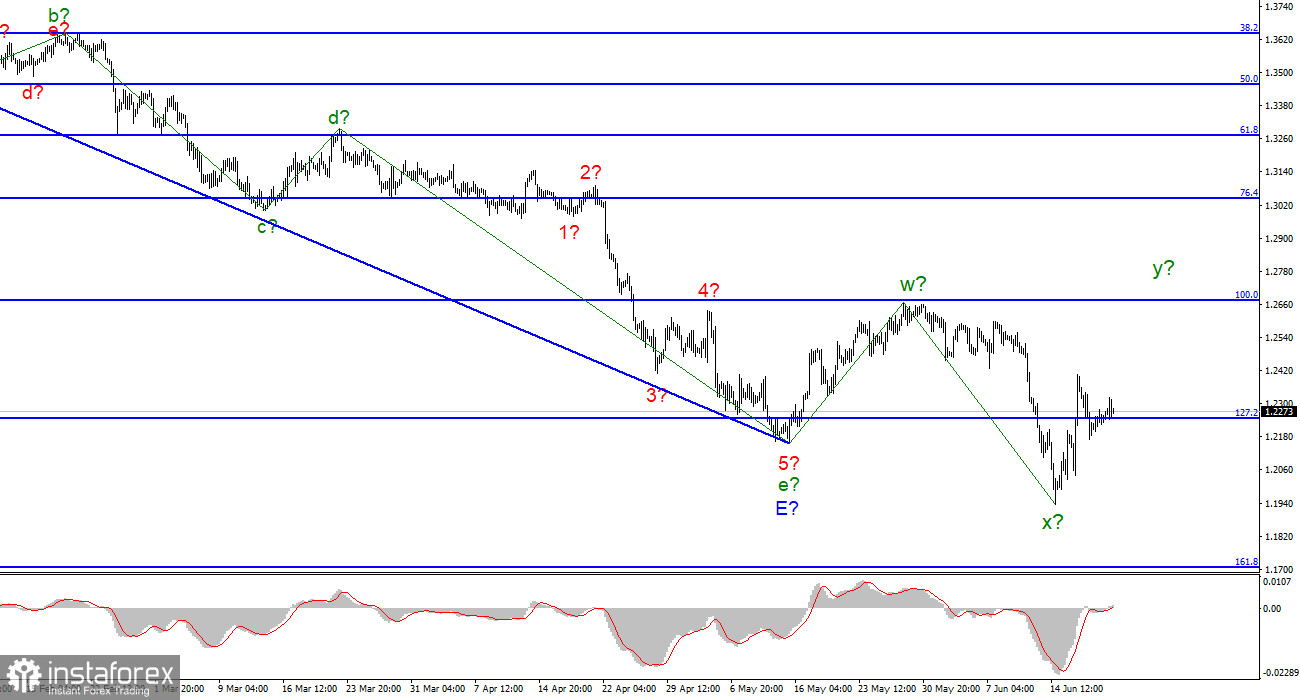

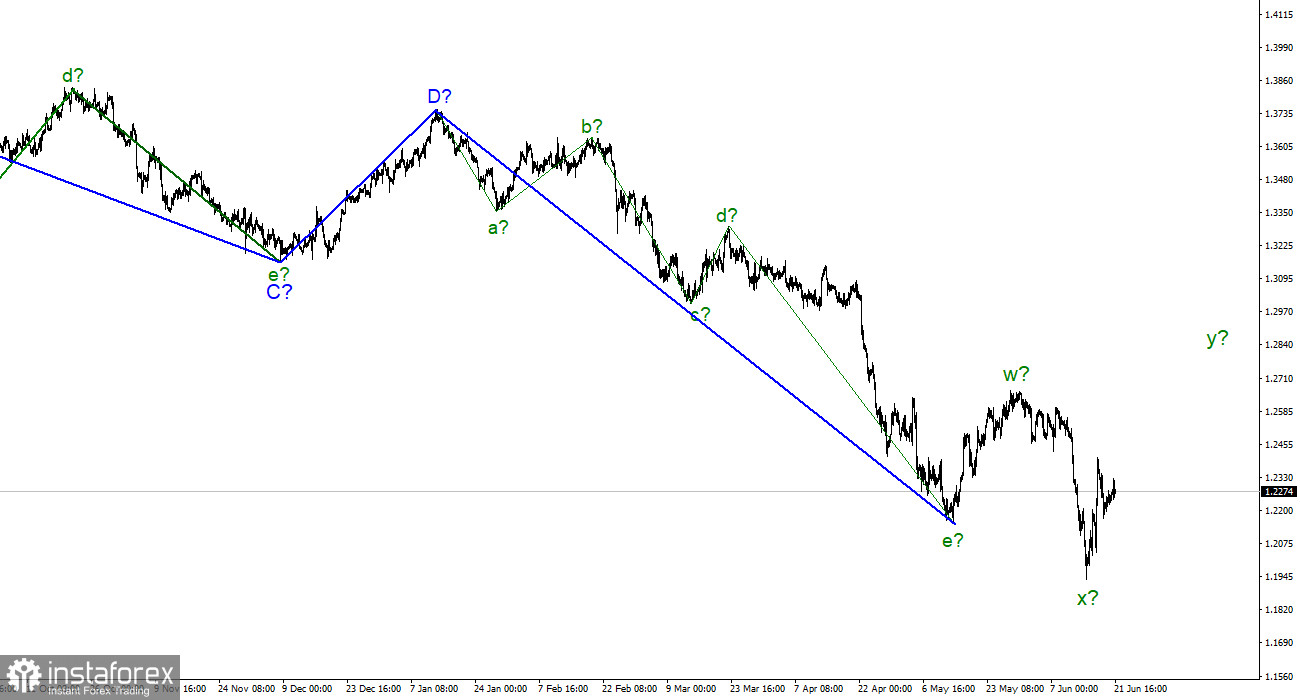

For the pound/dollar instrument, the wave markup already requires additions and adjustments, but it may still take on a more or less digestible form. At the moment, the last downward wave has gone beyond the low of the expected downward trend segment, which I consider completed. Thus, we will no longer see the classical correction structure a-b-c. Nevertheless, wave analysis allows for the construction of various correction structures, so a more complex three-wave formation w-x-y can be constructed. Anyway, the pound and the euro continue to show a very high degree of correlation, and both instruments should build approximately the same structures. At the same time, according to the euro currency, it can be a classic a-b-c, and according to the pound, a rarer w-x-y. But in both cases, the instruments should now build an ascending wave, which should go beyond the peak of the previous ascending one. The wave marking on the British now looks not quite unambiguous, but still has the right to life. The fact that a stronger appreciation of the US currency did not begin after the Fed meeting is encouraging and gives chances for building the necessary upward wave.

British inflation is likely to continue to rise.

The exchange rate of the pound/dollar instrument increased by only 30 basis points on June 21. Market activity on Monday and Tuesday was low, and the market seemed to freeze in anticipation of important events and news. Those will be on Wednesday and Thursday. In addition to Powell's two speeches, which may not arouse interest in the market, a report on inflation in the UK will be released tomorrow. Let me remind you that the Bank of England is doing everything in its power to cope with inflation and make it decrease at least a little. However, so far practically nothing is working out. In none of the last months has inflation shown a decrease of even 0.1%. Last week, the Bank