Markets are full of paradoxes. As a rule, during a recession, the demand for the US dollar as a safe haven asset grows. However, while the recession has not come, and there is talk about it, the bulls on EURUSD are raising their heads. They expect that the story of mid-May, when rumors of a pause in the process of tightening the Federal Reserve's monetary policy clipped the wings of their opponents, will repeat. How justified is this in the conditions of inflation that does not stop growing? I suppose that is not justified. But that's the nature of the market.

According to the consensus assessment of Wall Street Journal analysts, the federal funds rate in 2022 will rise to 3.3% by the end of the year. This implies at least three increases of 50 bps this year. Such aggressive monetary restriction is likely to drive the US economy into recession. Experts estimate its chances at 44%. For comparison, ahead of the previous recession there was 26%, the 2007-2009 recession at 38%.

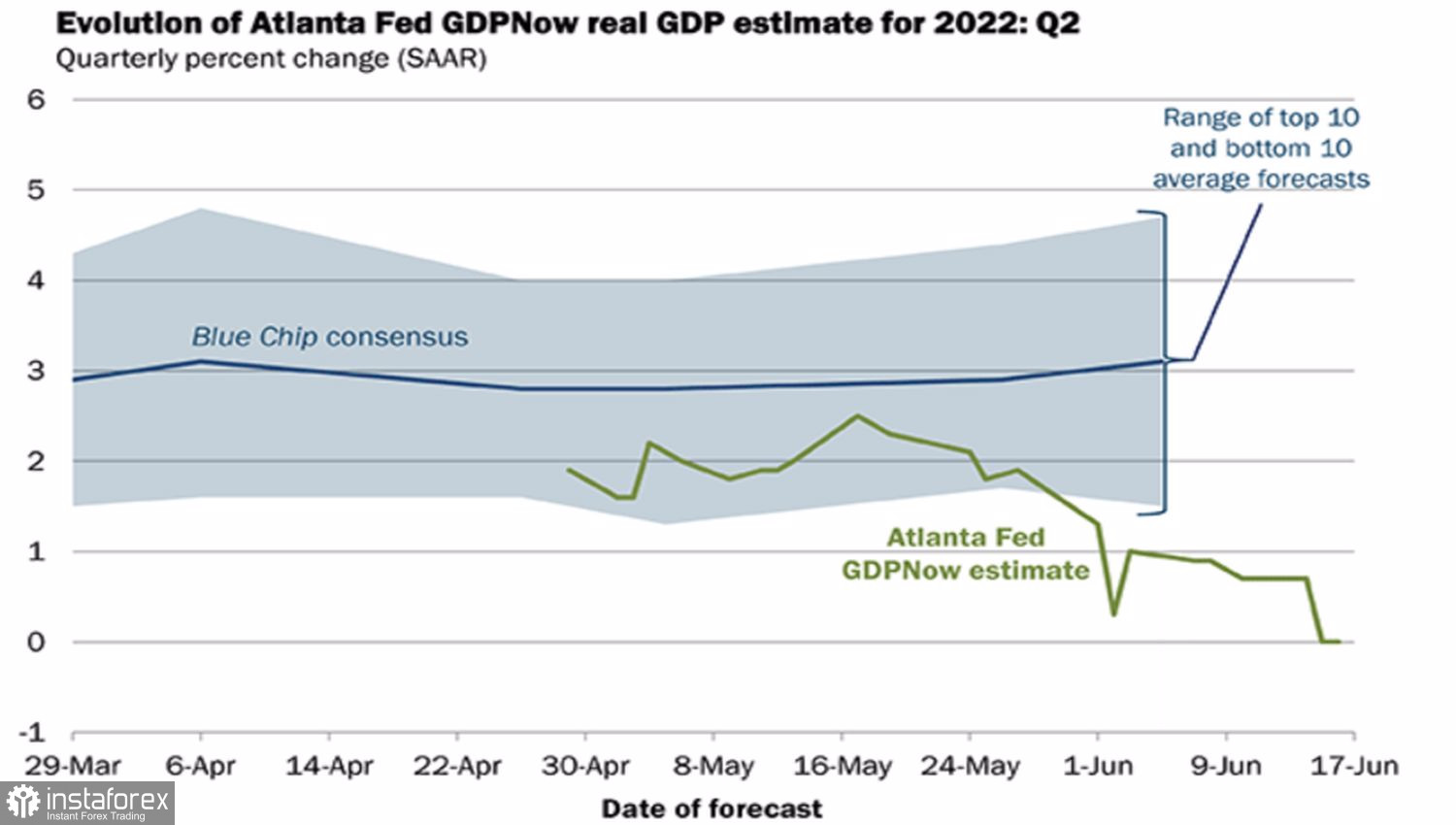

It should be noted that the disappointing macro statistics received recently suggests that a recession is already approaching in 2022. In particular, the leading indicator from the Atlanta Fed signals that US GDP will not grow in the second quarter after sagging by 1.5% into the red zone in the first. A little more – and the US will face a technical downturn in the first half of the year.

