There is always room for achievement in life. Despite the divergence in the economic growth of the US and the eurozone, the transition of US stock indices to the bears' territory and the Federal Reserve's readiness to raise rates more than the European Central Bank, the EURUSD pair periodically goes on the counterattack. This time, the ECB's intention to prevent fragmentation in the European debt market, the fall in oil prices, and the US stock market's attempt to find the bottom are playing on the side of the euro bulls.

ECB President Christine Lagarde promised the European Parliament to nip in the bud the debt crisis that raged in the eurozone about 10 years ago. Since the composition of the eurozone is not homogeneous in terms of economic development, some debts are sold faster, others more slowly. For a country like Italy, a rise in yields above 4% is sad news, as the cost of servicing debt at 150% of GDP is rising by leaps and bounds. This increases the risk of default and requires the intervention of the ECB.

The central bank is ready to develop and implement an anti-fragmentation program. According to the head of the Bank of France Francois Villeroy de Galo, it will include an asset sterilization mechanism: when some bonds, for example, Italian ones, are bought and others are sold. Understanding that the ECB will not leave things to chance gives confidence to the EURUSD bulls.

The fall in oil prices is playing on their side due to fears that the activity of central banks in the area of monetary restriction will provoke a recession in the global economy and a reduction in demand for oil. For such a net importer as the eurozone, the decline in Brent quotes is good news.

In addition, after the worst sell-off since March 2020, by the end of the week by June 17, US stock indices are gradually recovering. Global risk appetite is improving, putting pressure on safe-haven assets such as the US dollar.

