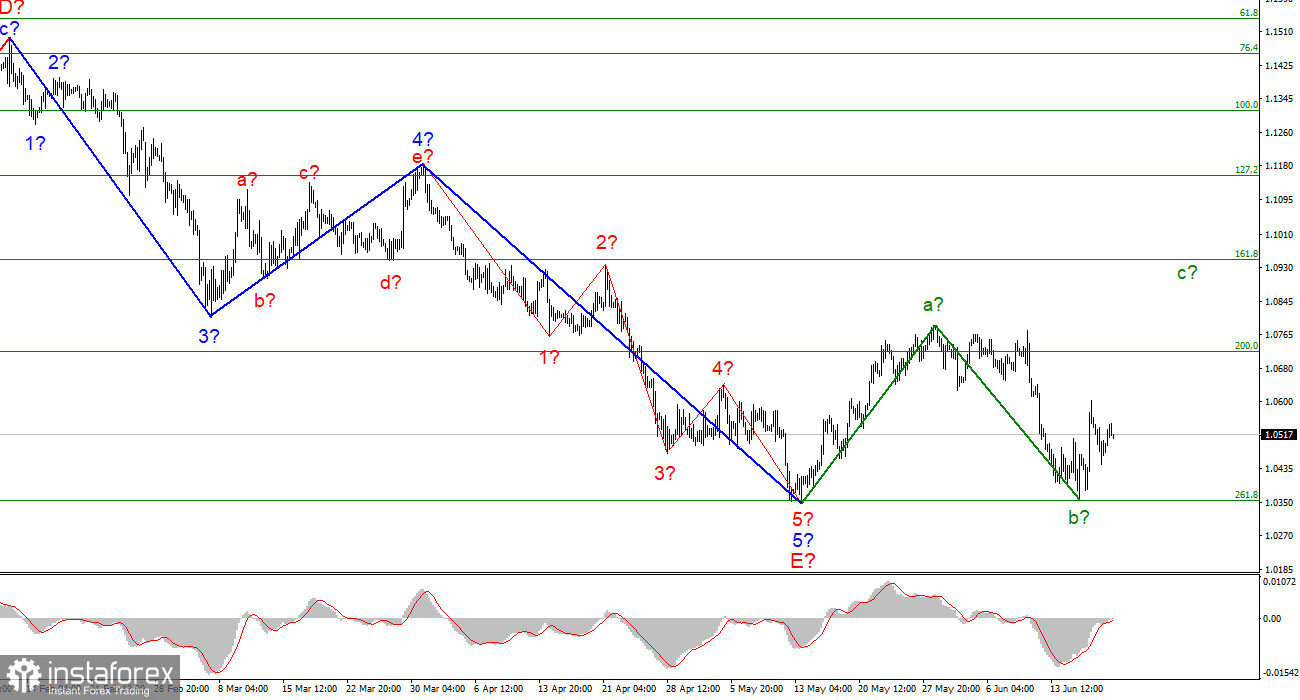

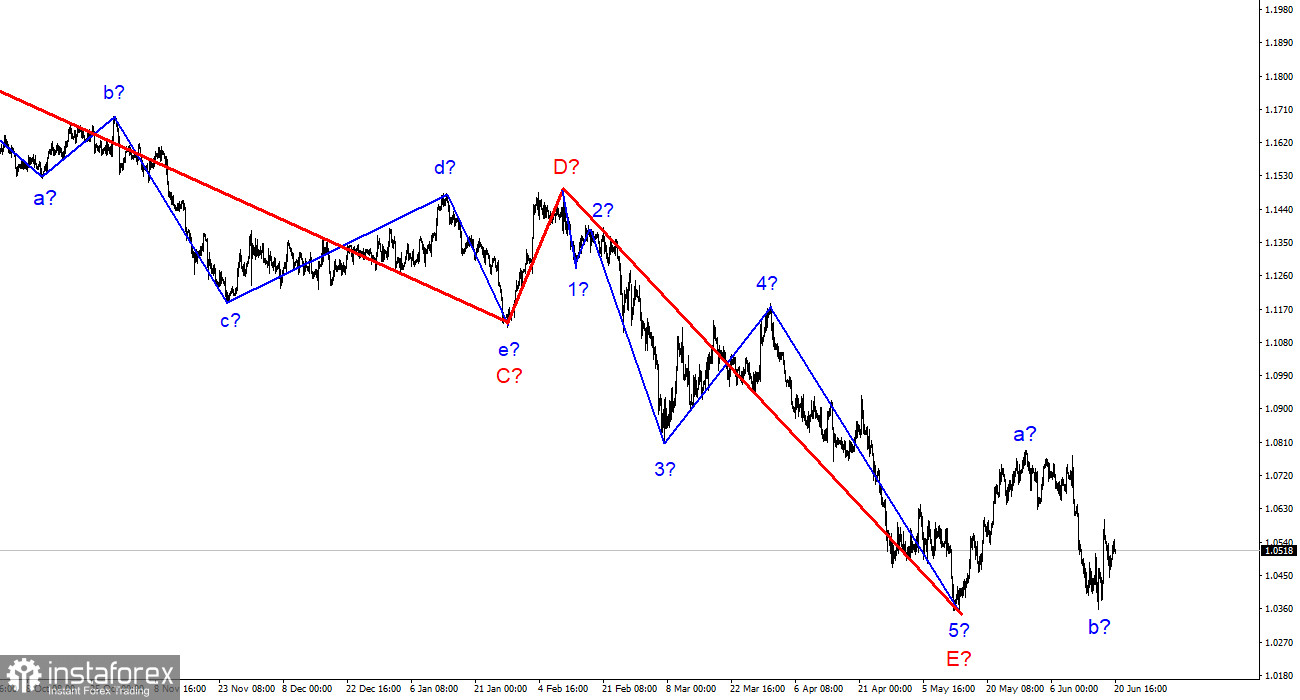

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments yet. The instrument has completed the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is indeed the case, then at this time the construction of a new upward trend section has begun. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave A is completed, and wave b is also presumably completed. If this is indeed the case, then the construction of an ascending wave c should begin now or has already begun. The instrument has not decreased under the low of the descending trend section, so the wave marking still retains its integrity. However, I note that the downward section of the trend may complicate its internal wave structure and take a much more extended form. Unfortunately, a very promising wave markup may be broken due to the news background, which led to a strong decline in demand for the euro currency. At the moment, the chances of building an upward wave c remain.

Jerome Powell repeats the same thing in every speech

The euro/dollar instrument rose by 45 basis points on Monday. Thus, so far, the demand for the euro currency continues to rise, and the demand for the dollar continues to decline, which exactly corresponds to my expectations based on the wave markup. The European currency in wave c may grow by another 300-400 points. Now we can only hope that the wave marking will not be broken. ECB President Christine Lagarde is due to speak in the European Union today, and today is a day off in the US, so the markets are closed. In part, the lack of a news background explains the low activity of the market on Monday. However, Fed President Jerome Powell made a speech last Friday, and US Treasury Secretary Janet Yellen made a speech