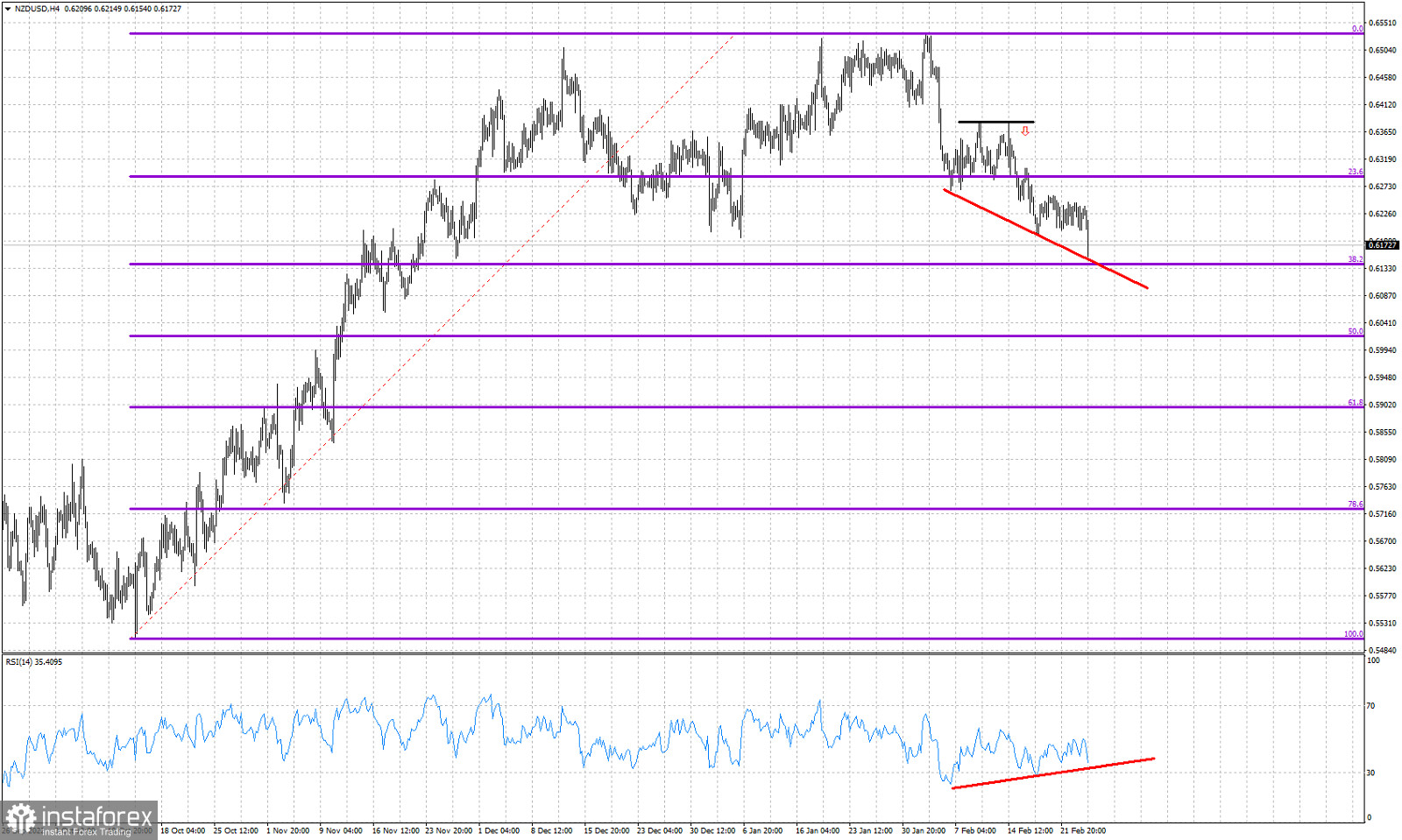

Violet lines- Fibonacci retracements

Red lines- Bullish RSI divergence

In our last analysis on NZDUSD when price was trading around 0.6270 we warned that price was vulnerable to more downside. Our target was the 38% Fibonacci retracement. Short-term support at 0.6250 and 0.62 was broken and price made new lower lows. Our minimum pull back target has been reached. The RSI is making higher lows as price is making lower lows. This is the second bullish divergence we see. We must repeat that this is not a reversal signal but only a warning. With price so close to key Fibonacci support and bullish RSI divergence, bears should be very cautious for a possible bounce higher.