After another wave of panic and massive selloffs, Bitcoin hit a low of $17k. Subsequently, the asset re-tested this zone twice, but the sellers failed to push through it. Despite the high level of cryptocurrency volatility in recent days, the market has managed to stabilize, with Bitcoin gaining a foothold above $20k. This can be regarded as a local success of the bulls and the market as a whole. However, should we expect that after a successful upward breakdown of $20k, the situation will start to change dramatically?

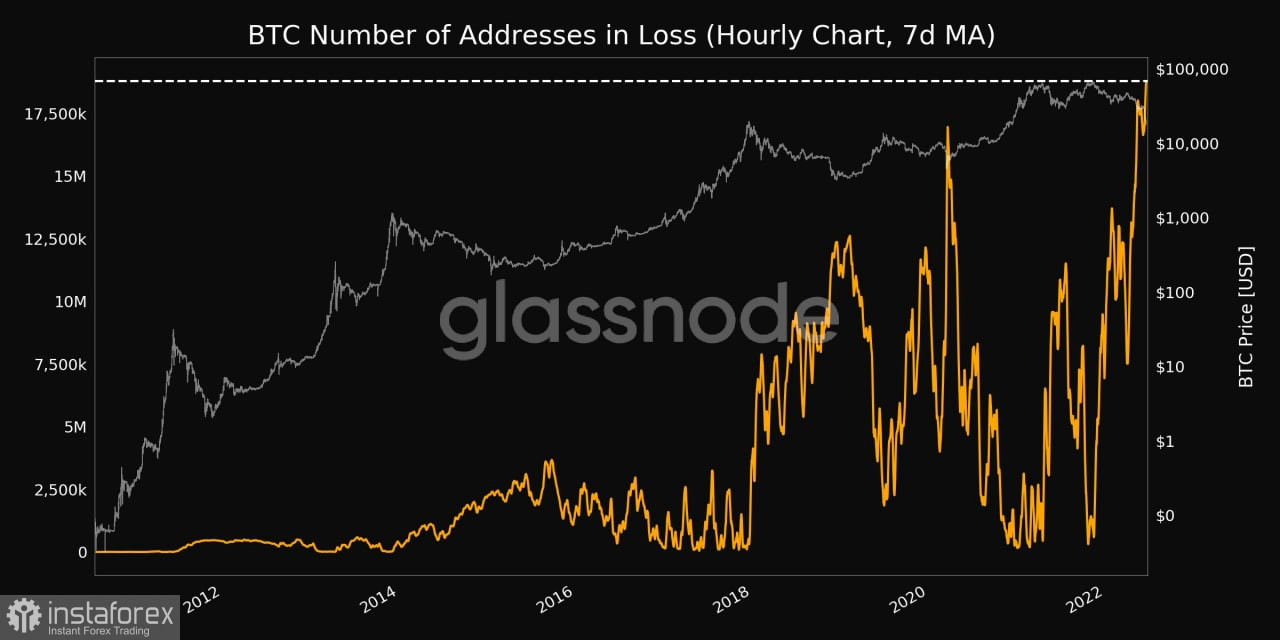

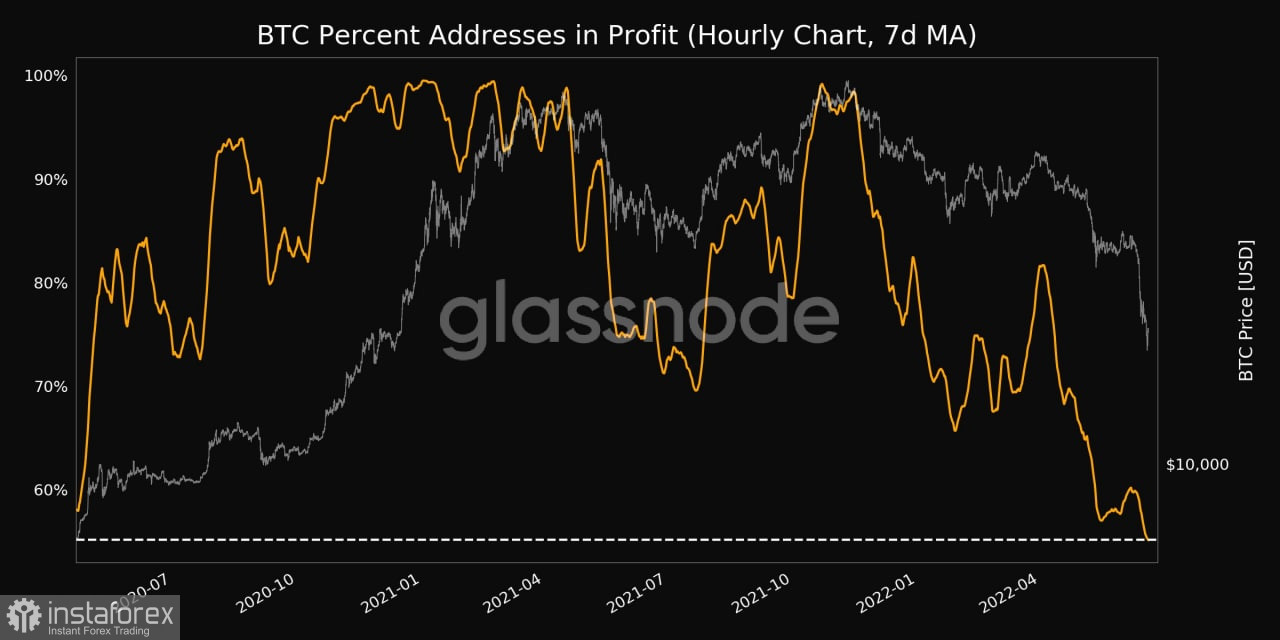

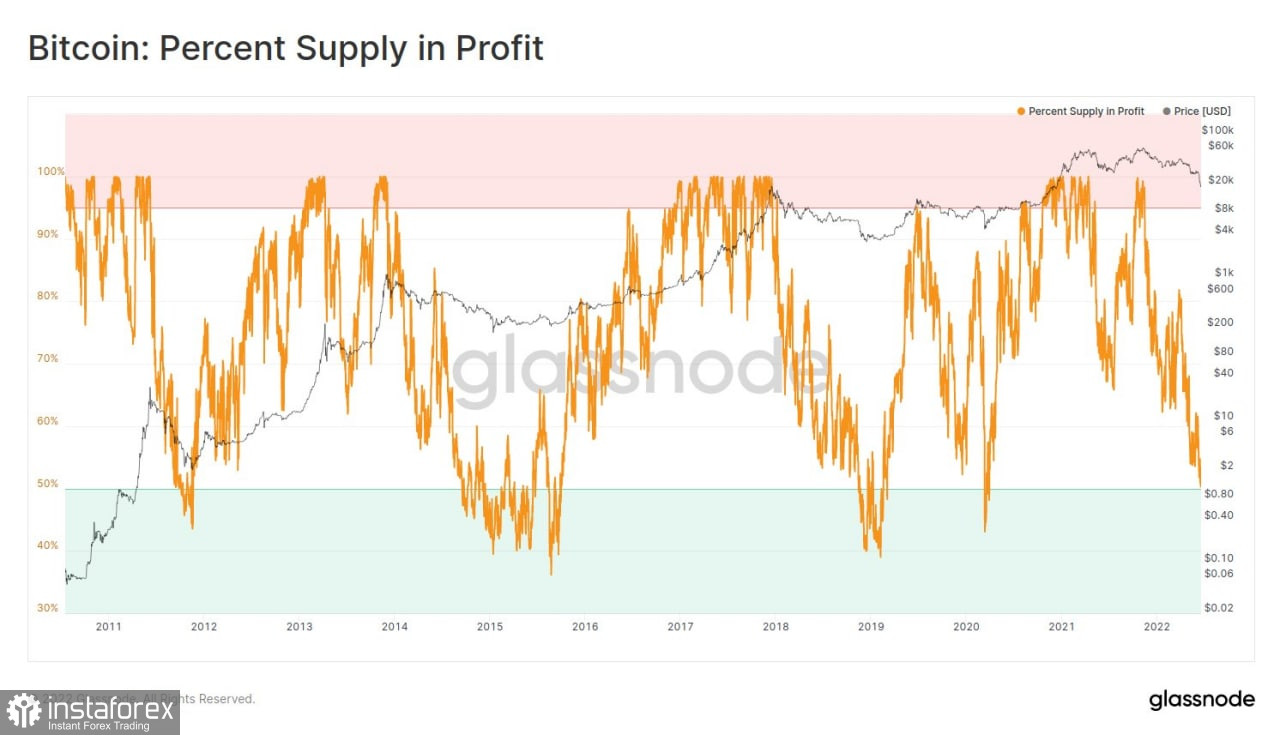

During the decline towards $17k, the number of profitable BTC addresses fell to 49%, which is a hallmark of a bear market bottom. However, after fixing the asset above $20k, the number of profitable addresses increased to 55%, which is a two-year low. At the same time, the number of unprofitable addresses set a new historical record.

In addition, absolutely all categories of Bitcoin investors are now incurring unrealized losses. The situation should change after the successful consolidation of BTC above $20k, but even so, all categories of investors released too many Bitcoin coins into circulation.

Despite this, investors are making zealous attempts to restore BTC/USD quotes above certain values. The $17.7k support zone became the springboard for such operations, where buyers managed to defend the price and form a green candle. Subsequently, Bitcoin came close to the $21k level. Technical indicators are modestly acquiring an upward trend. The stochastic oscillator and the relative strength index are again entering the bullish zone, which indicates the activation of buyers and the emergence of upward impulses. The MACD is also continuing its wide reversal towards zero. All this directly indicates the activation of buyers and an attempt to launch a local upward impulse.