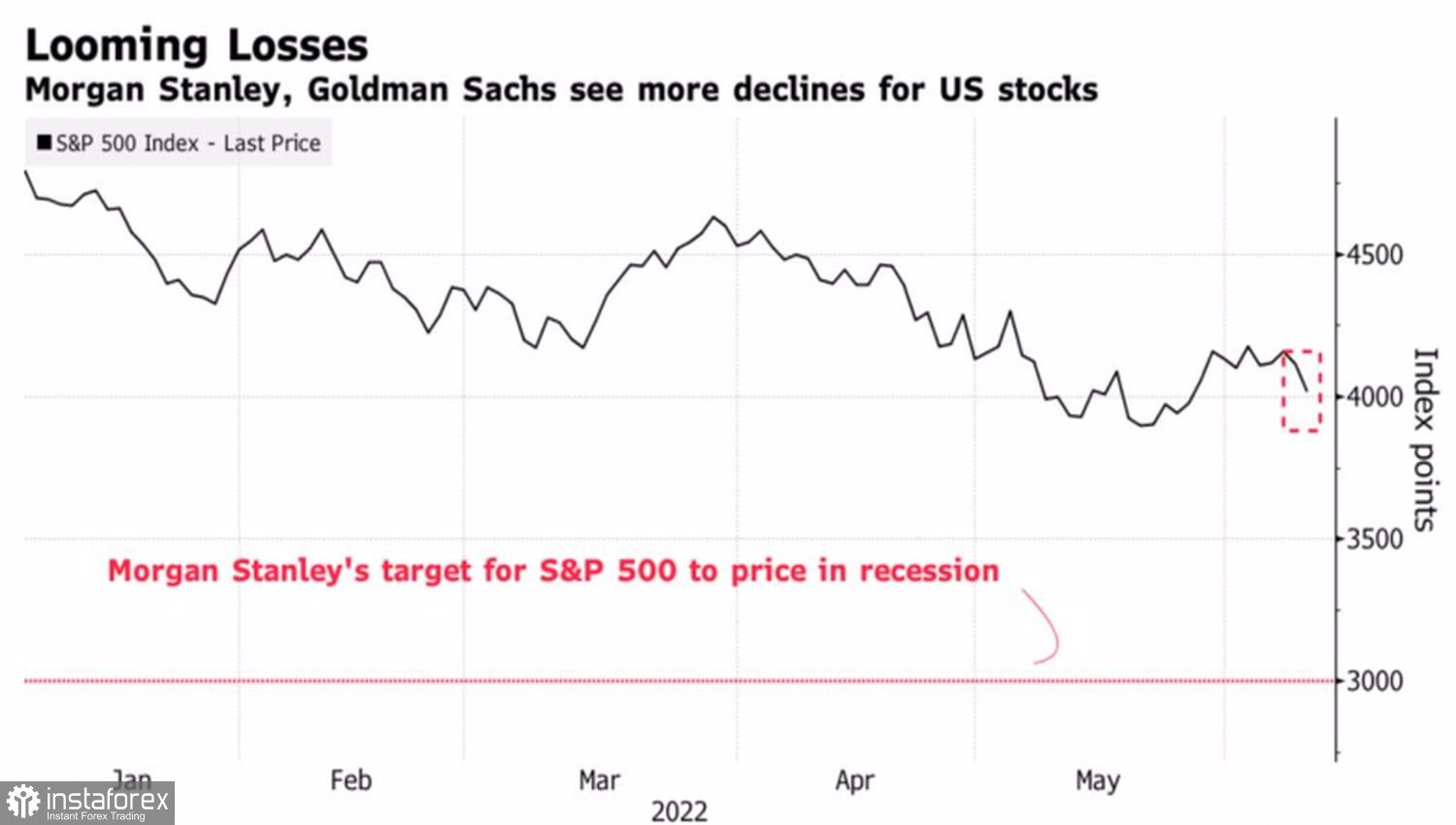

Alas, all these bullish factors for EURUSD are temporary. According to Morgan Stanley, the S&P 500 should drop another 15-20% to around 3000 to justify the magnitude of the coming downturn.Morgan Stanley S&P 500 Forecast

The bear market will not end until a recession occurs or the risk of it coming into the US economy is eliminated. According to Berenberg, it is too early to talk about the bottom of the stock market, as the fall in corporate earnings on recession expectations is just beginning.

I do not think that we should expect a significant peak in oil prices as long as the armed conflict in Ukraine is raging. Pushing Russia out of the market reduces supply while demand remains high. As for the ECB's intention to avoid fragmentation, this will limit the potential for growth in the deposit rate. Thus, the EURUSD downward trend remains in place.

