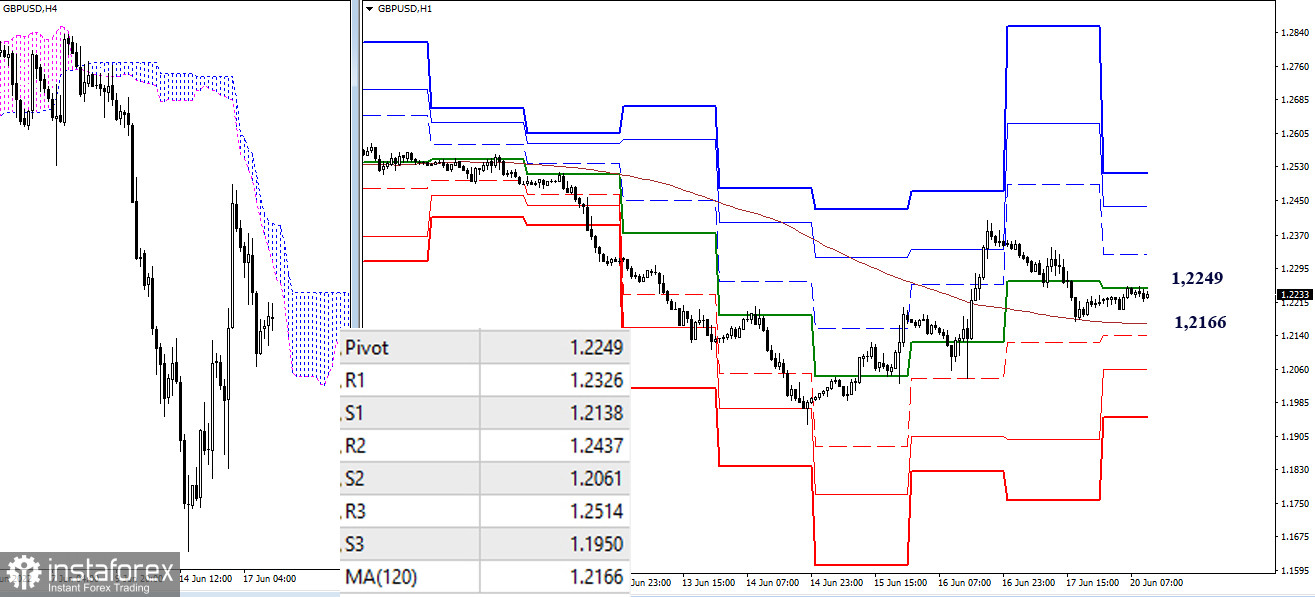

H4 – H1

The key levels of the lower timeframes today are located at 1.2249 (the central pivot point of the day) and 1.2166 (the weekly long-term trend). They continue to provide attraction and support, helping to keep the advantage of the bulls. Additional reference points for the rise within the day are the resistance of the classic pivot points, which can be noted at 1.2326 – 1.2437 – 1.2514. If the key levels are lost, then bears will strengthen their positions, conquering the support of the classic pivot points, which today can be noted at 1.2138 – 1.2061 – 1.1950.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)