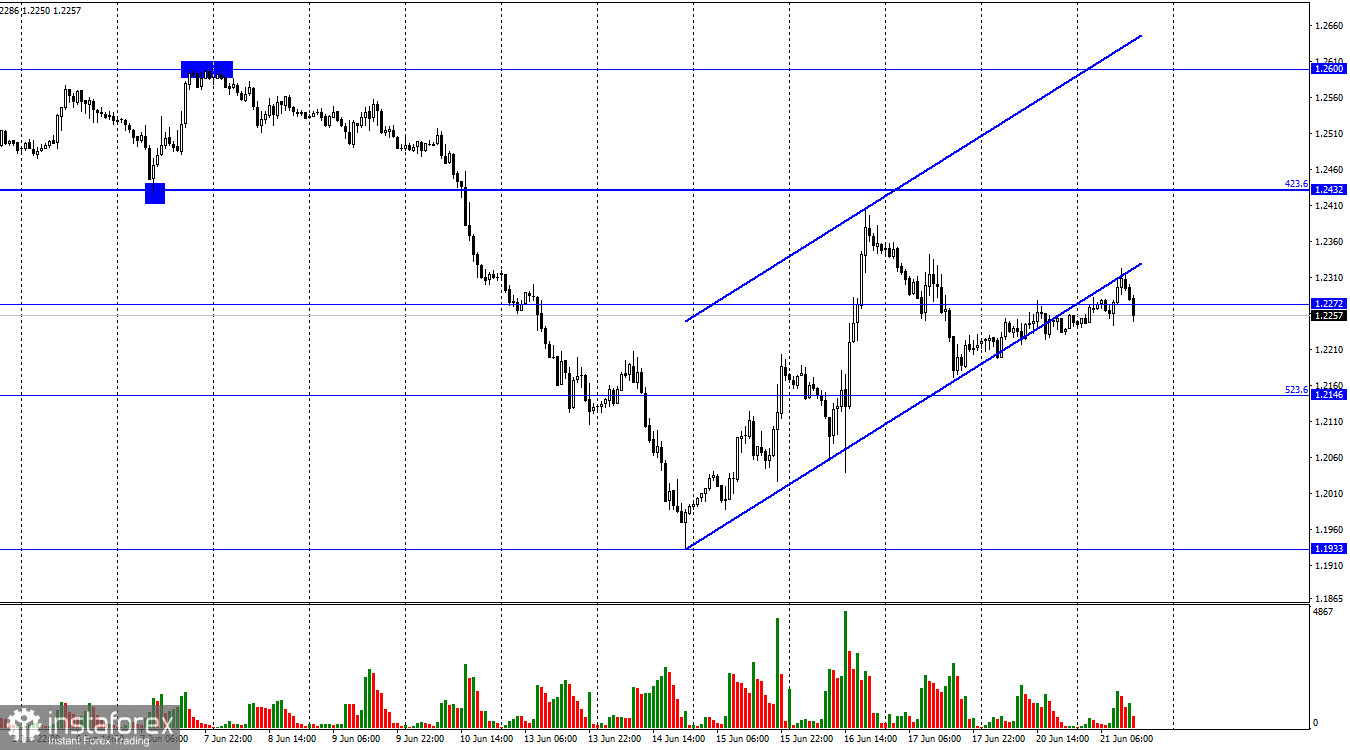

Hello, dear traders! On the hourly chart, the GBP/USD pair continued growing on Monday and Tuesday. However, it continued to rise below the uptrend channel which increased the chances of the British pound for further growth. However, it is clear that bull traders do not plan to keep the British pound rising. The situation will probably change tomorrow or the day after tomorrow after the UK inflation report is released and Fed Chairman Jerome Powell delivers his two speeches in the US. However, I believe that the British pound will start falling again. Meanwhile, British Prime Minister Boris Johnson has again delivered an ultimatum to the EU and introduced a bill to Parliament that unilaterally changes some clauses in the Brexit agreement. It refers to the Northern Ireland Protocol which neither the EU nor the UK can deal with.

Notably, Northern Ireland remained part of the UK and left the EU. Ireland, which is located on the same island as Northern Ireland, remained in the EU. However, the Irish and Northern Irish peoples are very close, and the authorities of both countries advocate for no customs inspections and strict rules for crossing the border and transporting goods between them. Nevertheless, the UK does not belong to the EU. Thus, a border is obligatory. At first, the EU authorities tried to shift the border to British ports. However, the problem was not resolved. Northern Ireland is facing unrest over inspections and shortages of certain goods. Therefore, the UK has decided to change some clauses of the Brexit agreement relating to Northern Ireland and its border. However, the EU strongly opposes these changes. Moreover, it has already threatened to go to the European Court of Justice. This scenario is likely to be realistic.