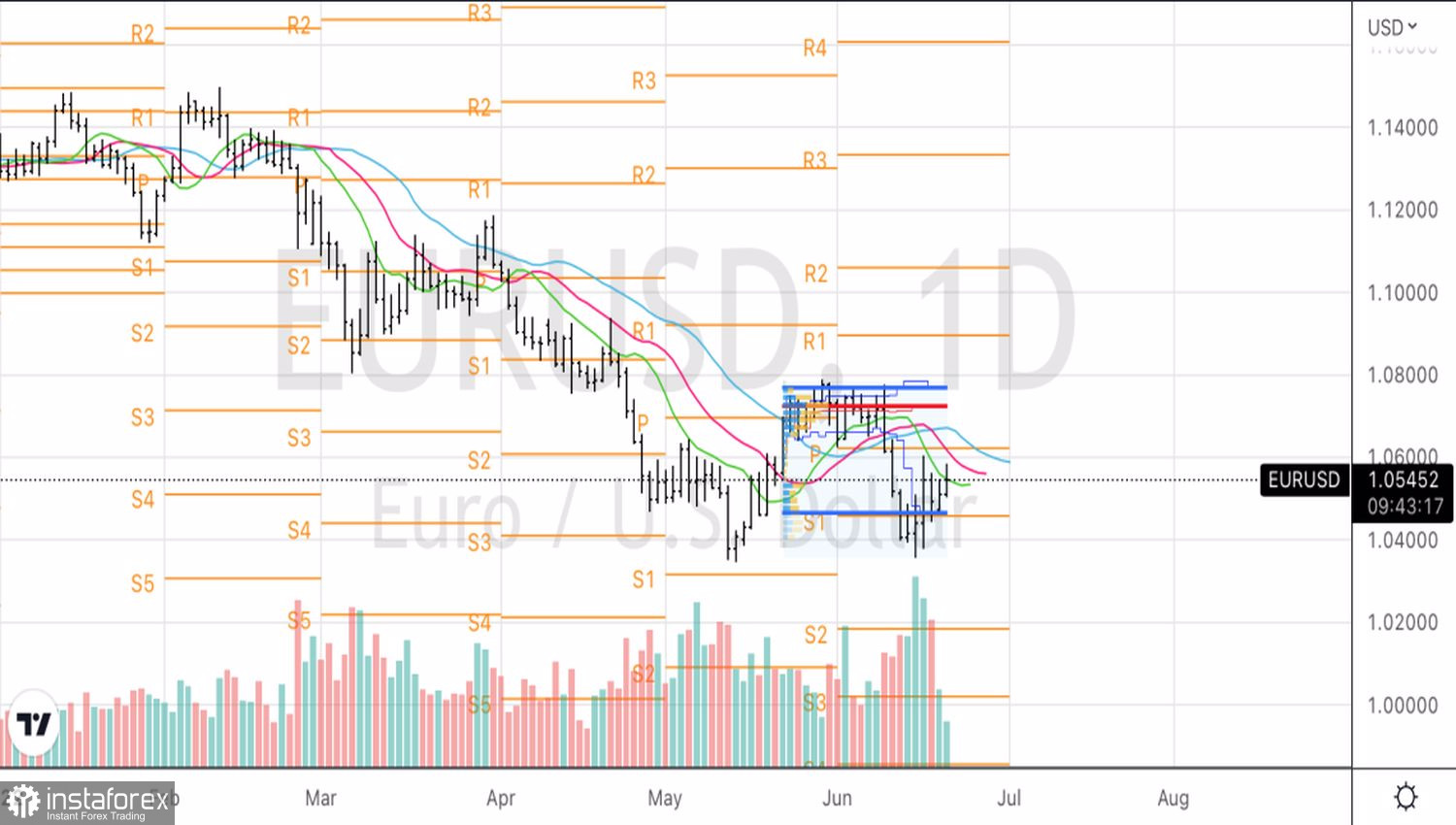

EURUSD, daily chart

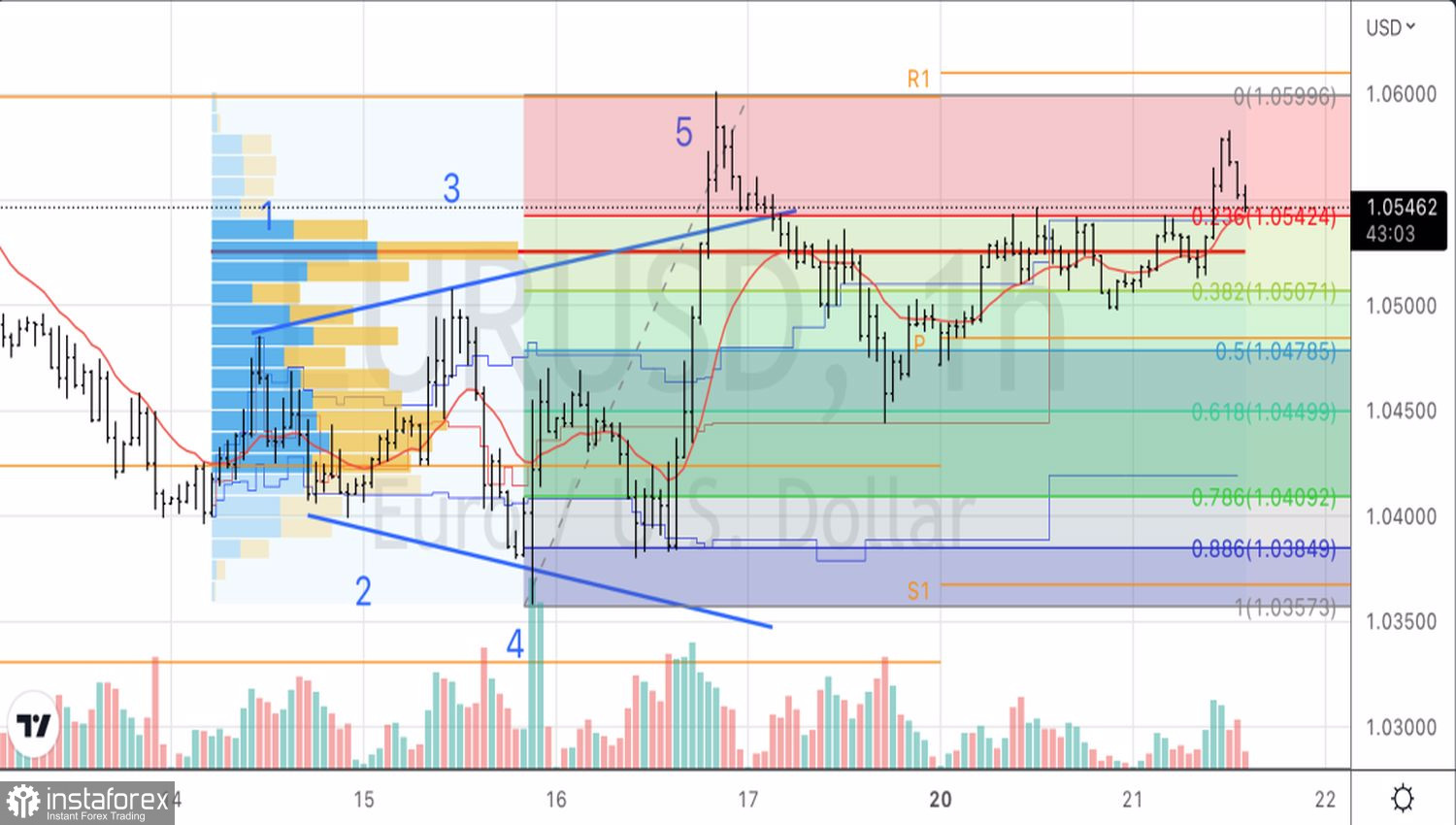

EURUSD, hourly chart

Technically, further dynamics of the pair will depend on the bulls' ability to cling to the 23.8% Fibonacci level from wave 4-5 on the hourly chart at 1.054 and for the fair value at 1.0525. Rebound from supports - a signal to enter long.