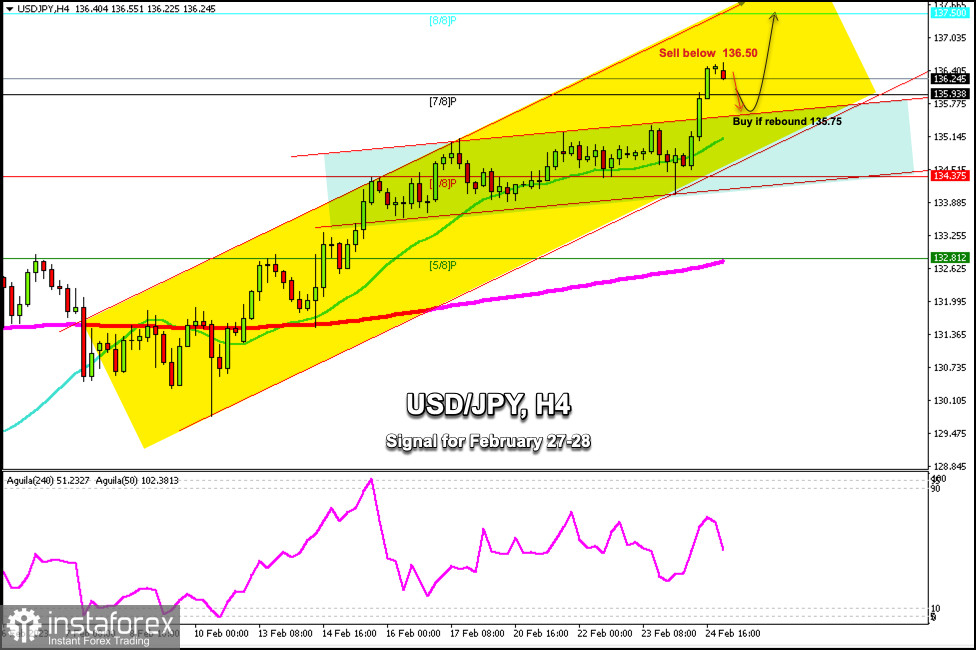

At the opening of trading this week, the Japanese yen is trading around 136.24, above the 21 SMA and above the 7/8 Murray.

On Friday of last week, USD/JPY broke through the uptrend channel, that has formed since February 14, and reached a high of 136.51. It occurred as a reaction to the upbeat US inflation data.

According to the 4-hour chart, we can see that the yen is showing signs of exhaustion. There could be a technical correction in the next few hours. The quote could reach the support zone of 135.75 – 135.50 (21 SMA).

The Japanese yen has rebounded since bottoming out of the uptrend channel formed on February 7, around 134.01. The rebound was followed by a strong reaction to reach the area of 137.50, an accumulation of 350 pips in a trading day.

We can expect that in the next few hours, there will be a technical correction toward the area of the daily pivot point located at 135.63. This level is being supported by the 21 SMA (135.20) and could give us an opportunity to buy with targets at 136.50 and the 8/8 Murray at 137.50.

In case the yen falls below 135.60, there could be a bearish continuation and the price could reach the 6/8 Murray located at 134.37.

Our trading plan is to sell at current price levels around 136.50 with targets of 135.93 (7/8 Murray) at 135.60. Additionally, if the USD/JPY pair consolidates in the 135.50 area it could be seen as an opportunity to buy with targets at 136.50 at 137.50 (8/8 Murray).