of England raised the interest rate for the fifth time in a row, but, most likely, this tightening will not have a positive effect on price growth. Analysts believe that inflation will rise from 9.0% y/y to 9.1% y/y. And although this increase will be very small, the fact that inflation remains at the highest level means a lot to the British.

By the way, inflation may be much more than 9.1% y/y. Let me remind you that Andrew Bailey himself spoke about the possible continuation of inflation growth, and the official forecast of the Bank of England last week showed that the index could grow to 11%. It is important for us that the demand for the Briton grows after the report is released. If you think very straightforwardly, then an increase in inflation against the background of a five-time rate increase is a "punch in the gut" to the Bank of England. Against the background of rising inflation, it may further tighten monetary policy, which is good for the pound. Thus, we have the right to expect an increase in the pound sterling tomorrow, but still, the market reaction may be different. So far, I expect growth to the 27th figure at least, because otherwise, the wave marking will require adjustments. And the pound hopes for a favorable market reaction to the inflation report and the lack of reaction to Jerome Powell's speeches.

General conclusions.

The wave pattern of the pound/dollar instrument has become clearer. I still expect the construction of an upward wave within the corrective upward structure. If the current wave marking is correct, then the instrument's increase will continue with targets located above the calculated mark of 1.2671, which corresponds to 100.0% Fibonacci. I recommend buying on each MACD signal "up".

On an older scale, the entire downward trend section looks fully equipped but may take on a more extended appearance. If the current correctional structure still takes an even more non-standard form, then adjustments will have to be made.