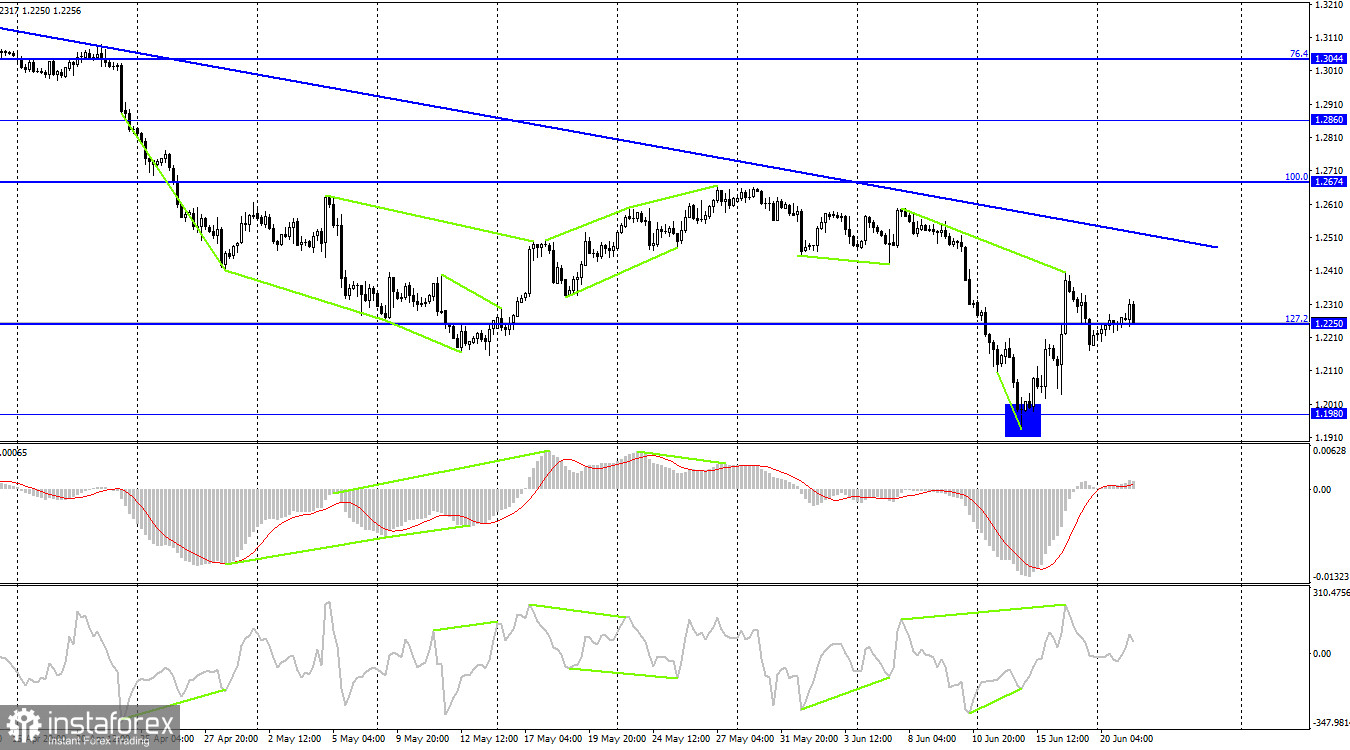

On the 4H chart, the pair reversed in favor of the US dollar after the CCI indicator formed bearish divergence. Then the pair returned to the 127.2% correction level at 1.2250. The pair's consolidation below this level will again lead to further decline towards 1.1980 where the British pound started rising. The descending trend line continues to characterize traders' sentiment as bearish.