Dynamics of US GDP

If it were not for the fight against inflation in the checkers mode, the Fed would probably talk about a pause in the process of tightening monetary policy. In fact, it is unlikely that it will do it. FOMC member Christopher Waller said he would vote for a 75bp rate hike in July if the economic situation remains the same as it is now.

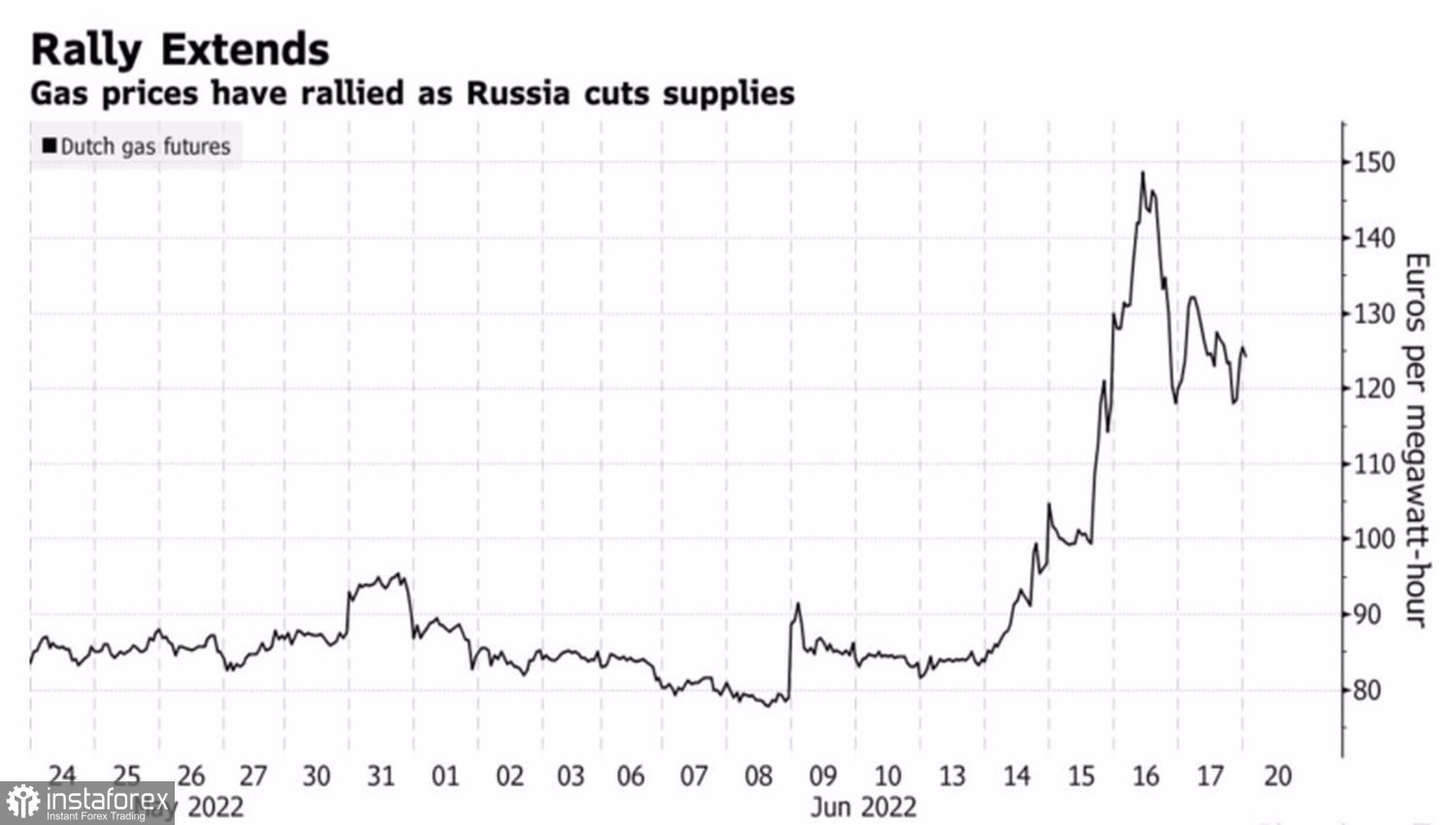

It should be noted that in Europe it looks worse. Disconnection of certain countries from Russian gas, problems with its supply lead to higher prices and to the use of previously accumulated reserves. By winter, when they will be needed, there will be no reserves left. They are already talking about rationing the use of blue fuel. The energy crisis does not even think to stop, which negatively affects the eurozone economy.