At the same time, it cannot be said that the attempts of buyers have an unambiguous success. We still haven't seen a massive buyback, indicating that $17k was just a stop on the way to a deeper target. In part, the weak buyback is due to fundamental factors, which have no analogues on the market yet. Bitcoin is declining so deeply because of the bear market, which was exacerbated by the Fed's monetary policy and the energy crisis. As a result, investors lack liquidity to defend important support areas. With inflation continuing to rise as well as the macroeconomic crisis, there is no doubt that the current bear market could be prolonged.

We have already noted that Bitcoin has decreased by 74%, and in a full and painful bear market, the fall reaches 80%–90% of ATH. There is no doubt that the current correction can be perceived as one of the most painful, and therefore there is every reason to believe that BTC/USD will continue to decline to local lows. The Fed tightens the screws on the interest rate and at the same time withdraws liquidity from the market, which significantly limits the opportunities for large investors. In such a market situation, the ultimate targets for Bitcoin could be the $10k–$15k levels.

If we talk about the actual completion of both the downward trend and the consolidation period, then we will talk about at least six months. During the last bear market in 2018, the asset set a local low at $3k. Subsequently, the coin was in a narrow range of fluctuations until the end of 2020, and only after that, there was a powerful bullish impulse, thanks to which the price reached a new value record of $64k. If we take the history of Bitcoin as a guide, then a full-fledged upward trend will not begin until 2023.