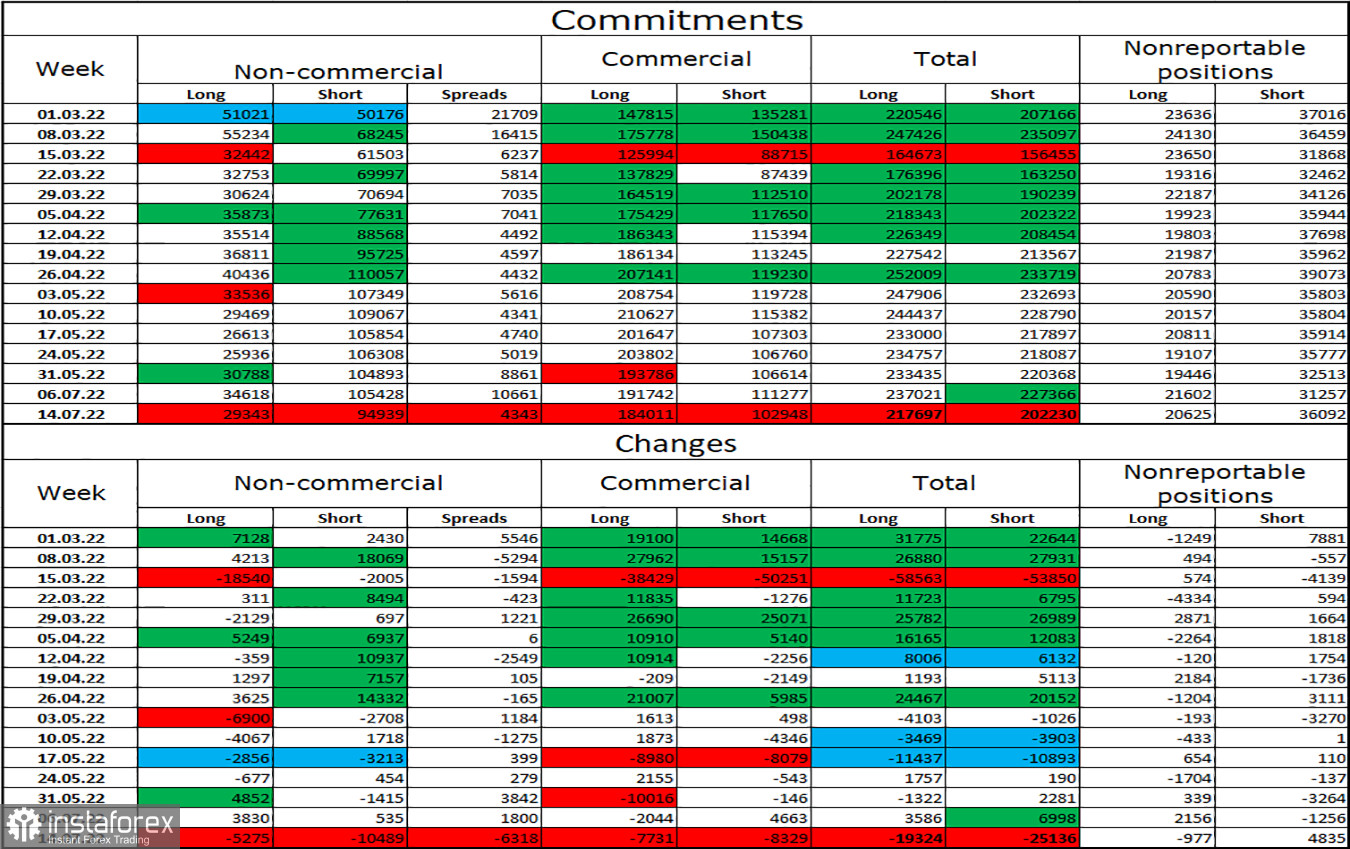

COT report:

The sentiment of non-commercial traders has become slightly more bullish over the past week. The number of long contracts held by speculators decreased by 5,275, while the number of short contracts fell by 10,489. Therefore, the general sentiment of major players remained bearish. Moreover, the number of long contracts exceeds the number of short contracts several times. Major players continue to sell off the pound, and their sentiment has not changed recently. Thus, I think the British pound could continue falling over the next few weeks and months. A large gap between the number of long and short contracts may indicate a trend reversal. However, the news background is increasingly more significant to major players now. Currently, it is obvious that speculators sell more than buy.

US and UK economic news calendar:

On Tuesday, the UK and US economic news calendars do not contain any entries. Therefore, the news background does not affect traders' sentiment. Some important events are due this week. However, the market may take a short pause.

GBP/USD outlook and recommendations for traders:

I recommend selling the pound when the pair closes below the ascending channel on the hourly chart with targets of 1.2146 and 1.1933. I recommend buying the pound if the pair consolidates above the level of 1.2272 on the hourly chart with the target of 1.2432. The current situation is ambiguous as the pair closed below the channel and above the level of 1.2272. It is better not to open positions.