Dynamics of gas prices

The EU also has problems with politics. The resuscitation of the Brexit theme is fraught with a trade war between the EU and Britain, and the inability of Emmanuel Macron as president of France to gather a majority in the 289-seat parliament increases uncertainty. It will be difficult for a centrist to promote laws, and the country may take a step away from the initiatives of the European Union.

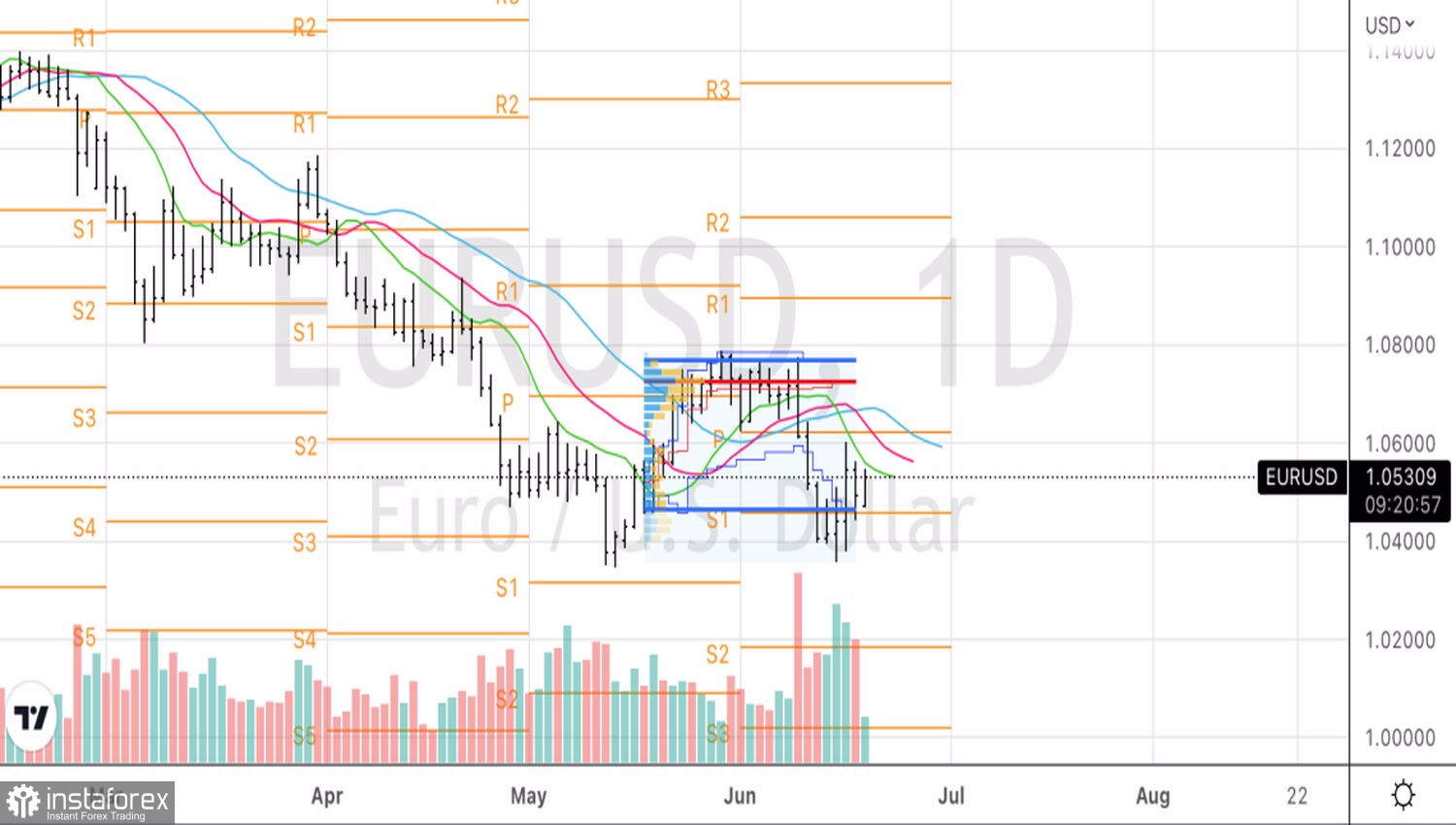

Thus, if in the short term, due to the fact that US stock indexes will raise their heads due to talk of a recession and a pause in the process of raising Fed rates, EURUSD may rise, the medium and long-term prospects of the pair remain bearish.