at the weekend. Both "heads" stated that the main goal of their departments remains to reduce inflation. Finance Minister Yellen drew attention to the fact that the current level of inflation is "unacceptable", but price growth may slow down slightly in the coming months.

Nevertheless, according to Yellen, it is unlikely to be possible to make serious progress in a short period. A large number of factors are now affecting the price increase, many of which are beyond the control of the American authorities. Thus, the Fed president does not deviate from his past rhetoric and is still overwhelmed with the desire to raise the interest rate. From my point of view, this is almost inevitable. The American central bank has no other way out now. A rate hike is a tightening of monetary policy. If the Fed intends to raise it by the end of 2022, and maybe in 2023, then after the completion of the construction of the three-wave upward trend segment, we will certainly see a new downward segment. In the best case (for the euro currency) this will also be a correctional site. At worst, it is impulsive. But in any case, first, you need to wait for the transformation of the wave pattern or the completion of the construction of the proposed wave C. The Fed's monetary policy is now practically the key factor for the instrument.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". Wave b is presumably completed. An unsuccessful attempt to break through the level of 261.8% indicates that the market is not ready for new sales of the instrument.

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downtrend has acquired a complete look. If this is indeed the case, then in the future for several months the instrument will rise with targets located near the peak of wave D, that is, to the 15th figure.