EUR USD, daily chart

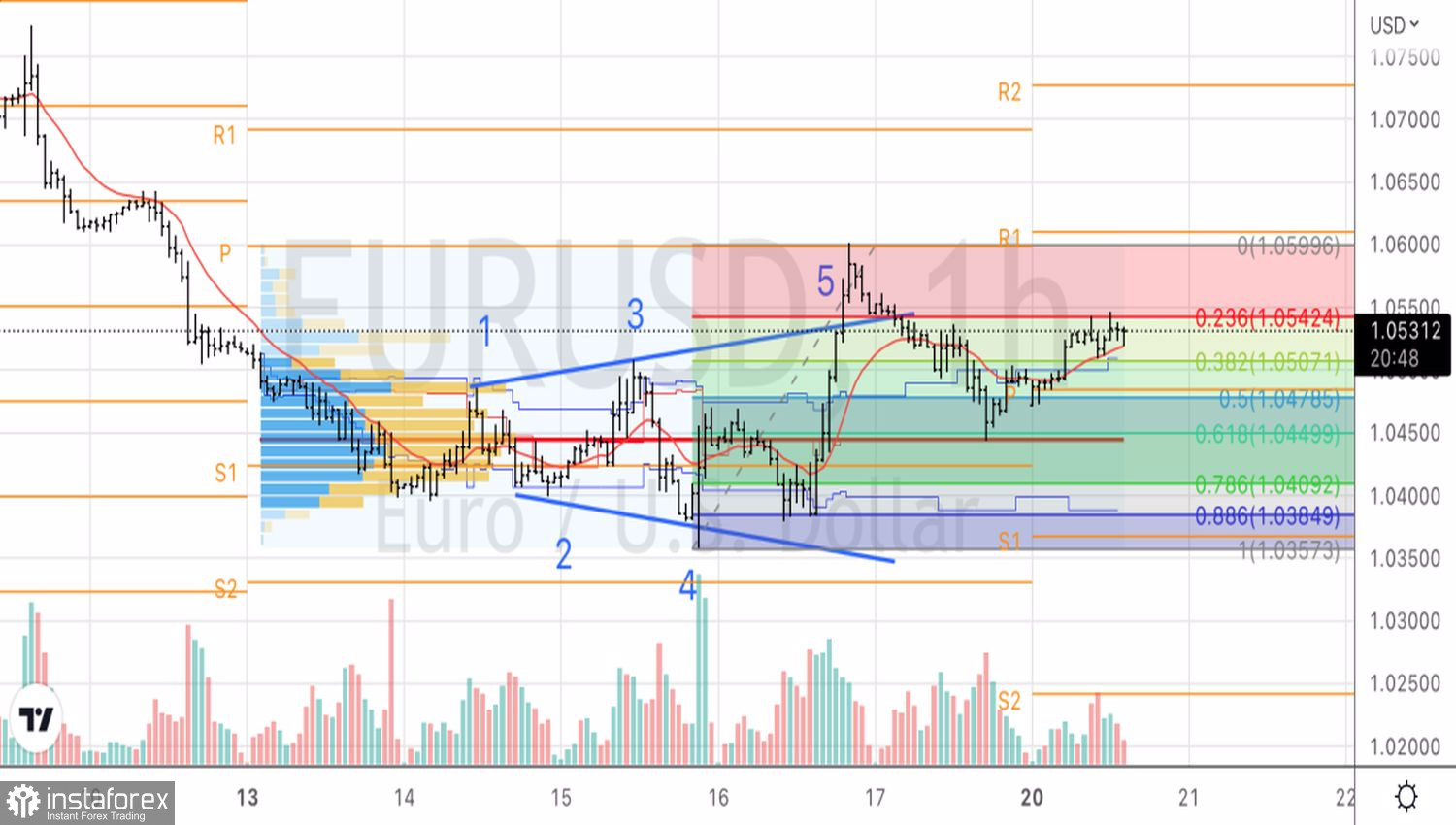

EURUSD, hourly chart

Technically, on the EUR USD daily chart, the inner bar gives entry points to the long from 1.056 or to the short from 1.044. On an hourly time interval, a breakout of resistance at 1.0545 is a signal to open long positions within the framework of the Expanding Wedge pattern.